January 16, 2026

Key takeaways

- Encouraging US inflation trends are creating a more favourable global investment climate and giving the Fed greater flexibility.

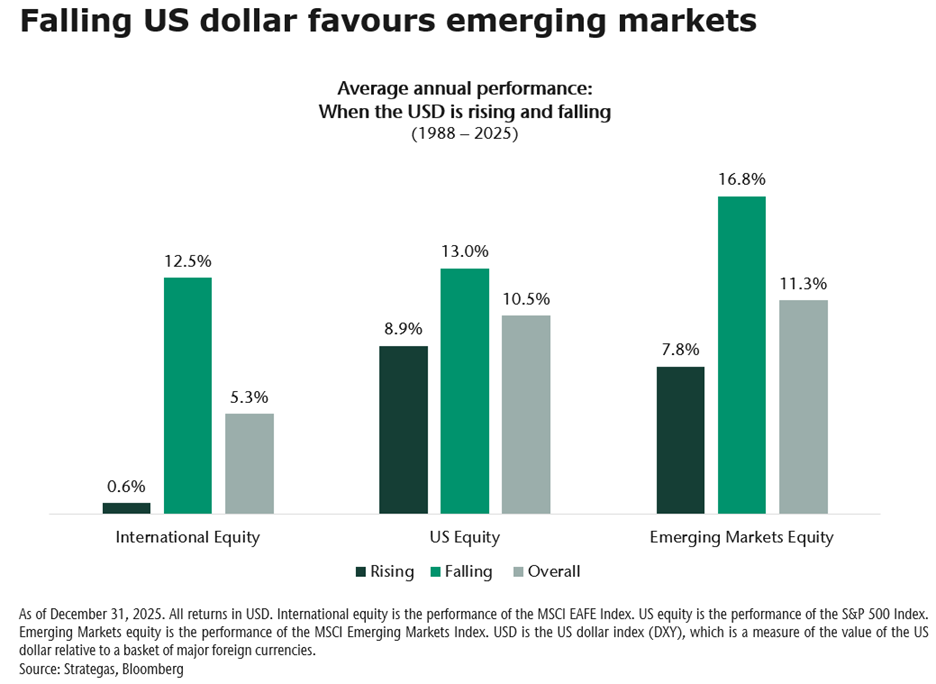

- A weaker US dollar may benefit emerging market equities, as we have seen historically.

- With US equity markets becoming more concentrated and valuations high, global diversification is increasingly important for investors.

Several macroeconomic forces are gradually shifting. Recent United States (US) inflation data has been somewhat more encouraging, the Federal Reserve (Fed) appears to have more flexibility than it did last year, and the US dollar is facing growing headwinds.

While none of these developments on their own is decisive, together they are beginning to create a more supportive environment for assets outside of the US—particularly emerging market equities.

Inflation progress, but not victory

December’s US inflation report was one of the more dependable inflation prints in recent months, with fewer questions around data reliability than prior releases. Headline and core inflation held at 2.7% and 2.6% year-over-year, respectively; modestly

outperforming market expectations and broadly consistent with a gradual easing trend.

The composition of inflation remains important. Core goods prices were flat over the month. This is notable given ongoing concerns around tariffs and supply chains, suggesting that firms continue to absorb some cost pressures rather than fully pass them

on to consumers.

Inflation in service-related areas remains elevated, but there are signs that pressure is starting to ease. Some of the most persistent sources of inflation are no longer accelerating as quickly as they were last year. Most encouragingly, housing-related

inflation is beginning to align with the cooling already evident in the rental market. As rent growth slows, the effect gradually feeds through to broader inflation measures.

That said, inflation risks have not disappeared. Energy-related components and electricity prices remain volatile, and progress in services inflation has been uneven. While the recent data is constructive, it does not yet signal a return to pre-pandemic

inflation dynamics.

Implications for the Fed and the dollar

This more balanced inflation backdrop gives the Fed slightly more room to maneuver, even as policymakers remain cautious. Continued progress—particularly in shelter and services—would make it easier for the Fed to continue easing policy in

2026, especially if growth cools further.

Expectations for lower US interest rates matter for the dollar. When rates fall, US investments become less attractive compared with those overseas, all else equal. That could reduce demand for the dollar. In addition, political uncertainty and weaker

fiscal discipline are making some international investors more cautious. Together, these factors increase the risk that the dollar weakens over time, even if the move is uneven.

A tailwind for emerging markets

Historically, emerging market equities have tended to perform better during periods of dollar softness. A weaker dollar eases financial conditions, supports capital flows, and improves earnings visibility across many emerging market economies. More broadly,

risk assets often benefit when the dollar is declining, as investors broaden their opportunity set beyond the US.

A more supportive backdrop, shaped by easier monetary policy and ongoing fiscal support, suggests that market leadership is broadening beyond a narrow set of US stocks. While artificial intelligence (AI) remains an important long-term theme, and US exposure

continues to be significant (given its leadership in technology), investors are becoming more focused on profitability and valuation.

With US equity markets highly concentrated and valuations elevated, the bar for continued outperformance is higher. The takeaway is not to reduce US exposure, but to diversify it. A more balanced, global approach—which includes selective exposure

to emerging markets—may offer a more resilient path forward as economic trends continue to normalize.