December 19, 2025

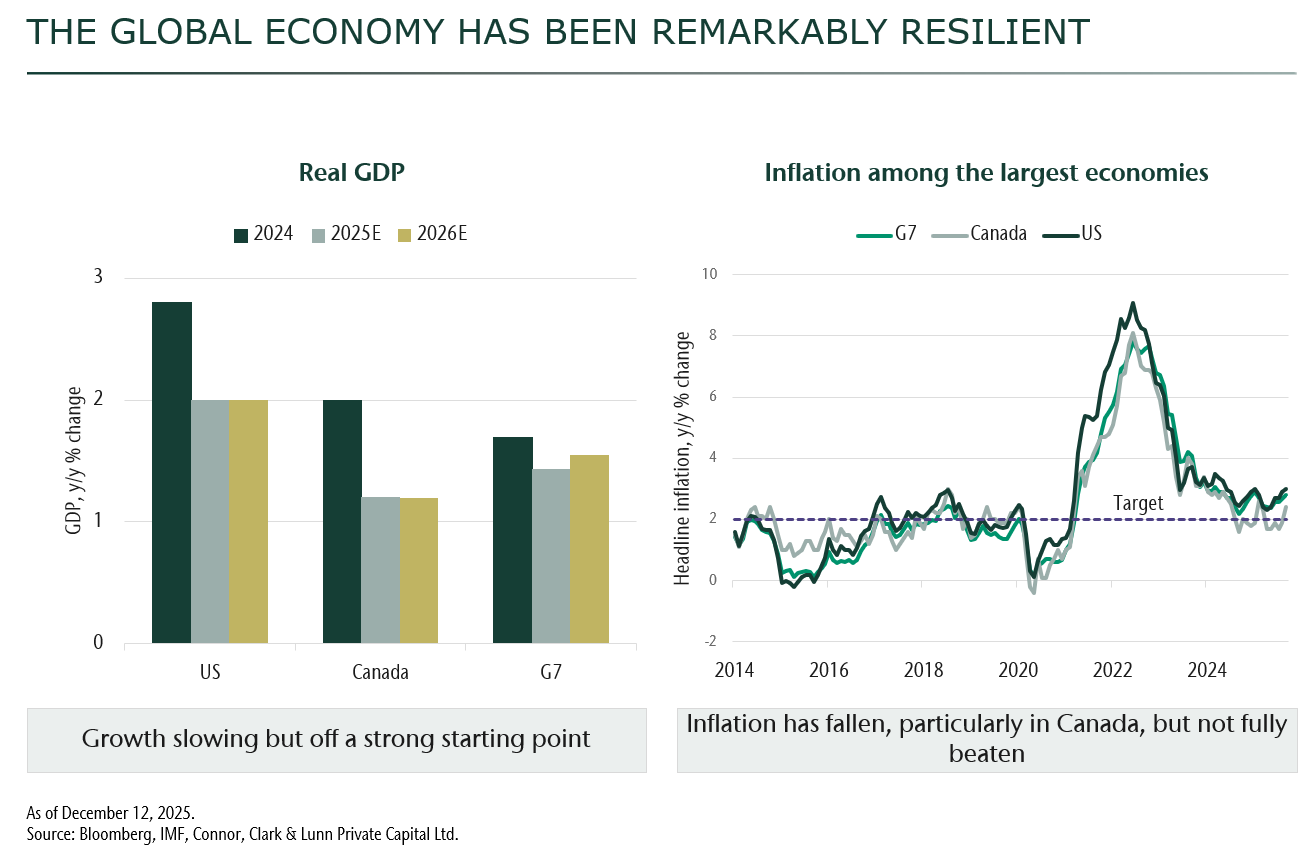

We expect the global economy to stay on a gentle growth path rather than contract in the year ahead. Growth has slowed, but healthy household and company finances—especially in the US—have helped avoid a downturn. Labour markets have cooled

without widespread layoffs; and firms are hiring more carefully but generally not cutting staff, which should support modest consumer spending into 2026.

US inflation has come down from its peak but looks likely to settle closer to 3% than the 2% target most became accustomed to before the pandemic. Many policymakers appear willing to tolerate somewhat higher inflation for a period, as governments use

stronger growth and inflation to manage large debt loads.

Our fixed income team believes this makes it harder for central banks to cut interest rates aggressively and could put some upward pressure on bond yields over time. Looking into 2026, our base case is “slower now, better later”:

- Growth stays subdued in the near term, as slower job creation and fading post pandemic tailwinds bite.

- Earlier rate cuts and targeted government support gradually lift activity into late 2026.

- Investment in AI related infrastructure—such as data centres, power and networking—should continue to support demand, even if traditional growth drivers are subdued.

Fixed income and alternatives: income and diversification regain their appeal

Bond markets have quietly done their job. Traditional bonds have returned roughly 2% this year, while bond strategies focused on higher income—by combining different types of government and corporate bonds and mortgages—have delivered close

to 6%. Notably, persistent, large government deficits are a key long-term theme. Over time, investors may demand higher yields to finance this borrowing, especially if inflation expectations drift higher. The timing is uncertain, but the medium-term

risk is elevated.

In this setting, we prefer to keep our bond portfolios slightly less sensitive to interest rate moves, while leaning more into diversified corporate and other nongovernment bonds, where yields remain attractive and company balance sheets are generally

healthy.

Alternatives such as infrastructure, real estate and private loans are also regaining their footing after a challenging period. Recent quarters have delivered improved returns and more stable valuations. With starting yields now higher, we see this as

a good entry point for investors looking for steadier long-term income and additional diversification.

How we are positioned: quality, cyclicals and income at the core

Our overall positioning reflects both the resilience of the economy and our view that equity returns will be more normal, not spectacular.

We have recently reduced—but not eliminated—our tilt toward equities as economic and labour market data have softened. We keep a slightly higher share of stocks and corporate bonds than in our long-term neutral mix, recognizing that risk assets

should still be rewarded if growth improves in 2026, even though the safety cushion is thinner than in prior years.

Within stocks, we are leaning into the broadening of market leadership. In Canada we are adding to strong, high quality companies in areas such as industrials, financials and energy, while trimming more defensive positions. Globally we are keeping meaningful,

but more balanced, exposure to AI across hardware, software and power, including reducing some of our biggest infrastructure winners and focusing where we see durable advantages. We also hold more gold than we typically would in our Canadian core

portfolio, supported by solid company fundamentals and low ownership among institutional and individual investors.

We are investing heavily in how we make decisions. This includes using more structured tools that blend company fundamentals and market trends to guide asset mix changes. This enables us to refine how we build equity portfolios, so that we can clearly

distinguish between broad market exposures and individual stock selection, and better diversify our global equity offering. We are also employing AI tools in our own research and risk analysis to help our teams work more efficiently, while ensuring

human judgment and experience remains at the centre of the process.

Risks we are watching—and how we’re responding

Although we have a positive outlook for 2026, we are not complacent. The primary risks we are watching include:

- Valuations. After several years of strong gains, some parts of the market—especially large, US, AI related companies—are priced for a good outcome.

- Policy risk. If inflation picks up again or government stimulus is stronger than expected, central banks may need to slow or reverse rate cuts, which could pressure both stocks and bonds.

- AI and credit risk. A funding squeeze for highly indebted AI infrastructure companies could slow data centre expansion and trigger a sharp pullback in semiconductor and power related stocks.

- Political and geopolitical shocks. Elections, policy changes or conflicts could create bouts of volatility and sudden shifts in investor sentiment.

Rather than try to predict exactly how these risks will play out, we build them into our portfolios: keeping diversification across regions, sectors and asset classes; balancing pro-growth positions in the likes of cyclicals, AI, corporate bonds (with

stabilizers such as gold, higher quality government bonds and infrastructure); and actively adjusting position sizes as company fundamentals, valuations and financial conditions evolve.

Conclusion: resilient, not roaring

The global economy has been more resilient than many expected, supported by strong balance sheets, active government policy and a powerful investment cycle around AI. At the same time, the easy gains from the early post pandemic recovery are behind us. Inflation is likely to stay somewhat above central bank targets, policy is becoming more finely balanced, and markets have already priced in a great deal of good news.

Against this backdrop, we expect solid but more moderate returns in 2026 than in recent years. Our portfolios are positioned accordingly: a slightly higher share of equities, with an emphasis on quality, income and a wider opportunity set; a preference for diversified corporate bonds; and meaningful exposure to alternatives and inflation sensitive assets that can help smooth returns over time.

Most importantly, we remain focused on what we can control—thorough research, disciplined risk management and thoughtful portfolio construction—so that, whatever path the economy and markets take in 2026, your portfolio is prepared to participate in opportunity and withstand the inevitable bumps along the way.

This is the second in our two-part “Navigating the 2026 Investment Landscape” series. To read part one, which focuses on equity markets and concentration risk, click here.