December 01, 2019

Variety is the spice of life, and when it comes to your investments, owning a range of asset classes—or ‘diversifying’—is an essential ingredient for a well-balanced portfolio. Beyond the typical diversification tactic of owning public-market equities and bonds, savvy investors may now consider enhancing their portfolios with investments in alternative asset classes like commercial real estate, infrastructure and private loans.

Why is diversification important?

Let’s take a quick step back and look at why diversification is important. It turns out that pairing up assets whose values don’t tend to move in the same direction at the same time—a typical example is equities and bonds—can significantly decrease the risk in an investment portfolio. This is considered a benefit because the value of a less risky portfolio will usually change more steadily over time than the more frequent and sometime larger swings of a riskier portfolio.

What this means is that including alternative asset classes, such as commercial real estate, infrastructure or private loans, in the stocks-and-bonds portfolio of a client with a medium level risk tolerance can help do one of two things: either reduce the portfolio’s risk without giving up overall expected returns or increase the portfolio’s potential for growth while maintaining the same level of risk. Which of the two outcomes prevails generally depends on the characteristics of the portfolio and asset classes chosen.

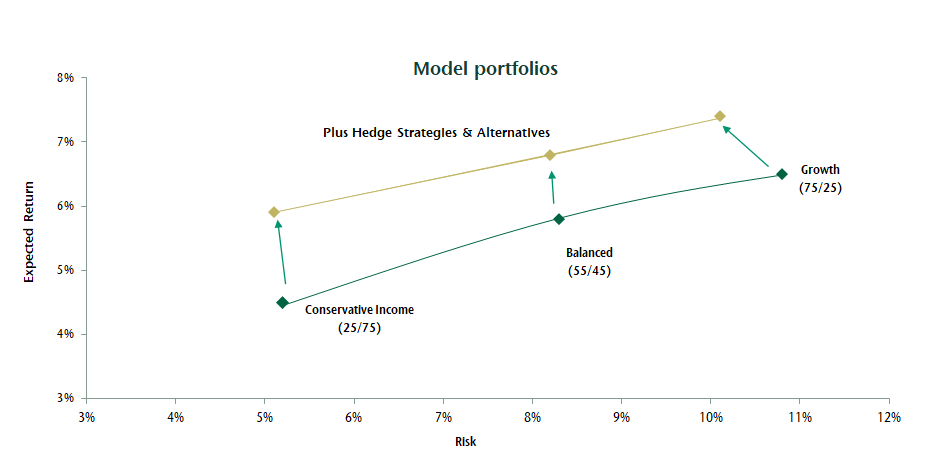

Below we’ve provided an illustration showing how alternative investments may affect the expected risk and return of a range of investment portfolios, based on our 20 year forecast, from those suitable for more risk-averse clients (conservative) to others designed for clients with a higher level of risk tolerance (growth).

Based on 50th percentile estimates of the range of returns for the applicable capital markets over the next 20 years. It is important to note that the range of returns does not cover all possible outcomes. Data does not represent past performance

and is not a promise of actual or range of future results. Allocations with alternatives include Real Estate, Infrastructure, and Private Loans (5% each).

Common characteristics of these alternative investments include attractive yields and a relatively low correlation to traditional asset classes. Commercial real estate and private loans, for instance, can provide stable cash flows over a known duration, while infrastructure investments can be less affected by economic cycles than traditional asset classes and have the potential for long-term capital appreciation. In this way, alternative assets can help a portfolio minimize the effects of the ups and downs in public market asset prices.

Alternative assets can help a portfolio minimize the effects of the ups and downs in public market asset prices.

The reason why many investors haven’t already baked alternative assets into their portfolios is simple: a lack of opportunity. Until more recently, only large institutional investors like pension funds and insurance companies had access to these specialized asset classes, but that’s been changing as more private and smaller foundation investors learn about the benefits of holding ‘alts’. To match this growing demand, some investment counsellors—including CC&L Private Capital—have been offering clients the ability to own a range of alternative investments, but unfortunately it still isn’t commonplace. Adding these asset classes is worthwhile though, as including alternative investments in your portfolio can help satisfy your appetite for diversification.