December 19, 2025

After three years of very strong stock market gains, we expect 2026 to bring more moderate returns. Markets are still supported by a resilient global economy, solid company balance sheets and moderate bond returns. Much of the recent strength has come

from companies tied to artificial intelligence (AI) and from Canadian gold miners, but the heavy investment going into AI and today’s higher valuations are creating new risks that we are watching closely.

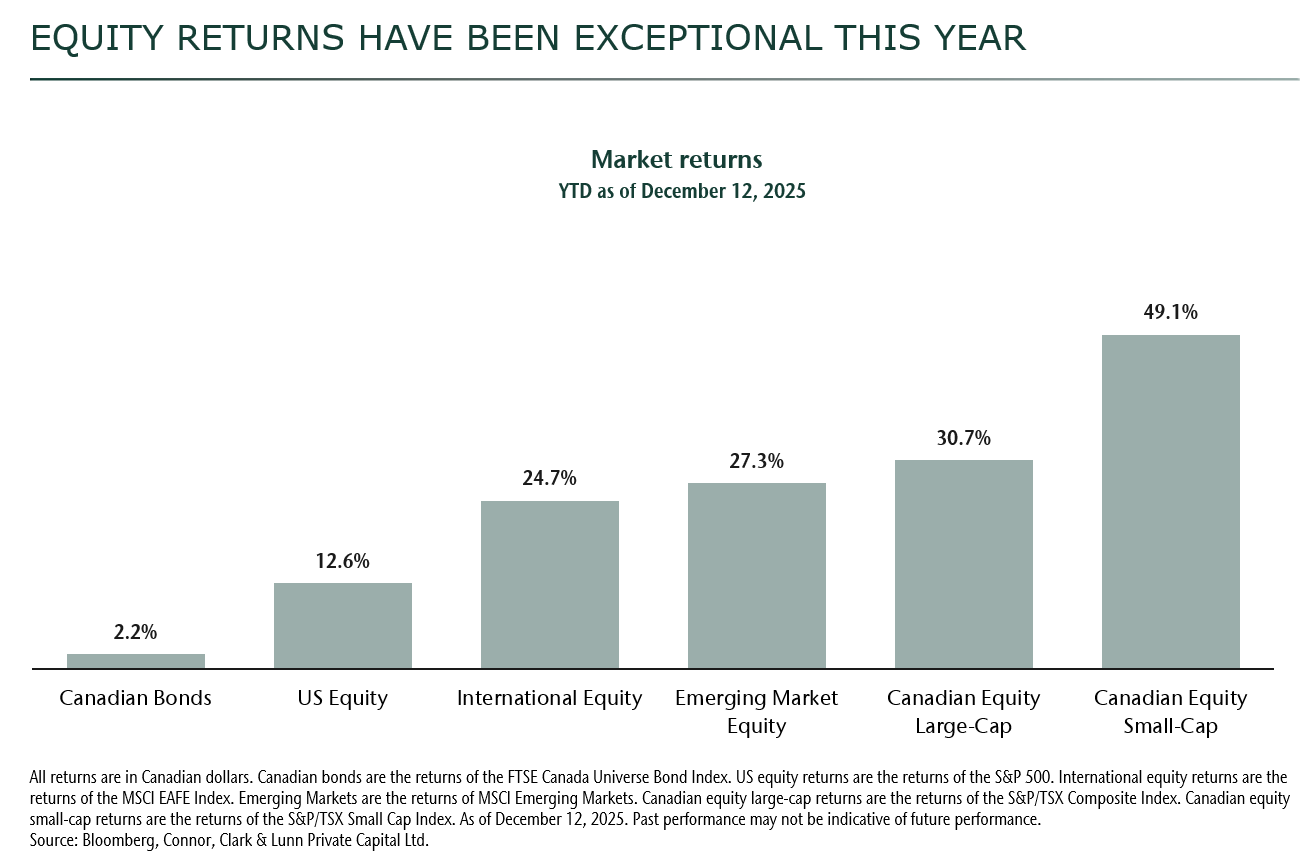

2025: A remarkable year for equities

2025 has been another remarkable year for investors. Canadian stocks have led the way, with the large cap index up about 31% and small cap stocks up 49%. Emerging market shares are also strong, rising 27%—more than twice the return of the United

States (US) market. A big part of these gains has come from Canadian gold and precious metal companies and from companies linked to AI globally.

Gold has been a surprise star as investors look for protection against US dollar weakness, large government deficits and persistently higher inflation. Central banks have steadily added to their gold reserves, while many large investors and individuals

still own relatively little gold, leaving room for demand to grow. At the same time, enthusiasm for AI rebounded after a midyear pullback, as investors refocused on the long-term earnings potential of companies building and using these tools.

Bond markets have played a role. Traditional bonds have delivered low single-digit returns, while bond strategies focused on higher income have done better. Behind these results are three main forces:

- New tariffs and trade tensions, which caused sharp market swings and a shift toward more economically sensitive stocks.

- Growing government spending and tax cuts, especially in the US, Canada and Europe.

- Regulatory changes that have both helped and hurt sectors such as energy and financials.

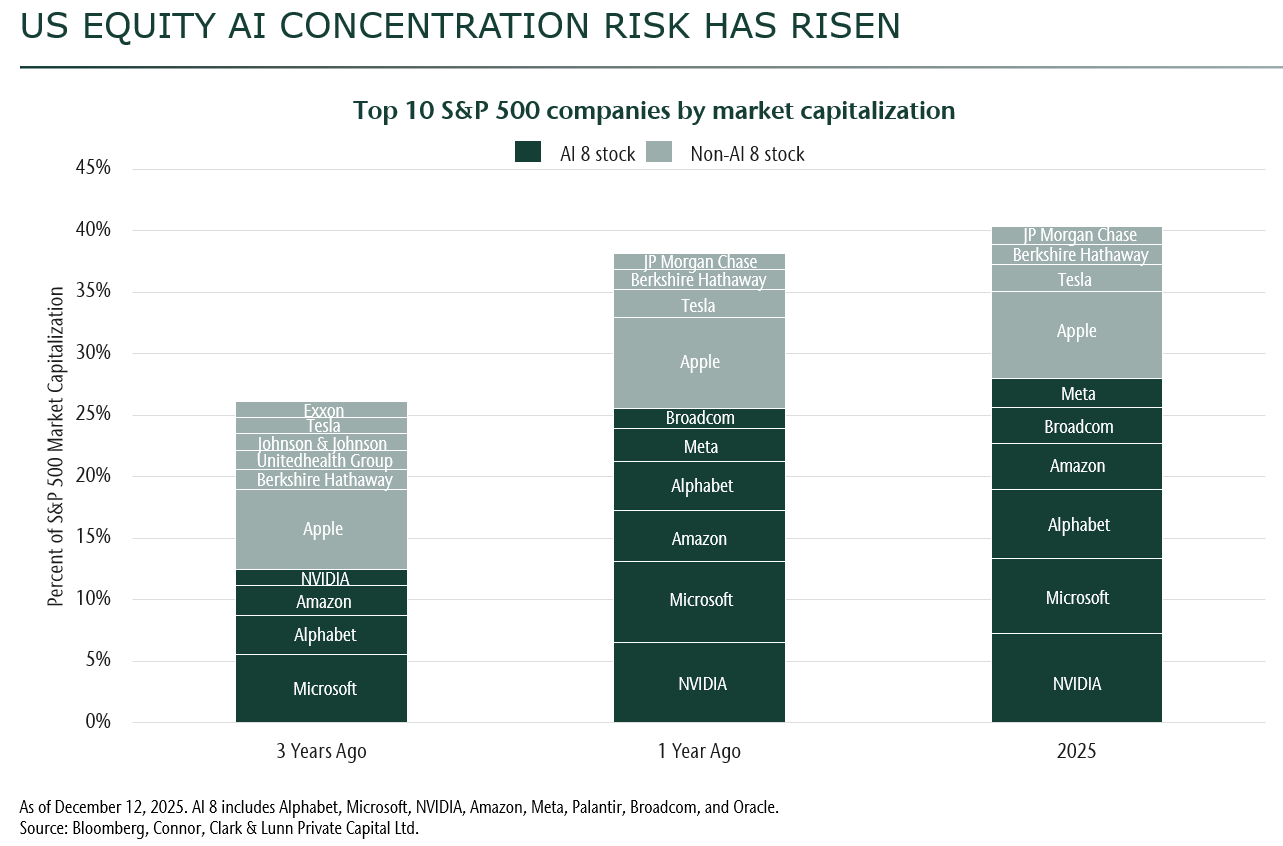

This has led to very strong—and more concentrated—stock market gains, especially in large US companies linked to AI.

From concentrated winners to a broader playing field

One encouraging shift in 2025 has been the broadening of market leadership. Canada and emerging markets have led global returns; and within Canada, small cap stocks have stood out. Even so, concentration risk remains high, especially in the US: almost 30% of the S&P 500 is now made up of companies that fund or benefit from AI, and around 40% of the index is in just 10 stocks. Those 10 companies represent about 28% of the world stock market—more than twice the weight of Europe. This doesn’t automatically signal a downturn, but it does mean that how we own AI is an important decision in equity investing today.

Our global equity teams remain positive about AI over the next year. Demand for computing power to support AI still exceeds supply, and we haven’t yet seen the pattern of repeated sharp selloffs that usually marks the end of a bubble. But we are

selective. We remain invested in AI related companies overall, while trimming some of the most crowded infrastructure holdings—such as our largest position in NVIDIA—and focusing more on software and platform companies with strong competitive

positions and valuable data. We are also watching a new risk: AI-related debt. AI infrastructure projects are increasingly being funded with debt, and a change in financial conditions or slower than expected profits could pressure these companies.

In Canada, there is less market concentration, and the economy is “okay but not booming,” with growth expected to be around 1.5%. Inflation pressures should ease somewhat as wage growth, rents and oil prices moderate, and as AI driven efficiencies

help businesses do more with less.

In this environment, three equity themes stand out for 2026:

- Selective AI exposure, from hardware manufacturers supporting large technology firms to companies using AI to improve their products and efficiency.

- Energy and power, including utilities and companies that benefit from the power needs of data centres.

- Gold and other inflation sensitive assets, where disciplined capital spending and under ownership by large investors create meaningful upside—if gold prices remain firm.

More broadly, we expect the opportunity set to widen further in 2026; beyond the largest US technology names and toward Canadian and emerging market cyclicals, smaller companies and select manufacturing and industrial businesses tied to reshoring, infrastructure

and investment spending. Given this backdrop, we are positioning portfolios for solid but more modest returns. We are slightly overweight stocks, focused on higher quality companies, and we are widening our opportunity set beyond the narrow group

of past winners.

To read the second part of our 2026 outlook, which focuses on fixed income and alternative assets, as well as the overall positioning of our portfolios, click here.