November 14, 2025

This week the longest United States (US) government shutdown in history came to an end. Visibility for the US economy has been clouded because key economic indicators — including employment and inflation — could not be updated due to workforce

disruptions. This has created additional uncertainty for investors as they assess the shifting macro landscape.

Effects still linger

Although the US government is back to work, it remains unclear how quickly agencies will restore the flow of data. As a result, the US Federal Reserve (Fed) and investors may be missing key economic indicators for October and November when the committee

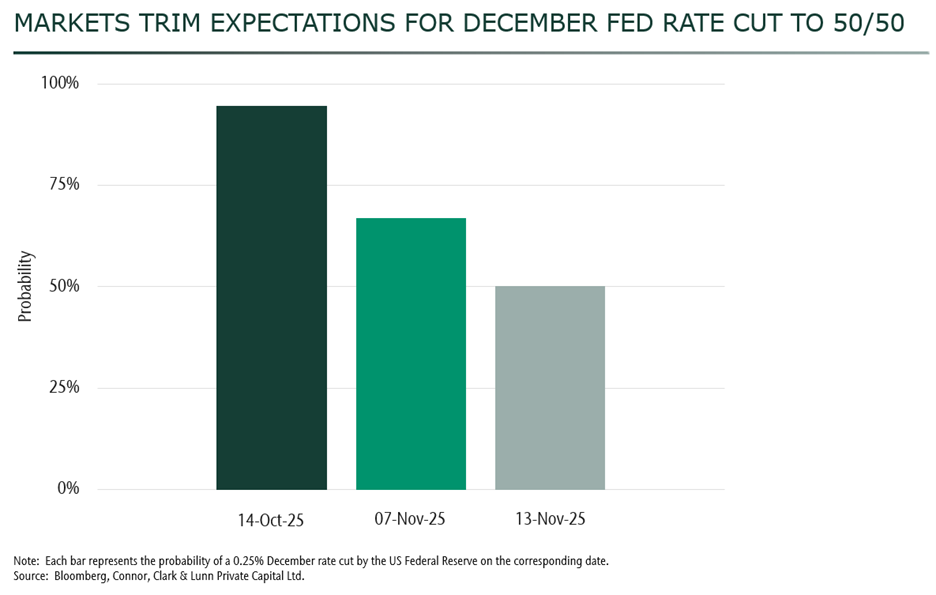

meets on December 9th to decide on interest rates. While not flying blind, their economic vision could remain impaired through the end of the year. Despite this uncertainty, markets still expect policy rates to trend lower. That being said, there

is a higher probability that the Fed will hold rates in December until they have more information on the economy.

Equity market pullback

The market fell on Thursday as expectations for a December rate cut were reset, erasing the week’s earlier gains but appearing as normal volatility on the longer-term year-to-date chart. What is notable is a move away from many Artificial Intelligence

(AI) stocks — which had been doing well recently — and a move toward more defensive and value-oriented sectors. This could be a sign of waning risk appetite, or merely reflect the sort of rotation typical of a healthy bull market. The

shift away from technology stocks could be viewed as constructive: investors are rediscovering the parts of the market that have been overshadowed by the AI narrative. This broadening gives the rally better footing.

The end of the government shutdown offers some relief to investors and policymakers, but the broader economic picture remains uncertain. As the Fed weighs how to balance still-elevated inflation against a softening labour market, the path of monetary

policy is far from settled. Markets, meanwhile, appear to be adjusting to this new phase — one defined less by exuberance in a few dominant sectors and more by selective, fundamentals-driven positioning. The recent rotation out of technology

and into value and defensive stocks suggests that investors are becoming more discerning. This shift could ultimately lend greater durability to the market’s next advance, once confidence in data and policy is restored.

Longer-term view of rates

While rate cuts are expected in 2026, the longer-term outlook points to upward pressure on interest rates and bond yields, largely driven by rising global government spending. In Canada, last week’s Federal Budget was generally viewed positively, emphasizing investment over program spending and showing some restraint. However, the deficit is widening sharply. This provides short-term economic stimulus but raises concerns about the long-term sustainability of persistent deficit spending.

The issue is most acute in the US, though Canada faces similar long-term risks. As government borrowing increases, investors will eventually demand higher compensation, pushing yields higher. If confidence wavers, yields could spike abruptly, forcing a shift from spending to austerity — which would potentially weigh on growth. This is not an immediate concern, but it is a key risk to monitor in the years ahead.