November 07, 2025

.jpg?sfvrsn=8ca997a1_1)

This week, Canada’s 2025 federal budget was unveiled, marking a shift toward long-term investment, productivity, and economic resilience. The market reaction was largely muted, reflecting expectations that the government would lean on fiscal

policy to support growth. Attention now turns to execution—how effectively these initiatives are implemented and whether they deliver the intended economic lift. Here are the key takeaways:

- Canada is set to rack up larger deficits under Prime Minister Mark Carney, with an additional C$167.3 billion in total budget deficits over five years.

- The deficits are fueled by the government’s push to direct more federal money into capital projects, and by a softer outlook for tax revenue due to an earlier income tax cut and weaker economic growth.

- The pro-growth budget includes new capital spending on community and trade infrastructure, and a new home-building agency, as well as a plan to inject tens of billions of dollars into Canada’s military.

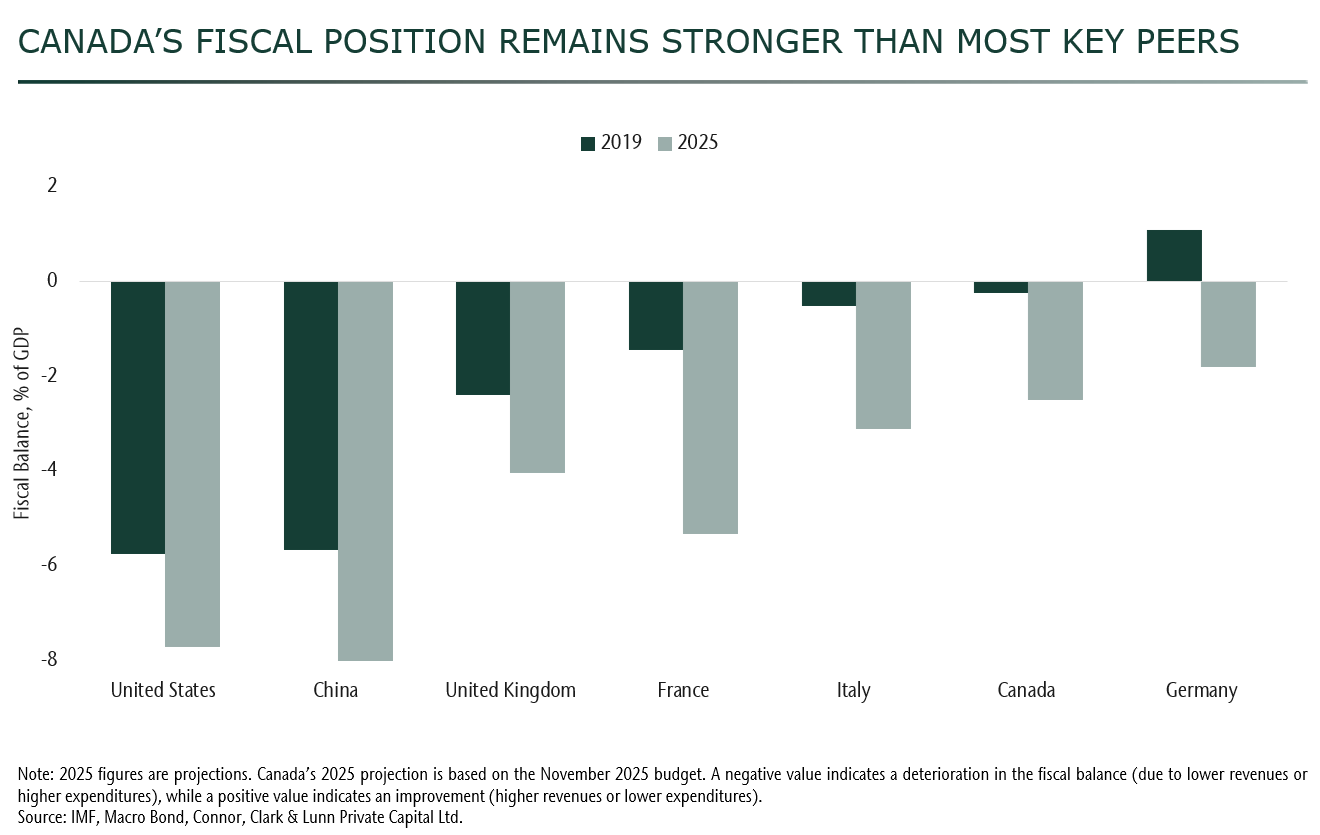

The Bank of Canada (BoC) has indicated that it is approaching the limits of how much additional monetary support it can provide without reigniting inflation pressures. Governor Tiff Macklem has emphasized that fiscal policy—not monetary easing—is now the more effective tool to cushion the economy from trade-related shocks and weaker global growth. In effect, the BoC is passing the baton to the federal government, which is using its fiscal capacity to stimulate investment and sustain demand. While this shift will widen deficits in the years ahead, Canada has one of the smallest deficits in the G7 as a share of the economy. This gives policymakers room to make what they describe as “generational investments” that aim to raise the economy’s long-term productive capacity rather than simply boost near-term demand.

Artificial intelligence (AI) volatility

Last week, concerns about the AI spending cycle slowing, or coming to a halt, were largely put to rest—at least for another quarter. Many of the largest technology companies either guided for higher capital expenditures next year or signaled plans

to keep increasing investment. The market continues to reward AI spending rather than AI return on investment, though that enthusiasm is starting to show signs of strain.

What stands out now is that not all spending is being rewarded equally, with Meta’s sharp selloff serving as a reminder that markets are becoming more discerning. Investors are increasingly demanding tangible returns on AI investment, not just ambitious

spending plans. Perhaps most notably, the technology sector appears to be heading toward a new debt cycle, as self-funding through cash reserves and free cash flow will not be enough to cover the scale of current projects. This shift could heighten

market volatility in the quarters ahead as investors reassess which companies can manage higher leverage effectively. As expectations reset and performance gaps widen, AI leaders and laggards may begin to diverge more sharply. For investors, a concentrated

portfolio of equity market winners tends to work just fine — until it doesn’t. At the moment, the S&P 500 is a case in point: its earnings remain both spectacular and spectacularly concentrated around the AI story.

Periods like this highlight the value of maintaining a broad opportunity set within portfolios. Concentrated markets can deliver exceptional gains, but they also leave portfolios vulnerable when leadership shifts or sentiment turns. Maintaining exposure

across sectors, styles, and regions helps investors participate in growth opportunities like AI while managing downside risk. Ultimately, portfolios anchored in multiple sources of return—not just the prevailing market theme—tend to deliver

the most consistent performance as market dynamics change.