February 13, 2026

Key takeaways

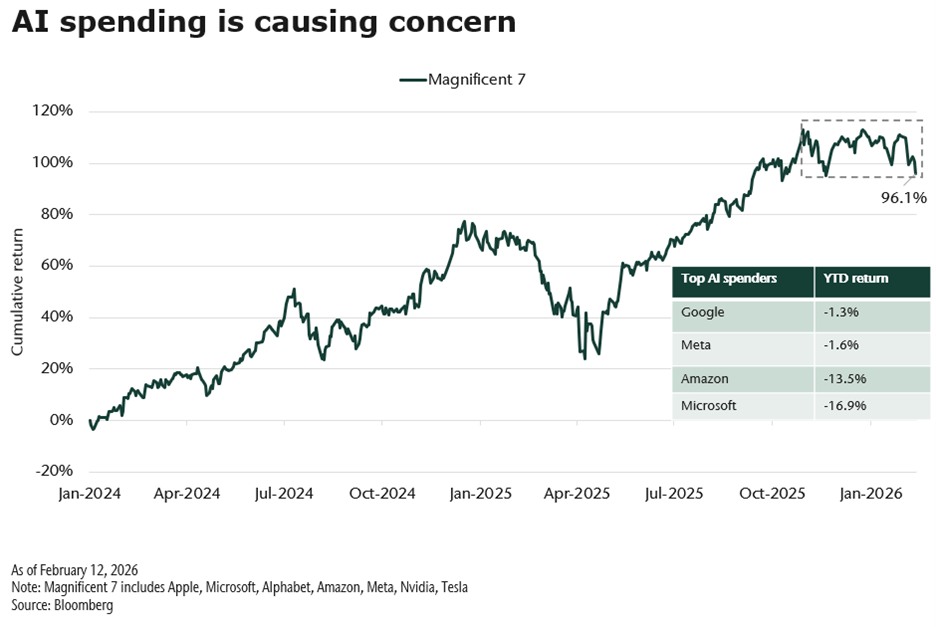

- While AI has been the main driver of global equity returns since 2023, over the past six months, key AI stocks have become highly volatile and declined.

- Companies are ramping up capital expenditures to scale AI, raising the bar for revenue needed to achieve satisfactory returns and increasing the risk of overspending.

- AI, once seen as a growth catalyst for software companies, may ultimately pressure their revenue models by lowering barriers to entry and compressing pricing power.

Artificial Intelligence (AI) drove the majority of global equity returns from 2023 through mid-2025. Over the past six months, that leadership has become far more volatile and key AI stocks are down year-to-date.

The issue is not earnings—these remain solid—but spending. Companies continue to raise capital expenditure plans to scale AI capabilities. As investment spending increases, so does the level of revenue required to earn an acceptable return.

Investors are increasingly wary that the competitive race for AI dominance could lead to overspending and capital misallocation. The payoff may still come; but the path to monetization remains uncertain, and it may take longer than markets initially assumed.

The AI disrupted

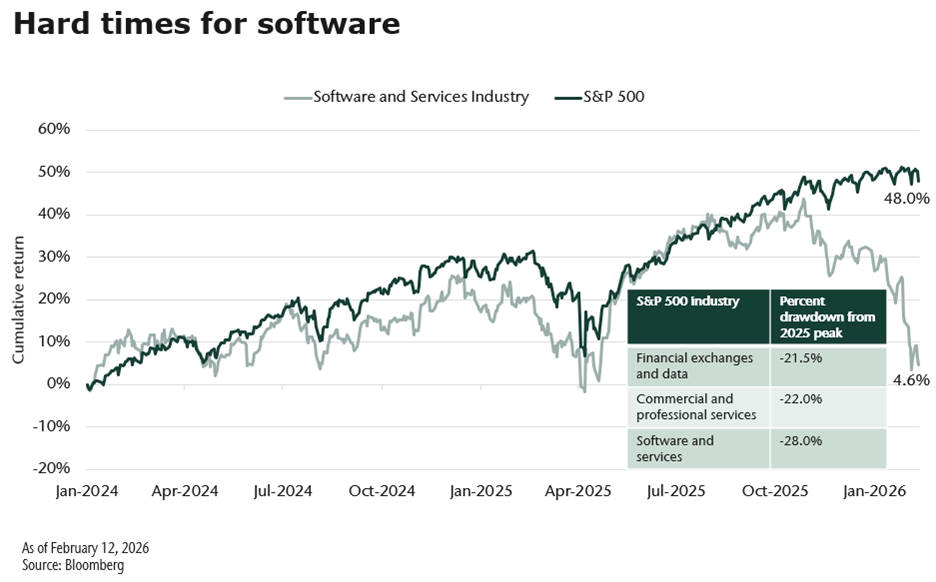

Software companies have been hit hardest in the recent pullback. Early in the AI cycle, they benefited from embedding AI into their products and charging for enhanced functionality. Today, the narrative has shifted. AI is increasingly viewed not just as an enhancement, but as a potential replacement layer.

The disruption is not showing up in earnings—at least, not yet. The unease is about longer-term risk. The concern is that agentic AI could eventually allow businesses to build customized tools themselves, reducing reliance on traditional software platforms. We do not believe these companies will disappear. But, if customers retain subscriptions while gaining alternative AI-driven capabilities, pricing power may become harder to sustain and growth expectations moderate.

The shift in sentiment has been meaningful. The United States (US) software industry has fallen roughly 28% over the past three and a half months.

Software is not alone. Professional services and data providers have also come under pressure on similar fears. Companies ranging from market data firms (such as S&P and MSCI) to credit bureaus (like Equifax and TransUnion) are facing questions about how defensible their data and analytics franchises are in an AI-enabled world. The group has declined sharply as investors reassess long-term competitive moats.

An additional concern is correlation. Software and business services stocks are increasingly moving in tandem. When correlations rise, diversification within growth portfolios declines, increasing the segment’s overall risk profile.

Hedging AI Risk

Part of gold’s strength this year appears tied to its role as a hedge against rising AI. While gold remains up on the year, it recently declined 14%, tracking weakness in AI-linked equities.

Gold’s longer-term fundamentals remain constructive—central bank accumulation, persistent fiscal deficits, and steady investor demand all provide support. However, gold equities should not be considered a precise hedge against AI volatility as their performance is also influenced by broader market liquidity and risk sentiment.

A more durable approach to manage AI risk is through portfolio construction. This means moderating exposure to the most capital-intensive AI spenders and broadening allocations beyond technology. Historically, defensive sectors, such as utilities, have tended to help stabilize returns. Financials and energy can provide cyclical diversification and benefit from different economic drivers. There is also merit in considering exposure beyond AI infrastructure builders to areas that could benefit from the spending cycle, such as power generation and grid-related businesses.

Diversification remains a core consideration in portfolio construction, especially when sectors that have historically behaved differently begin moving together. In an environment of rising correlations, managing concentration risk becomes increasingly important.