February 06, 2026

Key takeaways

- Recent declines in the technology sector are being driven by heightened concerns over capital expenditure, rather than any deterioration in company fundamentals.

- While investors are showing a preference for high-quality, structurally advantaged companies, certain companies with cyclical growth potential did rally.

- We are thoughtfully positioning our portfolios to capture long-term opportunities in AI while carefully managing short-term risks.

This week’s selloff across the “Magnificent 7” and the broader technology sector has been pronounced, but it has not been random. At its core, the market is grappling with a familiar tension: extraordinary long-term opportunity colliding with very near-term cash flow constraints. After leading equity markets higher for much of the past year, large-cap technology stocks have come under pressure as investors reassess how much they are willing to pay today for growth that may take longer to fully materialize.

The catalyst for this reset has not been deteriorating fundamentals. Large-cap technology earnings have generally been solid, and demand for Artificial Intelligence (AI)-enabled products and services remains robust. Instead, investor focus has shifted decisively to capital intensity.

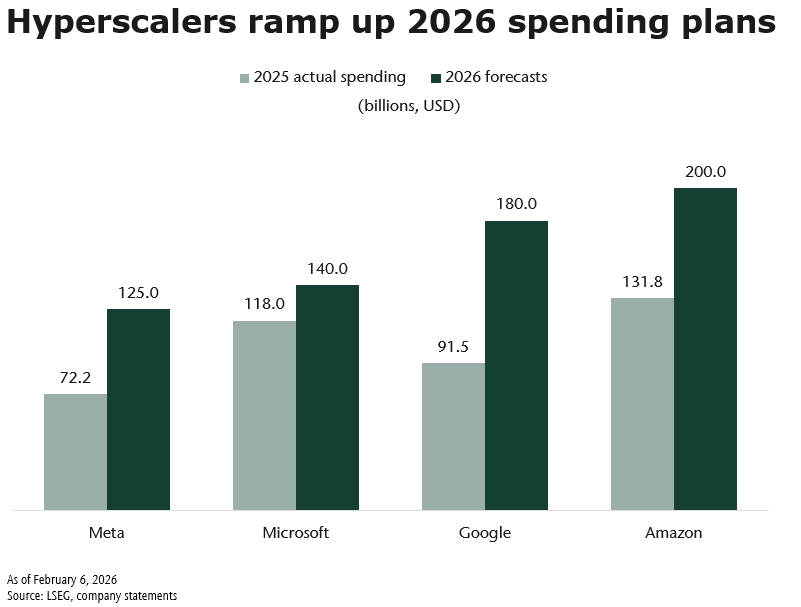

Over the past few weeks, several of the largest technology companies have outlined capital expenditure plans that are unprecedented in scale. Alphabet, Amazon, Microsoft, and Meta alone are expected to spend roughly $650 billion on capital investments in 2026. This is largely tied to data centers, networking infrastructure, and AI compute capacity. By historical standards, this level of spending rivals the largest infrastructure buildouts of past eras.

Markets have reacted swiftly. Amazon shares sold off after announcing plans to invest $200 billion this year, while Microsoft experienced its largest drawdown since 2020 following record quarterly capital expenditures and signs of moderating cloud growth. The message from markets has been consistent: investors are not questioning the importance of AI, but they are debating the pace, timing, and ultimate return on this wave of spending.

This dynamic has been particularly evident within semiconductors. The surge in AI infrastructure investment has driven extraordinary demand across the supply chain, most recently extending into memory. Performance dispersion within the sector has widened meaningfully, as high-quality, structurally advantaged names—such as Nvidia and Broadcom—diverge sharply from more commodity-exposed businesses like Micron. As capital rotates toward companies with greater earnings sensitivity to rising investment spending, some of the more cyclical beneficiaries have rallied—despite lingering questions about sustainability later in the cycle.

Our positioning

Against this backdrop, we have maintained a measured approach. We are currently modestly underweight United States (US) semiconductors, reflecting our preference for quality and durability over short-term momentum. While we acknowledge that highly cyclical names may continue to perform if the AI infrastructure build-out accelerates further into 2026 and beyond, these businesses sit outside our core opinion list given their sensitivity to pricing cycles and eventual normalization. That said, we are actively reviewing opportunities within AI infrastructure to ensure we are not carrying unnecessary relative risk should this phase of the cycle extend longer than expected.

On the software side, the recent weakness across the sector has reinforced our emphasis on selectivity. Elevated correlations among software names and uncertainty around how AI will reshape software economics have led us to reduce our exposure to more broadly exposed names. In contrast, we continue to see greater resilience in domain-specific and vertically integrated software providers. ServiceNow continues to hold a robust competitive edge in the enterprise workflow sector, while Intuit maintains its leadership in tax and accounting solutions. These businesses appear better positioned to incorporate AI as an incremental advantage rather than face it as a disruptive threat.

The bottom line

The market pullback reflects a repricing of risk rather than a collapse in fundamentals. The scale of investment flowing into AI is extraordinary, and that inevitably invites scrutiny around returns, timelines, and capital discipline. While volatility may persist as markets digest these questions, we continue to view AI as a powerful, multi-year structural theme. Our positioning reflects a deliberate balance: maintaining exposure to long-term winners while managing the risks that emerge when enthusiasm, spending, and valuations all rise at once.