January 09, 2026

Key takeaways

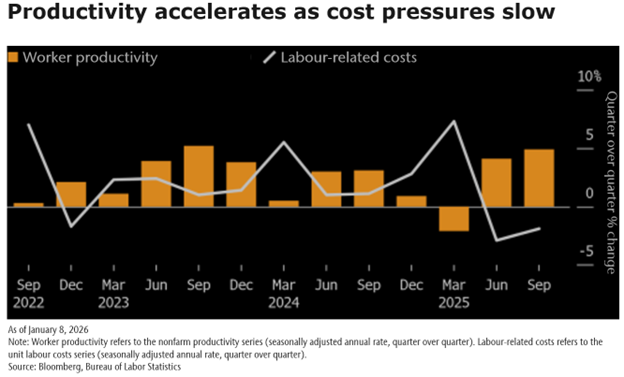

- Recent productivity gains are underpinning US economic resilience

- Productivity improvements are helping contain inflation and giving the Federal Reserve greater flexibility to lower interest rates

- Risks remain, but important buffers are in place

A defining feature of the United States (US) economy as we enter 2026 is resilience. Growth has held up despite still-restrictive interest rates, trade uncertainty, and a cooling job market. One key reason is stronger productivity—businesses are

producing more with the same resources, supported by Artificial Intelligence (AI) and broader efficiency gains. As productivity improves, the economy can grow without relying on more hiring or rising debt. This productivity boost helps explain why

growth has remained intact rather than slipping into a sharper slowdown.

Productivity and inflation

Productivity gains help keep inflation in check. When businesses can increase output without a matching increase in headcount, cost pressures ease and pricing pressure diminishes. Wage growth is also no longer putting upward pressure on prices. For the

Federal Reserve, these are important developments: they suggest the economy can continue to grow without reigniting inflation, increasing the likelihood they will lower interest rates over time.

Tariffs have been less damaging

One surprise of 2025 was that tariffs proved less inflationary and less disruptive to growth than widely expected. While trade policy created uncertainty, productivity gains, cost management, and supply-chain adjustments helped companies mitigate the

effects of tariffs. Inflation, while still above target, finished the year toward the lower end of forecasts, challenging the assumption that tariffs would reignite price pressures or derail growth.

Downside risks but buffers

Resilient growth, elevated but contained inflation, and expectations for lower rates have become the market consensus and align with our view. The primary risk to this outlook would be a sharp reversal in AI-related optimism. Remember 2022, when many

of these stocks fell considerably? Investors have repeatedly questioned the durability of earnings and valuation levels since then. Given the market’s concentration in the AI theme, this has the potential to result in a meaningful correction—one

which could impact the broader economy and push unemployment higher.

That said, the economy enters this period with important buffers. Less upward pressure on inflation and a more responsive Federal Reserve provide a safety net, suggesting that even downside scenarios are likely to be managed rather than destabilizing.

Bottom line

The US economy enters 2026 on solid footing. Strong productivity growth is allowing the economy to expand as inflation appears manageable, wage pressures ease, and interest rates decline. While risks remain, the balance of evidence points to a more durable and sustainable expansion.