January 23, 2026

Key takeaways

- Canadian data indicates slowing employment growth and rising unemployment, prompting expectations that the Bank of Canada may cut rates.

- In the United States, strong economic fundamentals—including a healthy labour market, solid household balance sheets, and resilient consumer spending—support expectations for fewer rate cuts.

- Volatility stemming from political tensions and tariff threats eased later in the week, allowing markets to refocus on economic fundamentals and lifting both equities and bond yields.

It has been an eventful week for markets, with politics shaping near-term sentiment. Early volatility tied to renewed tariff rhetoric from President Trump gave way to a more measured response as investors avoided hitting the panic button. That patience

was rewarded. A cooling in geopolitical tensions—including a swift dial-back of United States (US) threats around Greenland following discussions at the World Economic Forum—helped stabilize sentiment and allowed markets to refocus on

fundamentals. Solid economic data, in-line inflation readings, and a renewed rally in global chipmakers drove equities higher, along with bond yields. Beneath the market moves, the underlying economic backdrop highlights meaningful differences in

the outlook for Canada and the US.

Canada: near-term risk skewed to policy easing

Canada entered 2026 after a period of improving economic data. This led to markets expecting a Bank of Canada (BoC) rate hike. That narrative has changed. Recent data point to a softer end to the year, with employment growth slowing and unemployment rising.

The Canadian labour market now appears more consistent with cooling demand than renewed strength. From the BoC’s perspective, excess capacity continues to weigh on inflation, keeping the risk of further easing in focus.

Growth in Canada remains uneven. After a sharp contraction in 2025 and a trade-driven rebound, domestic demand has since lost momentum, even with earlier rate cuts in place. Recent monthly data suggest fourth-quarter economic growth is tracking close

to zero. Trade uncertainty remains a key constraint on confidence and investment. Absent greater clarity, it is difficult to see growth reaccelerating meaningfully. While the BoC has emphasized a neutral stance, they may choose to cut rates to further

support the economy.

US: resilient growth and fewer rate cuts

The US picture remains more constructive. Job growth has slowed, but the labour market continues to show resilience. Layoffs are low, jobless claims are near cycle lows, and there is little evidence of the kind of labour market stress that could threaten

household income as wage growth continues to outpace inflation.

Household balance sheets remain a key source of support. Net worth has surged alongside equity markets and home prices, debt service burdens are historically low, and larger-than-normal tax refunds in 2026 should provide an additional income tailwind.

While consumer confidence surveys have been volatile and politically noisy, they have proven to be a poor guide to actual spending. Hard data continues to point to steady consumer spending growth.

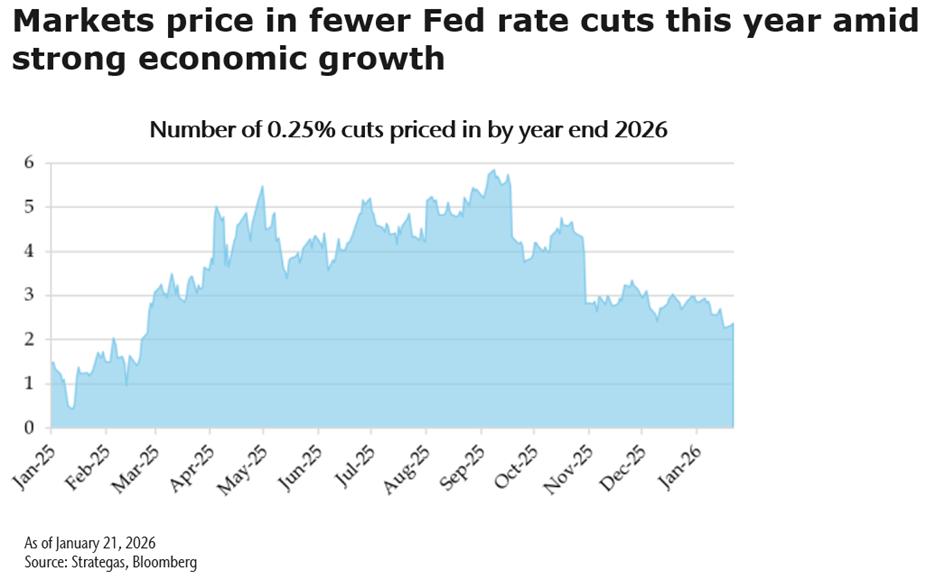

This resilience is increasingly reflected in market pricing for interest rates. Market expectations have shifted toward fewer rate cuts this year, falling from roughly three anticipated cuts just weeks ago to closer to two. Additionally, markets are pricing

in a prolonged Federal Reserve (Fed) pause, with the next rate cut expected in June. This adjustment appears driven less by inflation concerns and more by confidence in underlying growth, which was revised higher in the third quarter. Alongside a

solid second quarter expansion, this represents one of the strongest two-quarter growth periods since 2021.

Despite a broadly optimistic market narrative for 2026, risks remain ever-present. Geopolitical developments and US tariff policy could trigger bouts of volatility with little warning, while the evolving Artificial Intelligence (AI) landscape continues

to offer both significant upside and downside risks. In this environment, success is less about forecasting every shock and more about resilience.

We position portfolios to participate in growth where fundamentals are strongest, while maintaining resilience to sudden shifts in sentiment through diversification and active risk management. By staying selective, flexible, and valuation-aware, portfolios

can navigate near-term volatility while remaining aligned with longer-term opportunities and thematics.