October 31, 2019

Markets overview

Equity market returns this quarter were strong with the TSX and the MSCI World ex. Canada indices gaining 2.5% and 2.0% respectively in Canadian dollars. These markets reached new highs this quarter despite slowing economic growth and company earnings growth estimates. This slowdown has occurred as global manufacturing activity has declined and trade tensions remain. An important development for capital markets has been the change in global central bank policy with most of the developed world lowering their interest rates.

Easier policy may help economic growth and company earnings reaccelerate, but there remain many mixed signals in the economic data.

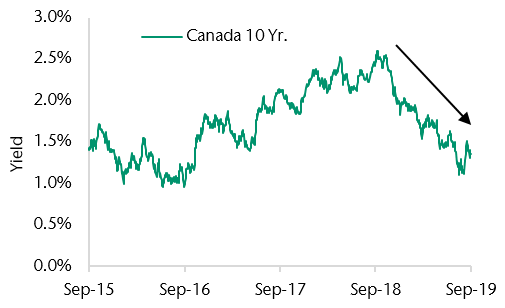

Fixed income markets also had strong returns this quarter. The Canadian Bond Universe Index return was up 1.2%, which is the result of bond yields falling and prices rising. Bond yields have moved lower as expectations for global economic growth have deteriorated and policy is more accommodative. Yields are now almost 50% lower than they were a year ago. This decline has resulted in strong bond returns, but reduces our forward-looking return expectation over the long term.

Equity markets reach new highs in the third quarter

Canadian bond yields decline

Our thoughts

Our investment process continues to indicate slowing global economic growth. In this environment we remain defensively positioned and expect further market volatility as investors’ expectations shift between a possible recession and a reacceleration of economic growth. Therefore, our short-term tactical positioning maintains an underweight to equities.

Within equities, we maintain an overweight allocation to global stocks compared to Canadian. In an environment of slowing economic growth we want to have more exposure to global equities, which have a lower weighting to cyclical sectors and a better growth outlook.

Our equity teams are favouring high-quality companies, with strong balance sheets and stable margins.

Within bonds, we have an underweight allocation to high yield and an overweight allocation to core bonds. This is prudent given that corporate debt levels continue to reach all-time highs and there are signs of tighter credit conditions, especially for lower-quality borrowers. Our overweight to core bonds will reduce portfolio volatility and improve portfolio returns in the event of an equity market decline.

We continue to recommend clients diversify their portfolios with alternative asset classes, when appropriate. Including a modest allocation to alternative investments may improve the balance between returns achieved and the risk required to generate those returns.

From the desk of Jeff Guise, Managing Director, Chief Investment Officer, CC&L Private Capital.