April 08, 2025

Markets overview

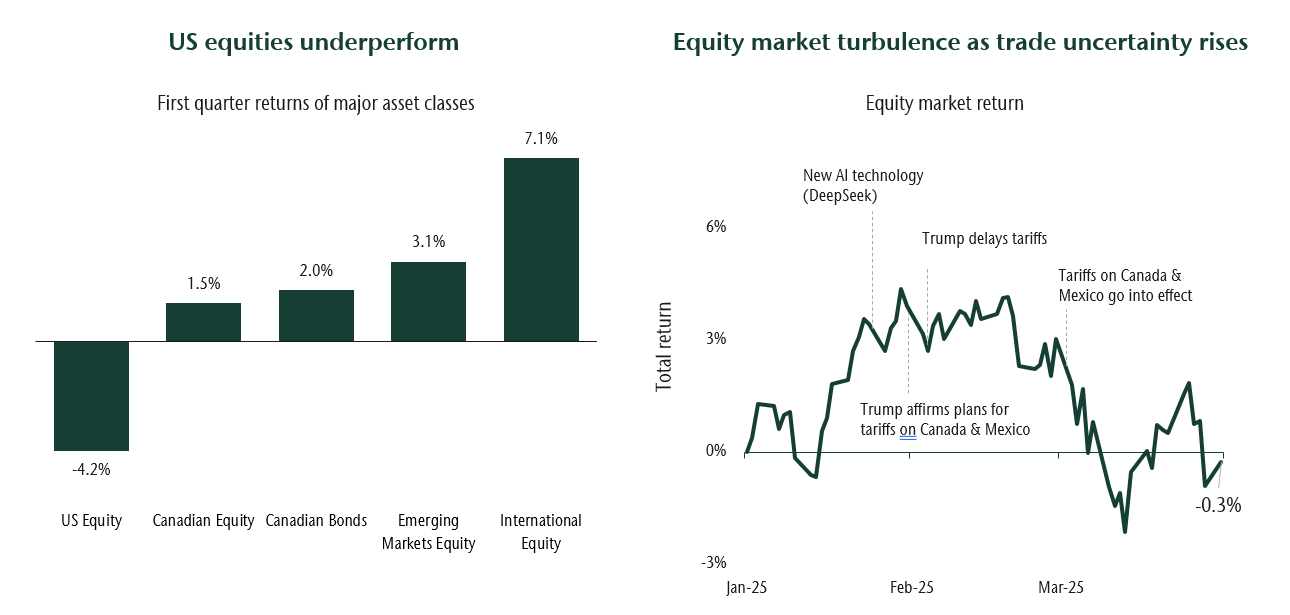

After two straight years of low volatility and strong returns, the first quarter of 2025 was a reminder that markets can be turbulent. Uncertainty around the new United States (US) administration’s tariff policies

has weighed heavily across markets. This year we have seen a reversal of many of the themes that dominated the investment landscape in 2024. After an extended period of US exceptionalism, US stocks have been the laggards in 2025 to date, while Developed

International stocks have surged. Emerging Markets and Canadian equities have also outperformed the US by a wide margin. At a sector level, the technology stocks that helped drive the S&P 500’s outperformance in 2025 have lagged markedly

while materials — including gold stocks — have significantly outperformed. More domestically-oriented stocks have also done better than multinational companies. The relative performance of different markets largely reflects these trends.

After quarter-end, President Trump announced new tariffs which were higher than many had predicted, sending stocks lower. The tariff announcement reinforced trends that had emerged at the start of the year, putting further downward pressure on economic

growth and upward pressure on inflation expectations. This puts central banks in an uncomfortable position as they choose between supporting growth and rising prices. For the time being, they are on hold until they have more data on the full effects

of these policies.

Fixed income returns were positive in the first quarter, serving to protect capital. Bond yields declined as the Bank of Canada cut interest rates twice and longer-term yields responded to concerns over slowing growth.

Portfolio strategy

The global economy started the year on sound footing. Inflation had eased and both economic activity and the labour market remained strong. This was particularly true for the US. However, with the swing in US trade policy and now the implementation of

tariffs, economic uncertainty has increased across the world. This, in turn, has increased the range of possible economic and investment outcomes, and has lowered consumer and business confidence.

As the possibility of negative outcomes increases, we have become more defensive in our portfolio positioning. In January, we reduced our overweight to equities and bought bonds. Within equity portfolios, we reduced cyclical sectors and increased our

exposure to companies where we have good revenue visibility, and where we see companies have strong balance sheets and manage their costs well to drive profitability. In Canadian portfolios we reduced weightings to companies that have significant

revenue exposure to the US. Our portfolio managers also increased the time spent speaking with company management to better understand how they plan to navigate various potential outcomes.

Within fixed income we have reduced our exposure to risk. We lowered our weight to corporate borrowers in core fixed income and purchased provincial bonds which appear more attractive in the current environment. We have allocations to short-term and high-yield

bonds, which can outperform if inflation concerns rise further and push yields higher. Over the past year, we also broadened our fixed income investment strategies to be more flexible in periods of uncertainty. We believe this will benefit clients.

The benefits of diversification have been evident this year, and we expect this to become increasingly important as divergences in returns are amplified both across and within markets. We have positions across asset classes, geographies, sectors, themes

and more. And we continue to find attractive risk-adjusted returns in alternative asset classes like hedge strategies as well as in private market investments such as direct real estate, infrastructure and private loans. These asset classes tend to

be less sensitive to quick changes in investor sentiment, and we expect the benefits of such holdings to become increasingly evident during this period of volatility.