December 19, 2025

Key takeaways

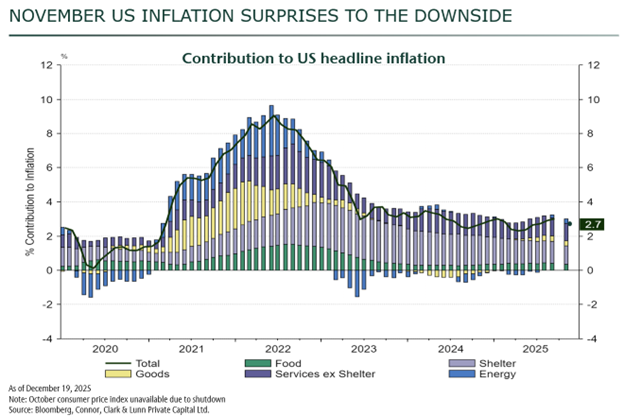

- November’s softer US inflation print is encouraging but inconclusive.

- Inflation may ease in 2026, but risks remain skewed to persistence above target.

- Infrastructure, value stocks, and credit have historically shown greater resilience when inflation remains elevated.

This week’s US inflation data for November was lower than expected. On the surface this is a good thing. However, we think this is more noise than signal and are hesitant to put too much weight into this decline. The reason is that the US government

was shut down which means no information was collected in October and they started later for the November data. In particular, some are questioning the magnitude of easing of the much-watched shelter costs.

2026 outlook for US inflation

This year US inflation has remained sticky. This is what happens when you put tariffs in place on an economy that is already performing relatively well. Here are four reasons inflation may moderate in 2026:

- The labour market in the US has been weakening, which may lead to lower wage growth and demand for goods and services.

- Shelter inflation is poised to keep ebbing as housing prices have declined.

- The economy will adapt to the new policy environment which may include lower tariffs.

- AI efficiencies could improve productivity and help businesses do more with less.

However, we believe inflation will remain above the target of 2.0% and there are risks that progress on inflation could stall in 2026.

- The biggest risk to inflation is stimulus from large budget deficits and elevated government spending.

- With large deficits, policymakers may be more tolerant of somewhat higher inflation for a period, as this helps manage debt loads.

- President Trump will appoint a new Fed chair in 2026, and it is widely believed he will choose someone more inclined toward lower interest rates, which could add to inflationary pressures.

What asset classes perform the best in periods of inflation?

Infrastructure, value stocks and credit can outperform in a period of above target inflation. Here are a few reasons:

- Our infrastructure portfolio is positively leveraged to inflation. In other words, all else is equal if inflation rises, we expect our contract revenues to increase faster than our costs, generating improved returns.

- Elevated inflation can place downward pressure on equity valuations overall, which can favour value stocks. Companies trading at lower valuations and with nearer-term cash flows tend to be less sensitive to rising discount rates than

higher-valuation growth stocks.

- Within fixed income, credit tends to do better in periods of higher inflation, particularly if higher inflation is leading to higher bond yields. Credit instruments such as high yield bonds typically offer higher coupon payments and

have less sensitivity to changes in yield.

Constructive view, cognizant of risks

Although momentum remains positive heading into 2026, a fourth consecutive year of strong equity gains will require markets to navigate several meaningful risks—most notably elevated valuations, concentrated market leadership, and the possibility

that inflation proves more persistent.

While mindful of these risks, we remain focused on what we can control: rigorous research, disciplined risk management, and thoughtful portfolio construction. This increases the likelihood that, whatever path the economy and markets take in 2026, portfolios

are positioned to capture opportunities while staying resilient through inevitable periods of volatility.