May 09, 2025

The past provides critical context for investing. While we can’t predict the future with a high level of certainty, the past reveals important patterns which help us to measure investment risk, understand how

different investments perform relative to each other, and determine those factors that generate long-term returns.

Historical guidance is rooted in data, which enables us to make informed decisions while navigating the unpredictable nature of market movements in the short term. If, on one hand, the use of history is important to an investment process, on the other

hand, hindsight works against investors.

Hindsight bias: the knew-it-all-along effect

Hindsight bias is a cognitive bias which demonstrates the tendency to believe you “knew it all along” after an event has occurred. With hindsight bias, we perceive an event as having been more likely to occur, and easier to foresee, than it

really was. This, in turn, tends to lead to overconfidence in our ability to predict future events. For example, after a market correction, an investor might believe that the outcome was obvious all along; their present knowledge influences their

past perception, and they quickly forget the uncertainty and competing narratives that prevailed at the time.

Consider, for example, Sir Isaac Newton and the 1720 South Sea Bubble. Despite his undisputed genius, Newton succumbed to the speculative frenzy around the South Sea Company. Having sold his shares for a profit, after seeing the share price continue to

rise, he repurchased shares at a higher price and incurred a substantial loss when the bubble subsequently burst. After the event, Newton himself believed this outcome was foreseeable, stating, "I can calculate the motions of the heavenly bodies,

but not the madness of people." In this way, the compound factors that led to the bubble are oversimplified; the role of misinformation, for argument's sake, is reduced, and the impacts of speculative trading (making high-risk, high-reward investments)

and herding (following the crowd) are amplified.

Investor bias and underperformance

Hindsight bias can result in an overconfidence in your ability to clearly view the future; leading to ill-informed decision-making (based on emotions and false assumptions) and resulting in an outcome that is hazardous to your wealth. There is a study

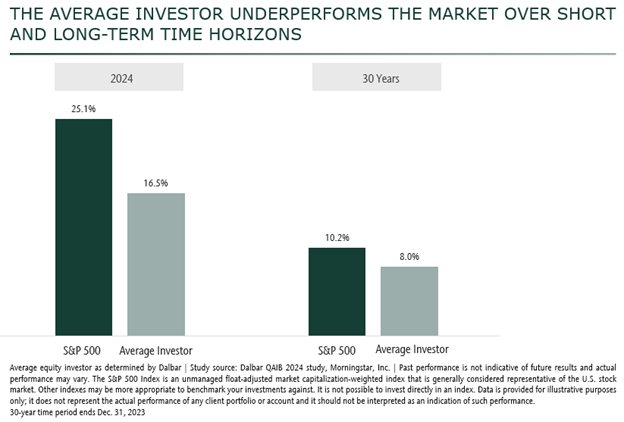

that illustrates that investor biases, including hindsight bias, lead to meaningful reductions in returns for investors. The chart below shows equity return data over the past year, and over a 30-year period. Just last year, the average investor in

United States (US) equity funds generated a 16.5% return which was 8.6% lower than the market (as measured by the S&P 500 Index). Over a 30-year period, the average investor underperformed by 2.2%.

While the long-term underperformance of 2.2% is better than last year’s underperformance, it compounds to be a very meaningful amount of money when measured over 30 years. Based on an initial investment of $100,000, the average investor would have

over $830,000 less than if they stayed invested in the market. Much of this underperformance is driven by investor behaviour and trying to “time” the market, moving funds around at ill-opportune times.

Uncertainty and hindsight bias

In investing, uncertainty is unavoidable but manageable through a disciplined investment process. Where uncertainty rises, we anecdotally find hindsight bias seems to follow. In the last five years we have seen periods of uncertainty during which many

commonly-held beliefs were flipped on their heads — and quickly. These examples should challenge our convictions and give us pause, lest (like Newton) we overlook competing narratives and fail to learn the lessons of history.

.png?sfvrsn=d531a197_1)

Discipline and diversification are the antidote

2025 has had its share of uncertainty as investors navigate the chaos of headlines and tariff announcements. History suggests that tariffs and trade uncertainty are likely to slow growth, put pressure on inflation expectations, and keep the US central bank on hold for future rate cuts for now. However, there are a wide range of potential policy outcomes and their effects on the global economy is unknown.

As an active manager, we constantly assess our positioning to understand where we are exposed to potential negative outcomes, and if we believe we will be rewarded for the risks we take. In some cases, we have reduced exposure to companies that could be adversely affected by a prolonged trade war. In other instances, as in our Canadian Value portfolio, we have chosen to hold companies in the crosshairs of US trade policy. While the reasons are various, the overarching theme is that the market may have overestimated the impact on the company, and the negative sentiment is overstated. To date, auto parts manufacturers and steel companies haven’t seen a decline in orders from the US. The deeply integrated nature of the auto manufacturing supply chain, together with the US steel supply deficit (the US produces only 70% of total domestic demand), means they still need Canadian suppliers.

A diversified investment approach, informed by historical research, and cognizant of biases, is prudent. This is especially key today, where we face a wider range of potential outcomes than usual. At CC&L Private Capital, we seek to keep our clients informed as we navigate these turbulent times. Should you wish to stay informed, connect with us through the form below.