November 15, 2024

As the year comes to an end, some people donate impulsively, tapping their phones or giving cash while out shopping. Although all donations matter, especially with rising living costs, it might be better to plan and enhance the impact of your generosity.

Here are a few giving strategies to keep in mind that can benefit charity and potentially reduce your tax bill.

1. Giving appreciated securities is often preferable to making cash donations

Why? Well, not only you potentially benefit from a tax credit on your donation, but you also remove the embedded taxes owing within your donated security (and can replace it immediately).

2. Donor Advised Funds (DAFs) can be beneficial if you plan to give over time and grow the assets earmarked for charity

That is, if you can take advantage of the large tax credit by contributing future donations to your DAF as an upfront lump sum. Tax-free growth within a DAF ultimately might lead to greater wealth transfer to charity over time.

Increase your wealth AND your giving

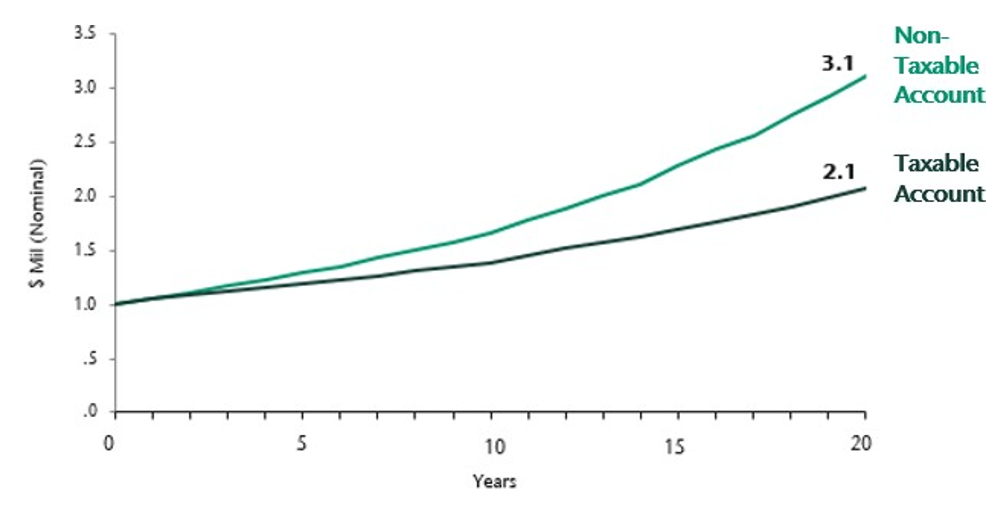

The 'Quantifying the Value of Tax Exemption' chart demonstrates the benefits of tax-free growth for wealth creation and charitable giving.

Suppose we have two Balanced portfolios (32% fixed income, 13% hedge strategies, 55% equity) with $1.0 million each. Portfolio A grows tax-free, while Portfolio B is subject to top marginal tax rates in British Columbia.* Assuming no spending from investments, our forecasts suggest Portfolio A will accumulate 58% more wealth over the next 20 years purely due to tax exemption. That means, over time, Portfolio A will have a bigger base from which to make charitable donations.

Quantifying the Value of Tax Exemption**

Additionally, if you have a RRIF and do not require annual distributions, you might consider donating your mandatory RRIF payments to charity in exchange for tax credits. Why? Because RRIF withdrawals are included in taxable income and are taxed at marginal rates. Depending on your unique tax situation and province, donation receipts from RRIF distributions to charity can offset (or more than offset) taxes owing on registered account withdrawals. 1

For investors considering donating, make sure the organization you support has a CRA charitable registration number. This will be required for issuing a valid tax credit receipt for your donation.

Community needs are high

Recently, more Canadians have been relying on charitable services while fewer people are giving to charity. Why the disconnect?

According to CanadaHelps, an alarming 20% of Canadians relied on charitable services to meet their basic needs in 2023. 2

At the same time, inflationary pressures and economic uncertainty have resulted in fewer people making charitable donations. The donor participation rate (i.e., percentage of households who claim charitable donations on tax returns) has continued

to decline.

The good news? While fewer people are donating, the monetary size of donations (typically made by wealthy Canadians) has grown. From 2015 to the end of 2021, total dollars donated in Canada increased 14%.

3

'Tis the season

Charitable donations are mutually beneficial at any time of the year, and at year-end in particular. They are a great way to support causes meaningful to you. They may also reduce your tax bill as part of a tax-efficient donating strategy. Giving back gives back.