October 18, 2020

Portfolio markets summary

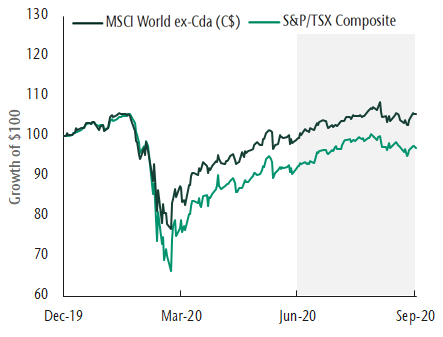

Equity markets continued to rise this quarter but at a slower pace. Despite continued concerns about the health crisis and unemployment, the S&P/TSX Composite Index was up 4.7% and the MSCI World ex Canada Index (C$) was up 6.0% this quarter. Higher returns reflect rebounding corporate earnings and investors’ expectations that the economy will continue to recover from low levels. The continued recovery is supported by historic levels of stimulus and a commitment by policy makers to remain supportive through the recovery. While stimulus payments to people who lost their jobs have ended in some countries, it’s likely that there will be further policy responses, especially if there are setbacks to the recovery. One such setback is if COVID-19 daily cases rise to levels requiring further social distancing. Despite the rise in cases we saw this quarter, hospitalizations are down which makes the health crisis more manageable.

Bond returns benefited from an improved investment outlook this quarter. The FTSE Canada Universe Bond Index was up 0.4% this quarter. Most of the return came from corporate bonds which saw yields decline back to more normal levels. The decline in yields was helped by the Bank of Canada buying these bonds and signaling a willingness to increase their purchases. Canada government bond returns by comparison were lower as bond yields ended the quarter modestly higher than where they started.

Equity markets decline and recovery

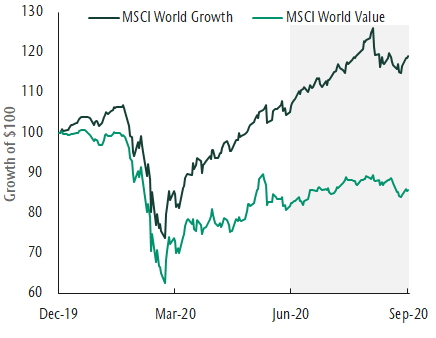

Growth significantly outperforms value

Portfolio strategy

Our tactical allocation investment process continues to point to an improving economic backdrop. To reflect this, portfolios are modestly overweight equities. As our conviction in the recovery grew this quarter, we chose to increase the portfolio weighting to asset classes that tend to do well at in the early part of a market cycle. Within equities we increased the weight to Canadian small caps and within fixed income we increased high yield bonds. A more positive economic backdrop supports increasing the weight of these more cyclical asset classes.

Overall our equity teams continue to own resilient, stable businesses that have strong earnings growth relative to the market. These factors fall under the growth style of investing and have been rewarded by the market over time. This has been especially true this year, both during the market decline and recovery. As the economic outlook improved we have moved cautiously towards cyclical companies. Within Canadian equities this means adding companies in industrials, consumer discretionary and financials. Within our global strategy the biggest change has been to increase emerging markets exposure. Within fixed income portfolios we have increased our weight to corporate bonds and have an underweight to provinces that have most significantly expanded their budget deficits.

From the desk of Jeff Guise, Managing Director, Chief Investment Officer, CC&L Private Capital.