September 03, 2024

It’s back to school time, and post-secondary campuses across Canada are humming with energy and excitement. This time of year is also a great reminder of the power of an RESP to help pay for those academic adventures.

Registered Education Saving Plans (RESPs) are flexible investment accounts designed specifically for post-secondary education, offering tax-free growth and government grants to encourage participation.

In the wake of rising costs, it’s important to plan early – years before the students in your life first walk onto campus – and to understand the tax benefits and government incentives that may be available to you.

How do RESPs work?

The important first step comes when the individual RESP subscriber(s) – typically a parent, grandparent, or family friend – names one or more future students as a beneficiary of that RESP. The beneficiary must be a resident of Canada and have a valid Social Insurance Number, and the post-secondary institution has to be an eligible school.

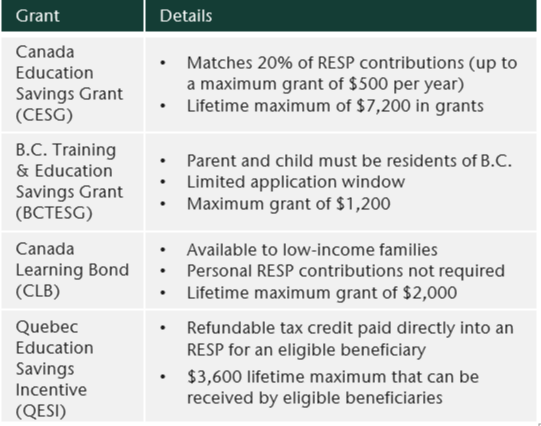

The RESP subscriber contributes, often yearly, up to a lifetime maximum of $50,000 per beneficiary, with “catch-up” payments available if you miss a few years. To further encourage education savings, the Canadian government offers financial incentives to eligible RESP subscribers. The following table summarizes key features of various grants available.

Some clients invest the entire $50,000 right up front. The thinking here is that gains from compound interest will be greater over the long term than the benefits of government grants. Regardless, overcontribution penalties will apply if you exceed $50,000 per beneficiary.

The benefits of starting early

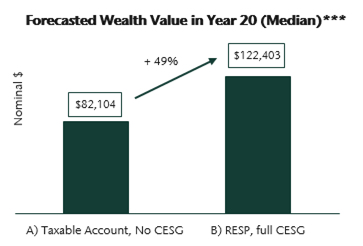

Unlike other registered accounts, RESP contributions are not tax deductible from the subscriber’s income. However, once in the plan, RESP assets grow tax-free. Investing early and well can result in significant wealth accumulation over time, as seen in the following graph.

The chart quantifies the benefit of tax-free growth and government grants. For illustrative purposes, suppose we have two high-net-worth individuals who save for their children’s future education. Client A contributes $2,500 net annually to a personal taxable account in B.C. (top marginal rates).*** This account type does not qualify for education savings grants. Client B, contributes the same $2,500 net per year to a tax-deferred RESP. Client B receives maximum CESG payments ($500 annually up to a total of $7,200).

We have conservatively assumed all cashflows do not increase with inflation.*** Assuming both clients invest in a CC&L Balanced Growth portfolio, we expect Client B to accumulate 49% more wealth by year 20, purely due to tax-free growth and CESG income.*** If Client B qualified for additional grants such as the BCTESG, this difference would be even larger.

When it comes time to drawing down

An RESP really begins to pay off once it’s time for the beneficiary to start college, university, an apprenticeship, or a trade school, as the RESP will generate Educational Assistance Payments (EAPs) to cover school related costs.

Qualifying expenses may include tuition, books, transportation, or rent. For full-time studies, EAPs are limited to $8,000 for the first 13 consecutive weeks of enrollment ($4,000 for part-time studies). After the initial 13-week period, there are no withdrawal limits for students who continue to qualify for EAPs.

RESP withdrawals (i.e., those EAPs) are taxed at the beneficiary’s marginal rate and not the subscriber’s. This is advantageous since most students earn little to no income while attending school. Therefore, taxes owing on EAPs are often insignificant.

CRA requires proof of enrollment by the beneficiary in a post-secondary institution before you initially take money out of the RESP. Getting this proof from the relevant post-secondary institution is usually straightforward. If you have more than one beneficiary for the RESP, you will need proof of enrollment for each student.

What if the beneficiary doesn’t attend?

Life plans can change. So, what happens if the beneficiary decides to not pursue post-secondary education? There are a few options open in this case.

Subscribers could keep the RESP open for possible future studies, for example. (RESPs can remain open for 35 years). Alternatively, you could transfer the RESP to a different beneficiary, or to the subscriber’s RRSP. (Some conditions apply in these two cases). Or you could close the RESP, thereby returning contributions to the subscriber and the grant money back to the government. Accumulated income is taxed at the subscriber’s marginal rate + 20%, and 12% in Quebec.

No time like the present to start

RESPs are a great way to combat the rising costs of post-secondary education. And as is the case with RRSPs, starting early is key. Plus, tax-deferred growth combined with government education grants can significantly impact your savings overtime.

Our Wealth Advisors across the country are always ready to answer your questions. Whether you are a valued client or interested in discovering more about the services CC&L Private Capital offers, please feel free to call or email us anytime.

We would love to be a part of your important education savings journey.