October 07, 2025

Markets overview

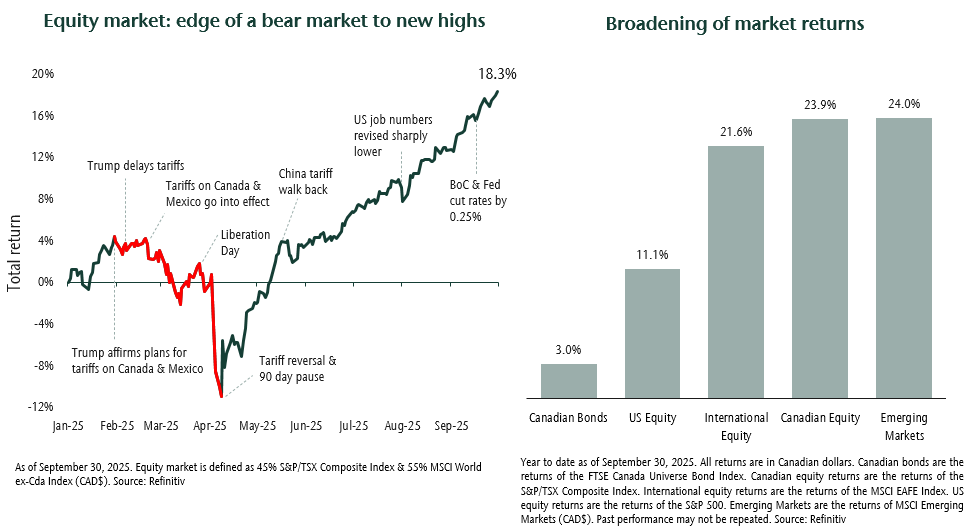

Equity markets extended their strong run from the April lows, driven by expectations for interest rate cuts and increased government spending. Investors appear confident that fiscal stimulus will outweigh the drag

from tariffs, helping to temper fears of a material economic slowdown. Despite a softer labour market, consumer and business spending have kept global growth surprisingly resilient.

Artificial Intelligence (AI) and gold have been dominant themes for the market. Gold and precious metal companies represent a large share of the Canadian index, which helps explain the strong performance of Canadian equities. Recently, there has been

a broadening of equity market returns. This is reflected in regional returns, with developed international, Canada and emerging markets all significantly outperforming the United States (US) this year.

Canadian bond returns were solid but low relative to other asset classes. Bond yields fell modestly this quarter, while high-yield bonds and broader credit outperformed traditional bonds.

Portfolio strategy

The global backdrop remains supportive, with resilient growth and additional stimulus likely in the months ahead. Yet risks remain. Growth has slowed this year, and the labour market has been weaker than initially anticipated. Expectations for further

interest rate cuts—which have helped fuel recent market strength—are rooted in weakening jobs, and inflation not moving materially higher. However, inflation remains above target in the US, and we believe the full effects of tariffs have

not yet been realized in prices.

Other risks include valuations and market concentration. Equity valuations are elevated, with increasing concentration around the AI theme—particularly within AI-leading companies, such as the “Magnificent Seven”. Today, these companies

are all heavily invested in AI, and their stock price is closely tied to the AI revolution. A few years ago, these businesses had more diverse revenue. While these firms remain highly profitable and dominant, their dependence on a single theme amplifies

risk.

Despite these risks, we remain constructive. We have exposure to many of the themes that have driven markets higher—such as AI and gold companies—as well as investments in areas of the market that previously underperformed but are beginning

to show strength. This includes small-cap stocks and emerging markets. These areas of the market are benefiting from lower borrowing costs and a lower US dollar. We also see opportunities in Canadian value companies that have lagged the broader market

but offer compelling long-term value to shareholders.

Within fixed income we continue to maintain a tilt towards credit outside of our traditional bond strategy. We believe the higher all-in yields from credit will offer better near-term returns for clients as company fundamentals and the economy remain

sound. Over the past year, we have also increased the level of credit diversification.

We remain balanced in our positioning and disciplined in our investment process. While markets are rewarding risk today, the cycle is aging. Quality, profitability and income remain the foundation for sustainable returns, even when markets inevitably

become more volatile.