July 07, 2022

Markets overview

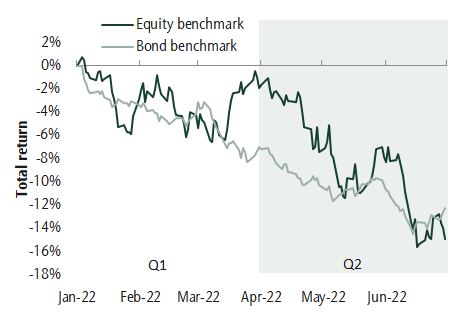

It has been a difficult quarter and year for markets. Economic headwinds, high inflation and tighter financial conditions are leading to a slowdown in growth. These conditions are the aftershock of very accommodative monetary and fiscal policies put in place to help the economy through the pandemic. This year central banks have pivoted quickly to raise interest rates in an attempt to cool unacceptably higher than expected inflation. Given the backdrop, market turbulence is understandable albeit uncomfortable. This quarter, the MSCI World ex. Canada (C$) was down –13.3% and briefly entered bear market territory after falling more than 20% this year. The S&P/TSX Composite Index declined -13.2% this quarter and has fallen by –9.9% year to date. Only commodities and alternative asset classes have generated positive returns this year.

Stocks and bonds moved lower

Markets impacted by higher rates

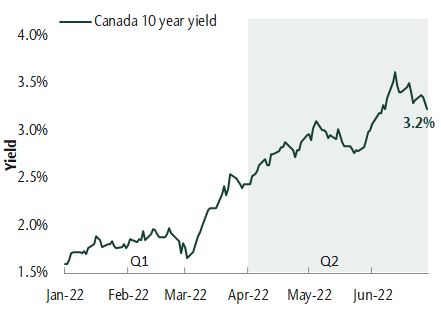

Bond returns moved sharply negative as investors priced in more central bank rate increases to contain inflation. The FTSE Canada Universe Bond Index was down –5.7% this quarter bringing the year to date decline to -12.2%. This is a reversal of the strong gains experienced in the bond market as yields fell in prior years. As core bonds have declined, short term and high yield bonds have provided some protection because they are less sensitive to increases in yields.

Portfolio strategy

Strategically, we have been recommending an allocation to alternatives for many years. These include our private market alternatives as well as multi-strategy hedge. These strategies have performed well and have been more resilient than the public markets. While it will take time for these asset classes to fully reflect current conditions, they continue to generate strong income and protect capital as rates have moved higher and inflation has been persistent.

Our tactical allocation process closely monitors changes in the economy. Tighter monetary policy necessarily means slower growth and financial markets are increasingly worried that higher rates will lead to a recession. A recession is not a certainty but whether the slowdown meets the technical definition or not, the next few quarters are expected to be volatile. Given the challenging environment, we have continued to be more defensive. In client portfolios we have reduced the allocation to equities. Within equities we favour Canadian stocks which we believe will be more resilient, underscored by high commodity prices and better valuations. Our allocation within bonds reflects the rising rate environment and we are beginning to add to core bonds which may protect capital if the economic slowdown becomes more acute.

Our portfolio management teams have been defensively positioned and have become more so this quarter. We have increased weights to high-quality companies with more sustainable earnings as we believe earnings will begin to decline in the second half of the year. Looking forward we are cautiously adding to areas with good value and stability that can do well in turbulent markets. We believe bond yields will move higher at a slower pace and our fixed income portfolios are positioned accordingly.

From the desk of Jeff Guise, Managing Director, Chief Investment Officer, CC&L Private Capital.