August 28, 2025

e245c9a4-7b28-4fd9-baa7-c2008a09a7c0.png?sfvrsn=e9b3adcb_1)

As the summer comes to a close, campuses across Canada are preparing for another year of learning. This is a good time to reflect on the power of RESPs. In the wake of rising costs, it is important to plan early—years before the students in your

life first walk onto campus—and to understand the tax benefits and government incentives that may be available to you.

Adrian Tate, Associate Vice President of Communications at CC&L Private Capital, comments, “As my daughter begins her journey at Simon Fraser University this fall, the reality of today’s education costs—for us around $20,000 in the

first year—hits home. Starting an RESP early was one of the best decisions we made. It wasn’t just about saving money; it was about creating opportunity. With the help of government grants and compound growth, we’ve built a foundation

that lets her focus on learning, not worrying about debt. Watching her take this next step reminds me that every dollar saved was a quiet promise that we believed in her future from the very beginning.”

What is an RESP?

A Registered Education Savings Plan, or ‘RESP’, is a registered account that enables you to make contributions towards the cost of a student’s future post-secondary education.

There are different types of RESPs. In the case of individual RESPs, the owner, known as a subscriber, can be anyone. As the name suggests, individual RESPs only allow one beneficiary. For family RESPs, the subscriber must be a relative through blood

or adoption. Family RESPs allow for one or multiple beneficiaries and age restrictions apply. The subscriber makes RESP contributions up to a lifetime maximum of $50,000 per beneficiary. The beneficiary must be a resident of Canada and have a valid

Social Insurance Number to qualify.

Unlike other registered accounts, RESP contributions are not tax deductible from the subscriber’s income. However, RESP assets grow tax-free. If invested well, this can result in significant wealth accumulation over time.

The role of government grants

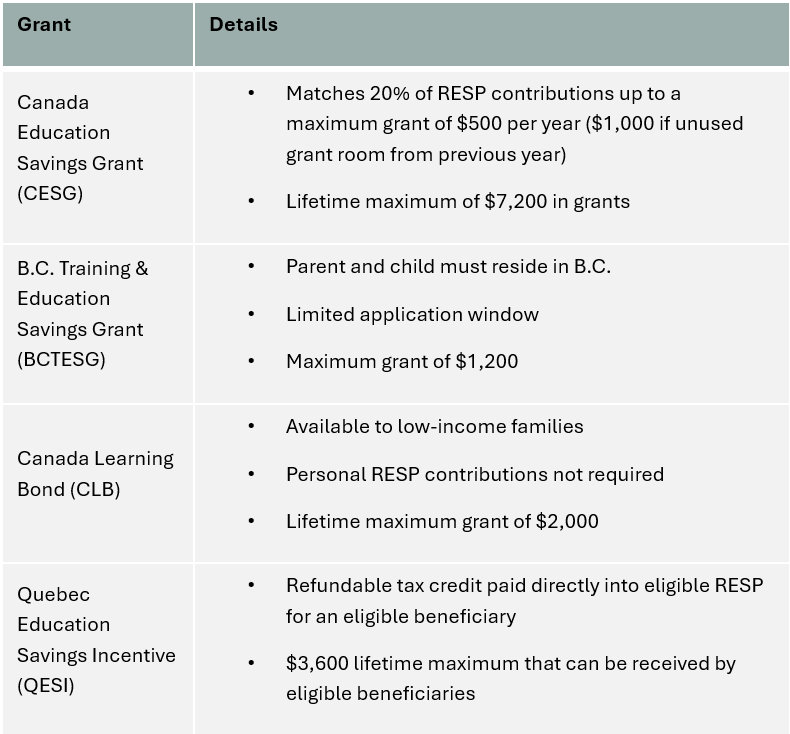

To further encourage education savings, the Canadian government offers financial incentives to eligible RESP holders. The following table summarizes key features of various grants.3

Many subscribers prefer to make a series of RESP contributions over time to take advantage of Canada Education Savings Grant (CESG) contributions. The government matches 20% of annual RESP contributions, up to a maximum of $500 per year and $7,200 over

the lifetime of the RESP. If contributions are missed in one year or more, subscribers are able to make ‘catch-up’ payments, however, the CESG will pay out a maximum grant amount of $1,000 per beneficiary per year. Subscribers who have

$50,000 readily available may choose to fund their RESP up front if they think the investment growth on such a large sum will outweigh the benefits of the foregone grants.

The benefit of tax-free growth and incentives

The following chart quantifies the benefits of tax-free growth combined with government grants. For illustrative purposes, we have compared two high-net-worth individuals in British Columbia who have just welcomed their first grandchild.

To save for their child’s future education, Investor A will contribute $2,500 net annually to a personal taxable account over the next 20 years (subject to British Columbia’s top marginal tax rates). This account type does not qualify for

education savings grants.

Investor B, however, opens a tax-deferred RESP when their child is born. They contribute the same $2,500 net annually and apply for CESG payments over time ($500 per year up to a total of $7,200). We have conservatively assumed all cashflows do not increase

with inflation.**

Assuming both investors implement a CC&L Balanced Portfolio, we expect Investor B to accumulate 50% more wealth by the time their child reaches age 20, purely due to tax-free growth and CESG income.

Forecasted Wealth Value at Age 20 (Median)***

.png?sfvrsn=9e0f1eb0_1)

RESP withdrawals

An RESP can be an essential tool when planning family finances.

• They offer tax-free growth and government grants to encourage participation

• EAPs are taxed as the beneficiary’s income, often at low or zero rates (due to the beneficiary being a student)

• EAPs can cover various post-secondary costs, such as tuition, books, transport, and rent

Once a beneficiary requires post-secondary education (i.e., college, university, apprenticeships, or trade school), the RESP will pay out Educational Assistance Payments (EAPs) to cover education-related costs. Only the subscriber who set up the RESP

can make a withdrawal request. Importantly, the beneficiary must be enrolled in full- or part-time studies at an eligible school in a qualifying educational program. Qualifying expenses may include (but are not limited to) tuition, student fees, course

materials, moving expenses, transportation, rent.

Notably, EAPs are taxed at the beneficiary’s marginal rate—not the subscriber’s. This is advantageous since most students earn little to no income while attending school, and the taxes owing are often negligible.

What if the beneficiary has other plans?

If a beneficiary chooses not to pursue post-secondary education, there are a few potential options. These may include:

- Keep the RESP open for possible future studies. RESPs can remain open for up to 35 years (from when the plan was first opened).

- Transfer the RESP to another qualifying beneficiary

- Transfer the RESP to a subscriber’s qualifying RRSP

- Close the RESP. Return contributions to the subscriber and grants back to the government. Accumulated interest earned on benefits and contributions (AIPs) may be paid back to the subscriber. AIPs are subject to the subscriber’s

marginal tax rate + 20% (12% for Quebec). 3

Conclusion

RESPs are a great way to combat the rising costs of post-secondary education. Tax-deferred growth combined with government education grants can significantly impact investment growth over time. Talk to your wealth advisor about the potential advantages

of having a RESP. We would love to be a part of your loved one’s education savings journey.