January 09, 2026

Markets overview

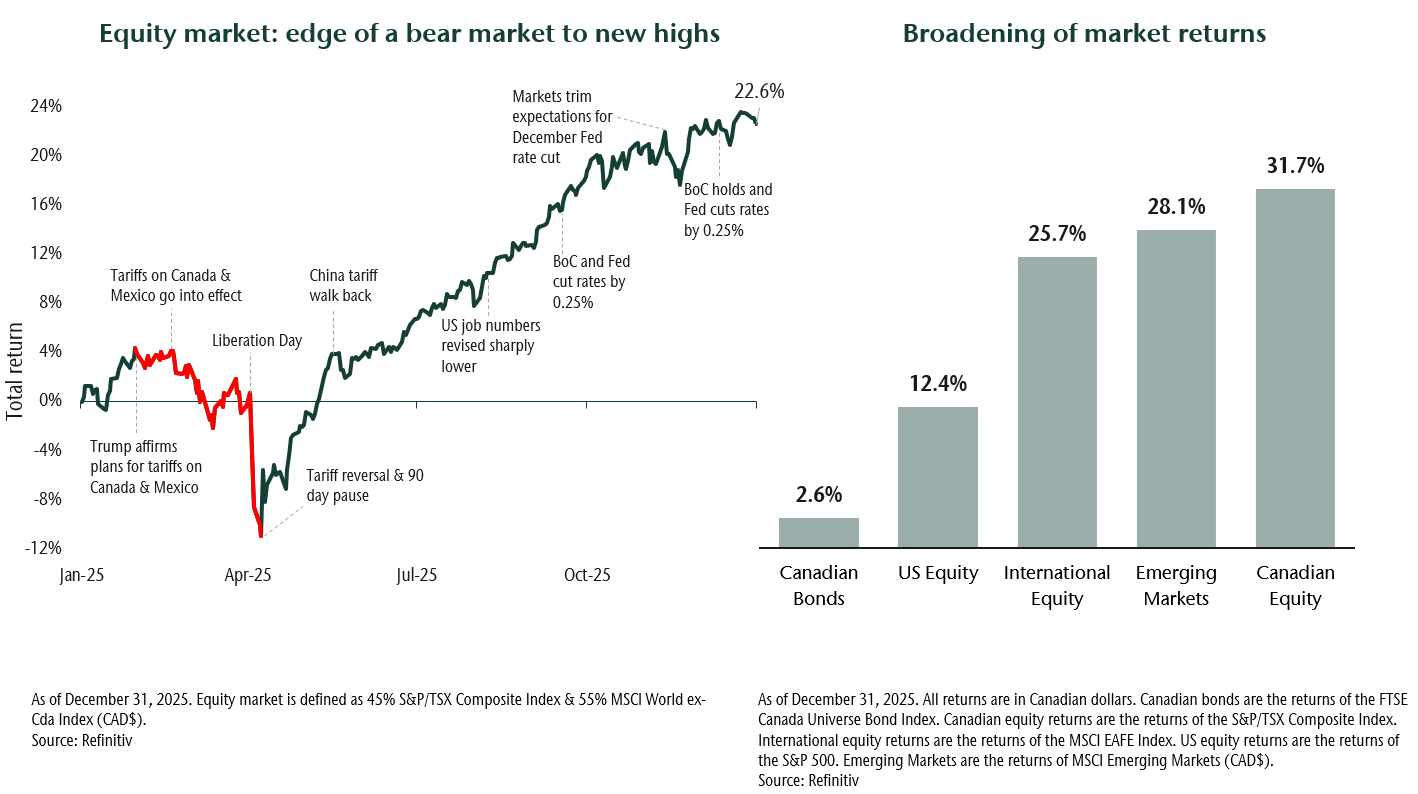

Despite tariff-related turbulence earlier in the year, 2025 proved another exceptional year for investors. Equity markets delivered very strong returns, extending the gains of the previous two years, but leadership

changed meaningfully. Canada and emerging markets led global returns in 2025, a notable shift after an extended period of United States (US) dominance. Artificial Intelligence (AI), strong gold performance, and a weaker US dollar were the defining

investment themes of the year and explain much of the divergence across regions and sectors.

Market strength was supported by a resilient global economy, even as job growth slowed. Consumer and business spending remained resilient, while central banks cut interest rates in response to a cooling but stable labour market. Ongoing fiscal support

also played an important role in offsetting trade uncertainty across the globe.

Bond markets contributed modestly to

portfolio returns. Traditional bonds generated low single-digit returns, while higher-income-oriented bond strategies performed better as corporate fundamentals remained sound.

Portfolio strategy and positioning

Our core views remained consistent throughout 2025. Economic growth slowed, but it did not stall. Labour markets cooled without widespread layoffs, helping sustain income growth and consumption into 2026. And central banks moved policy closer to neutral,

while fiscal policy increasingly became the primary tool supporting growth.

At the same time, some risks have increased alongside markets. Valuations are elevated in several areas, particularly in those parts of the US market most exposed to AI. Market concentration remains high, with a small number of companies accounting for

an outsized share of index returns. And while inflation has moderated, it remains above target; the full impact of tariffs and fiscal stimulus may still emerge.

Against this backdrop, we have a positive outlook while staying focused on risks. Within equities, we maintain meaningful exposure to AI-related companies—reflecting their long-term earnings potential—and have become more selective as valuations

have risen. While we remain vigilant regarding risks, we believe we are still in the early stages of the AI revolution, with more gains to come. We also continue to hold a material allocation to gold and precious metal companies, supported by the

strongest fundamentals we have seen to date, improved capital discipline, and sustained demand for gold from central banks and investors.

Beyond these themes, portfolios are diversified across regions and styles. We have exposure to areas that are beginning to show renewed strength, including global small caps, emerging markets, and Canadian cyclicals that benefit from lower borrowing costs

and improving growth expectations. Within fixed income, we remain tilted toward diversified credit and enhanced income strategies rather than traditional government bonds, as higher all-in yields and solid corporate balance sheets offer more attractive

near-term return potential. Within alternatives, we continue to see attractive opportunities for differentiated returns and diversification.

From an asset mix perspective, we remain modestly overweight equities. While we are regularly assessing where markets may falter, we believe markets could continue to be rewarded if growth reaccelerates into 2026 and policy remains accommodative. That

said, the margin for error is narrower than in prior years, reinforcing the importance of balance and diversification.

Looking ahead

We expect returns to moderate from the exceptional levels of recent years. Portfolios are positioned accordingly, with an emphasis on quality and profitability complemented by diversification across regions, sectors, and asset classes. While volatility

will inevitably return, our focus remains on disciplined portfolio construction and long-term fundamentals, ensuring portfolios are positioned to participate in opportunities while remaining resilient through the inevitable market fluctuations.