December 05, 2025

Key takeaways

- The US job market is cooling, a sign the economy is currently in a soft patch.

- The US is expected to cut interest rates next week while Canada is likely to hold.

- Stocks have been sensitive to changes in US rate cut expectations and an improving outlook for 2026.

The job market remains a key focus in both Canada and the United States (US) as central banks prepare to decide on interest rates next week. Recent data suggest the US Federal Reserve (Fed) is more likely to cut than the Bank of Canada (BoC), and the

direction of the job market helps explain why.

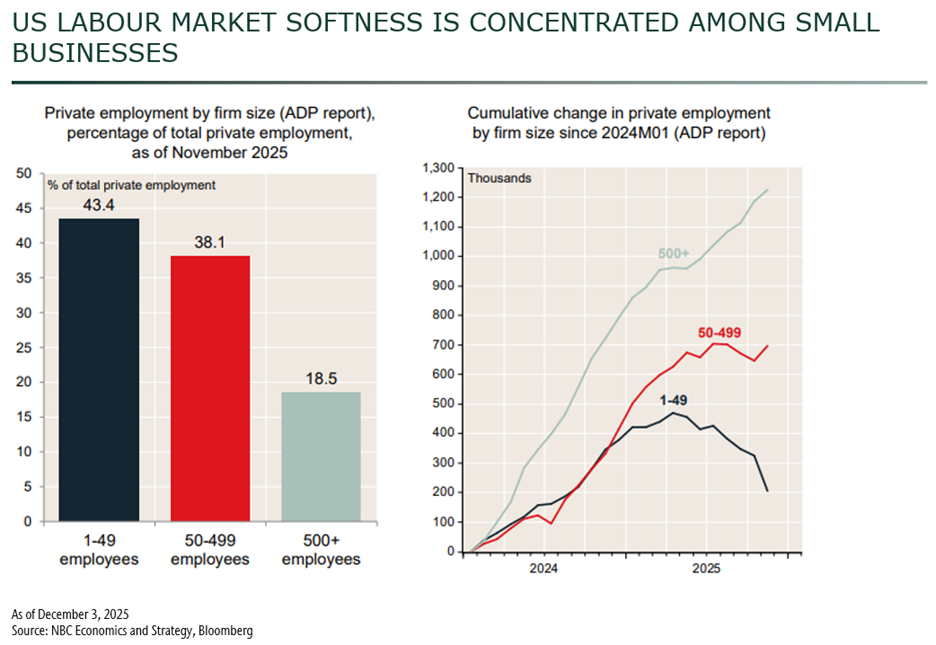

US small businesses show signs of strain

Hiring in the US has slowed, and the latest private-sector report shows the steepest job losses among small businesses since the pandemic. These companies have been reducing staff since the spring. This shift raises concerns about the broader economy.

Fed governors have been talking more about the slowing labour market in recent speeches. We anticipated this slowdown and expect to see improvements in the economy and stabilization in the labour market in 2026. However, for now, this strengthens

the Fed’s case for a cut next week.

Canadian employment surpasses expectations

Canada’s November employment report extended a three-month run of solid job gains and reversed the summer’s weakness. The unemployment rate fell sharply to 6.5% from 6.9%—the largest monthly decline since 2022—driven by slower

population growth and a gradual expansion in the labour force.

This solid jobs report follows a series of better-than-expected Canadian economic indicators in recent weeks, including the upside surprise on third-quarter GDP and the earlier robust job gains. While inflation is still slightly above target, the BoC

is widely expected to keep rates unchanged next week and to remain on hold for some time. At 2.25%, the policy rate sits at the lower bound of the estimated neutral range, a level seen as appropriate to support growth while containing inflation. In

addition, government spending is expected to bolster the economy next year.

Stocks recover and approach new highs, again

After a pullback in November—driven by fears that technology stocks had risen too quickly—the equity market has bounced back. The recovery is being driven by the softening in the US labour market, which has increased the likelihood of a Fed

cut next week. This, combined with an improving outlook for 2026 and strong company earnings, are supportive of stocks.

In short, the US economy is slowing but not stalling. If the Fed cuts next week, it should help reinforce the recovery trajectory we expect to take shape in 2026.