January 30, 2026

Key takeaways

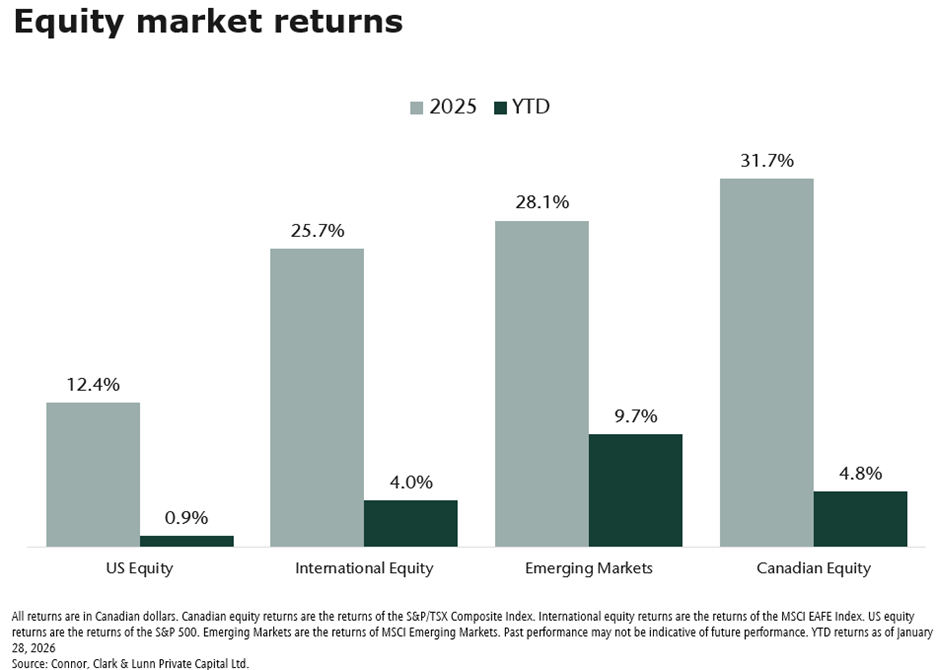

- Equity markets posted exceptional returns for a third consecutive year in 2025, with Canadian, emerging market, and developed international stocks outperforming.

- AI, gold, and dollar softness remain influential, but 2026 has brought more divergence within some themes—along with elevated geopolitical risks and policy uncertainty.

- While the overall investment environment remains constructive, elevated valuations mean returns may moderate and opportunities appear more attractive in Canada and non-US markets.

2025 marked a third consecutive year of exceptional returns for equity investors. After two years dominated by United States (US) equities, market leadership broadened meaningfully. Canadian equities, emerging markets, and developed international stocks all outperformed, supported by a combination of Artificial Intelligence (AI)-driven growth, strong performance in gold-related equities, and a weaker US dollar.

Markets were underpinned by resilient economic growth, inflation that remained contained, and central bank rate cuts. Despite elevated geopolitical risks, investors largely looked through near-term uncertainty, creating a broadly supportive backdrop for risk assets. Notably, market performance in the first month of 2026 has followed a similar directional pattern.

Volatility in themes

Four key themes emerged in 2025, and we provide an update on each below. While these themes have persisted into this year, we are seeing growing divergences within some.

- AI remains a defining force.

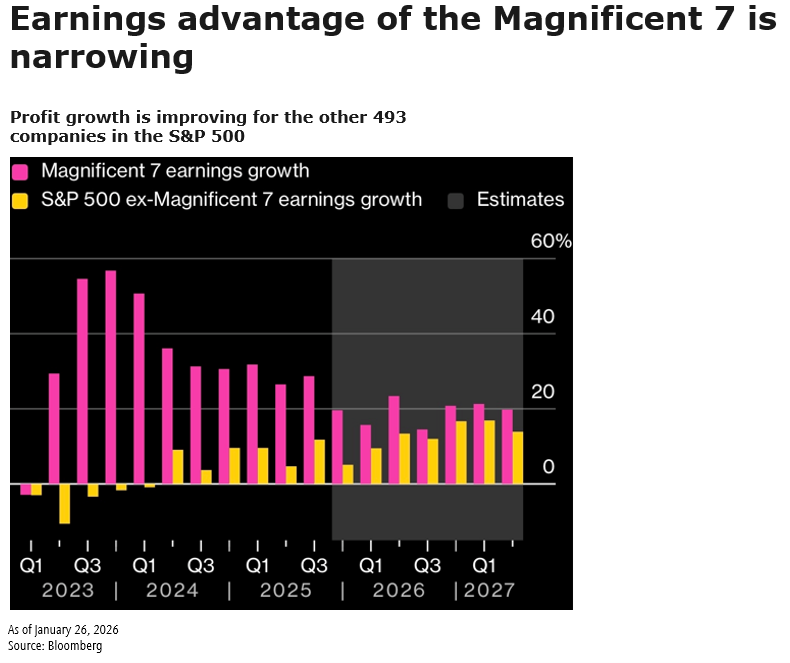

AI continues to shape market outcomes and is likely to do so for years to come. More recently, investor focus has shifted toward whether heavy investment in AI infrastructure can be translated into sustainable profits. As a result, some large AI-exposed companies lagged broader markets during the first month of this year, with leadership beginning to extend beyond the so-called “Magnificent 7”. Given that AI-related companies now represent close to 20% of global equity market capitalization, some consolidation and rotation should be viewed as healthy rather than concerning. - Gold continues to benefit from uncertainty.

Gold has extended its strong momentum, rising roughly 20% in January after an exceptional year in 2025. The fundamental backdrop remains supportive, driven by central bank purchases, investor demand for diversification away from the US dollar, fiscal pressures, and ongoing geopolitical risks. While returns have exceeded expectations and short-term pullbacks would not be surprising, interest from both institutional and retail investors continues to provide underlying support. - A weaker US dollar remains an important tailwind.

Dollar softness continues to support markets outside the US. Historically, periods of US dollar weakness have been favourable for emerging market equities, easing financial conditions and improving earnings visibility. Both last year and the early part of 2026 have reflected this pattern. - Geopolitics and policy uncertainty remain elevated.

The year, we have already seen renewed tariff threats, geopolitical flashpoints, and ongoing questions around fiscal discipline and central bank independence. While markets have generally refocused on fundamentals, these factors reinforce the potential for episodic volatility and uneven market reactions.

Outlook: constructive, but more balanced

The overall backdrop for risk assets remains favourable. Supportive monetary and fiscal policy, resilient nominal growth, and easing cost pressures underpin a positive environment for equities. That said, returns are likely to moderate from the exceptional levels seen in recent years.

Valuations are elevated—particularly in those parts of the US market most exposed to AI—and this leaves little room for disappointment. At the same time, opportunities appear more compelling in Canada and select non-US markets, where valuations are more reasonable and earnings expectations less demanding.

Earnings leadership is beginning to broaden across the US market. While the “Magnificent 7” continues to deliver profit growth, earnings growth across the rest of the S&P 500 is improving, narrowing the gap after a period of high concentration. This convergence points to increasing opportunities beyond the largest technology stocks, particularly among companies with strengthening fundamentals and more attractive valuations.

Risks to the outlook

While the base case remains constructive, the margin for error is narrower than in prior years. One key risk is a renewed upside surprise in inflation—potentially driven by energy prices, tariffs, or fiscal pressures (which could limit central bank flexibility to further cut rates in the US). A sharp reversal in AI-related optimism is another risk, particularly given market concentration and elevated expectations. Geopolitical developments and abrupt shifts in trade policy also have the potential to trigger short-term volatility.

What’s the trade?

Against this backdrop, we have positioned our standard equity portfolio accordingly:

- AI - we remain modestly overweight to global AI companies, reflecting their long-term earnings potential, while being more selective as valuations rise. We also used periods of strength to sell our winners and diversify outside of the theme.

- Gold - our Canadian core equity team is overweight gold while our Canadian value team finds it hard to buy these companies and is underweight. Most of our clients hold Canadian small caps, which have a higher weight than the large cap benchmark, resulting in our overall Canadian equity positioning being approximately neutral relative to the TSX Composite benchmark.

- US dollar exposure - we are underweight the US dollar as our portfolio construction reduces US equity exposure in favour of emerging markets. This worked well last year and continues to serve us well this year. In fixed income portfolios, we now hedge all US bonds, this way we aren’t affected from the potential decline in the USD dollar.

- Our exposure to geopolitical uncertainty is hard to quantify. One area of the market where we see persistent pressure is in the bond market. There is upward pressure on bond yields—given high levels of global fiscal spending, with no end in sight—and here, we have benefited. We have less sensitivity to changes in interest rates due to our diversified global bond holdings. And our investments in mortgages have performed well in what has been a lower-return environment for traditional fixed income.

The bottom line

After three strong years for equity markets, the investment backdrop entering 2026 is evolving, but with durable themes. Going forward, returns are likely to depend more on companies delivering earnings growth than on rising valuations—even as the broader economic environment remains supportive. Canada stands out in this context, benefiting from commodity exposure, improving earnings trends, and more attractive valuations compared with the US, where valuations are higher. In fixed income, bond yields appear likely to remain within range, as easing inflation is balanced by ongoing interest rate and fiscal pressures.

Looking beyond the near-term cycle, longer-term forces continue to shape markets. Rising geopolitical tensions, persistent fiscal deficits, and rapid investment tied to AI are influencing growth, inflation, and policy decisions. While inflation pressures have eased, they are likely to be more uneven and volatile than in the years prior to the pandemic.