January 07, 2022

Markets overview

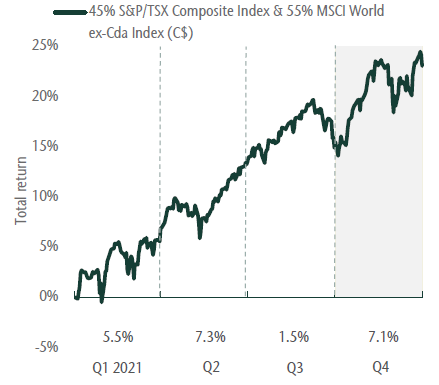

Equity market returns were strong this quarter as the economy showed resilience in the face of higher COVID cases and more lockdowns. In this environment, earnings growth has underpinned the continued recovery in stock prices. The MSCI World ex. Canada Index (C$) was up 7.6% and the S&P/TSX Composite was up 6.5%. This brings these market returns in at 21.2% and 25.1% for the year, respectively. High quality large cap companies outperformed in the fourth quarter, as looking forward there is a wide range of potential economic and policy outcomes. On the policy front, central banks have begun their path to policy normalization in the face of strong growth and high inflation. This tends to result in choppier returns for markets than the relatively smooth path of upward returns we have seen since the market recovery began in March of 2020.

Strong equity returns

![]()

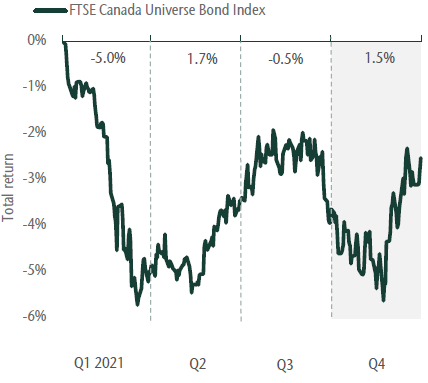

Bond returns showed recent improvement after bouts of decline earlier in the year. This quarter bond yields fell modestly, reflecting the uncertainty of growth, inflation and central bank policy. The result was an increase of 1.5% for the FTSE Canada Universe Bond Index this quarter. The index finished the year down -2.5%.

Bonds improve but remain negative for the year

Portfolio strategy

Our view is that we have experienced a strong economic recovery and that pandemic-led imbalances in the economy should be resolved as the business cycle normalizes. While we believe inflation levels will recede, they have remained higher than initially anticipated. This is a risk, particularly in how central banks choose to deal with current high inflation levels. Our portfolio management teams have generally taken profits in cyclical companies and added modestly to more defensive-oriented businesses. We continue to own high quality companies with strong leadership teams that we believe can navigate supply chain challenges and pass on higher costs.

In client portfolios we remain overweight stocks and underweight bonds. As equity market performance has been strong, we have sold equities to keep our overweight from expanding. There is also more uncertainty today which warrants a lower equity overweight. Within fixed income, we favour high yield bonds which carry better income and should outperform core bonds in a period where credit conditions remain on a solid footing.

From the desk of Jeff Guise, Managing Director, Chief Investment Officer, CC&L Private Capital.