April 21, 2020

Portfolio markets summary

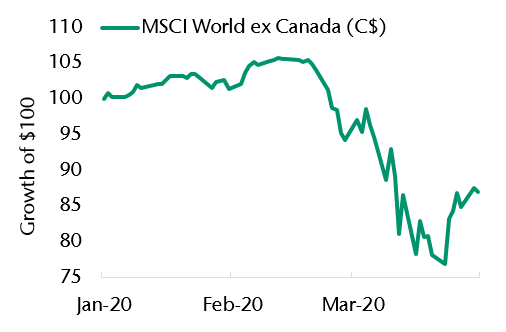

The COVID-19 pandemic has rattled markets in ways unseen in over a decade. This quarter the S&P/TSX Composite Index was down -20.9% while global stocks faired better with the MSCI World ex Canada Index (C$) down -13.0%. Equity markets entered a bear market and the economy almost certainly is in a recession. The spread of COVID-19 across the globe prompted the decline but investors are focused on the economic impact which is higher unemployment and less demand for goods and services during the shutdown. Central banks and governments across the globe have quickly lowered rates and are implementing unprecedented new policies to improve market liquidity and support people and businesses that are vulnerable. To compound the market shock, OPEC and Russia negotiations broke down over limiting the supply of oil. Instead of reducing supply it has increased. The increased supply combined with the decreased demand for oil, due to the measures to slow COVID-19, resulted in a 66% decline in the price of crude oil this quarter. This decline more significantly affects the Canadian equity market which has a large energy sector weight.

Bonds protected capital this quarter generating a small but positive return. The FTSE Canada Universe Bond Index was up 1.6% this quarter. Most of the bond market returns came from Government of Canada bonds which benefited from investors bidding up the price of these bonds and forcing yields to historic lows. Corporate bond returns were slightly negative as the outlook for companies generally deteriorated and investors demanded higher yields to hold these assets.

Global equity market decline

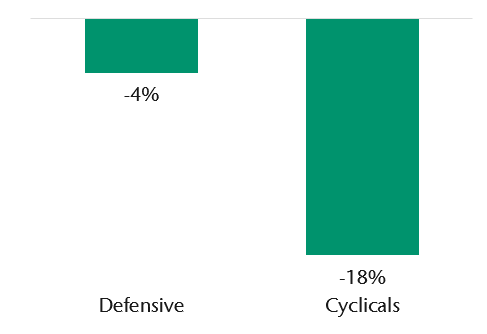

Global sector performance

Portfolio strategy

Generally speaking, our portfolio positioning was defensive providing capital protection during the market weakness. The equities in portfolios are globally oriented, broadly diversified with strong balance sheets, less leverage and a focus on strong cash flows. These equities have held up relatively well as investors seek high quality investments in periods of volatility. Towards the end of the quarter our teams began to selectively add to companies that we expect will outperform in a recovery while still remaining overall defensive.

Our asset allocation strategy has been to remain modestly underweight equities. In order to maintain this positioning we have sold bonds and bought global stocks during the quarter. Within equities, portfolios have benefited from an overweight to global stocks compared to Canadian. In a period of economic stress we want to have more exposure to global equities, which have a lower weight to cyclical sectors and a better growth outlook. Within bonds, we have maintained our underweight to high yield and overweight allocation to core bonds. This positioning will continue to serve clients well in this period of uncertainty. When the impact of the virus inevitably subsides we will be looking to add more equities and high yield bonds to portfolios.

From the desk of Jeff Guise, Managing Director, Chief Investment Officer, CC&L Private Capital.