October 24, 2025

At the start of the year, there were concerns about tariffs and their potential impact on the economy. While the economic environment remains uncertain, more is now known about tariffs, and growth has been resilient. Tariffs have been manageable thus

far; however, we are seeing signs of price increases in Canada and the United States (US). Should you be concerned, and what does this mean for markets?

Higher prices are not a big concern, for now

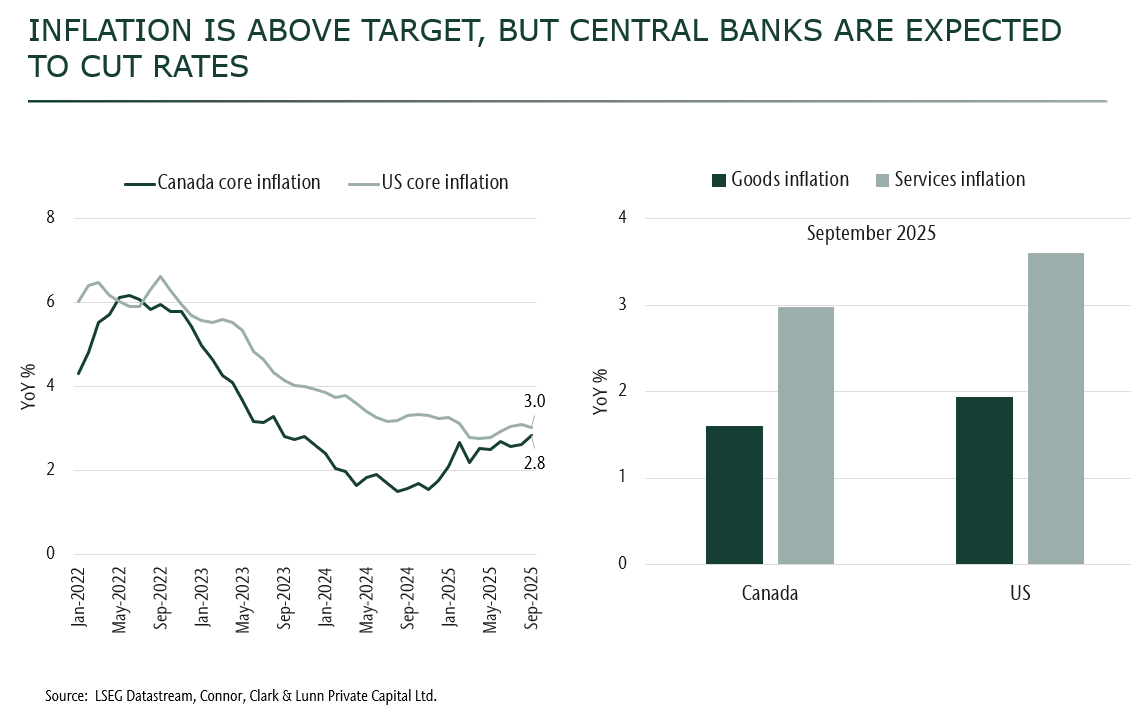

September inflation data for the US and Canada showed movement in opposite directions. US inflation moderated, while Canadian inflation surprised to the upside. Service costs remain high, and goods prices are reaccelerating. However, core inflation sits

at 3.0% and 2.8% on a year-over-year basis for the US and Canada, respectively. This is higher than the stated 2% target, but not yet high enough to concern the market. Your wallet, on the other hand, is already lighter as the cost of groceries, restaurants,

and travel are difficult for many to stomach.

Why isn’t inflation bad for stocks?

It wasn’t that long ago—recall 2021—when inflation rose from these levels, and 2022 was subsequently a poor time for both stocks and bonds. This week, equity markets continued to move higher and don’t appear concerned about higher

inflation. There are a few things at play which help to explain why:

- Inflation is expected to increase only modestly from here, remaining far-below 2022’s peak levels. Both market-based and survey-based expectations for longer-term inflation remain anchored at reasonable levels, and central banks are still expected

to cut this year and next, which will be stimulative for the markets.

- Equity market valuations may remain elevated if longer-term inflation expectations are stable, and central banks are cutting.

- All else equal, company earnings tend to rise when inflation is higher—and the market is anticipating better earnings growth next year.

- Nominal economic growth is also higher and—assuming all else remains constant—governments have an incentive to keep the global economy running hot to ease the mounting debt and deficit problems.

Higher growth, better earnings, and stability in valuations are the base case for markets. For these reasons, markets are moving higher.

What could go wrong?

If inflation rises meaningfully towards 4%, then central banks may need to pause cuts or even increase rates. Under this scenario, valuations would fall. At the same time, we could see the labour market deteriorate further, hitting consumers' paychecks

and reducing spending. This is one of many scenarios we are closely monitoring.

Our challenge remains tactically navigating policy uncertainty and discerning signal from headline noise. As we do, we will continue to keep you up-to-date with our latest views on how markets are unfolding.