April 18, 2024

Fixed income is an important component of any balanced investment portfolio. At CC&L Private Capital, we continually evolve our pension-calibre investment platform and have recently introduced a new fixed-income asset class to our clients' portfolios: Emerging Market Credit.

What is Emerging Market Credit?

Emerging Markets are fast-growing economies on a journey towards having all the characteristics of a developed economy. They have transitioned from their 'developing economy' stage but have yet to become developed economies. Examples of Emerging Markets

are China, Brazil, Mexico and India. There are 69 economies in total.

Emerging Market Credit is a large asset class worth about $4 trillion—three times as large as the US high-yield credit and Canadian bond markets. Emerging Market Credit encompasses investment-grade and high-yield bonds issued by sovereign and

corporate entities.

Characteristics of Emerging Markets

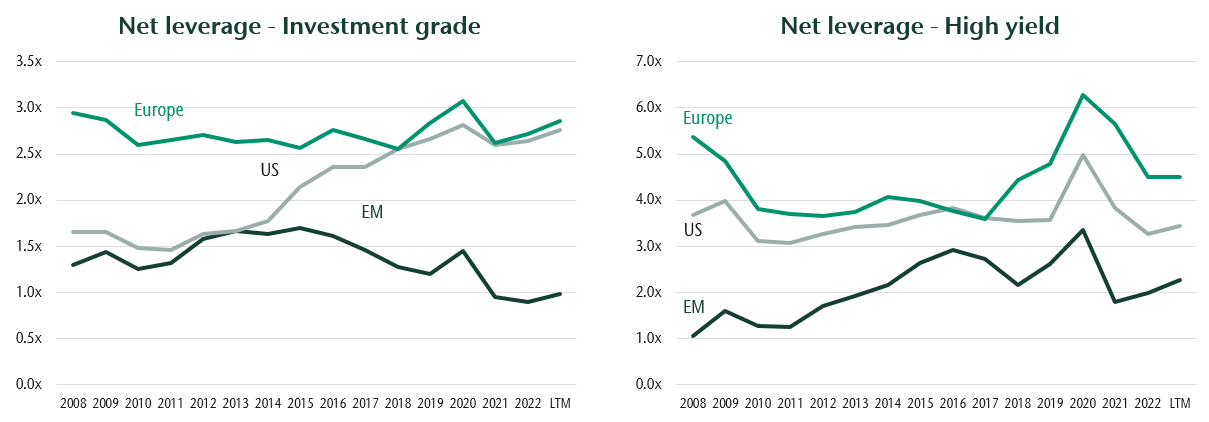

Many corporate credit issuers in Emerging Markets are resilient and high-quality companies. For example, they are often less leveraged than their comparably rated developed-market counterparts: over time, Emerging Markets investment-grade companies have

been reducing their debt to just above 1x earnings before interest, tax, depreciation and amortization (EBITDA)—a common measure of a company's leverage. By comparison, US and European investment-grade companies have seen their debt climb to

2.5x EBITDA. All other things being equal, credit investors prefer companies with lower leverage ratios.

Emerging Markets (EM) corporate issuers carry less debt relative to their ability to generate cashflow to service that debt

Another way Emerging Markets companies differentiate themselves from their developed market peers is by how they are often managed, largely due to their greater experience and familiarity with economic volatility. Emerging Markets corporate management teams tend to build their companies' capital structures to withstand sudden and aggressive economic shocks, as well as sustained economic shocks. They are more conservatively managed in that regard than many developed-market firms. They also tend to perform well in periods of macroeconomic headwinds.

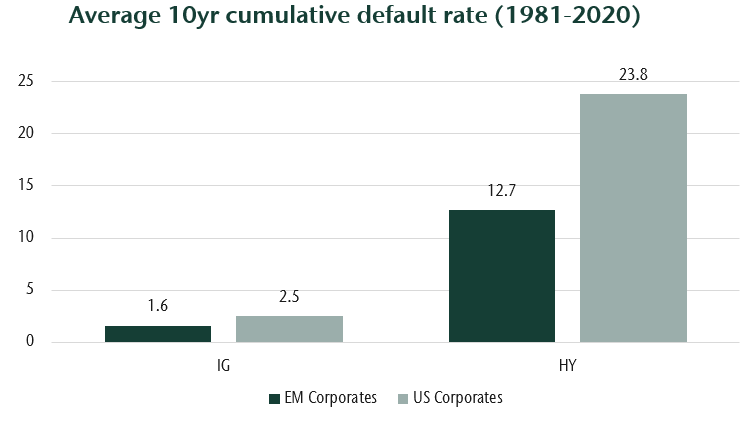

Given this structural setup, it may not be a surprise that Emerging Markets high-yield companies default at roughly half the rate of US high-yield issuers.

Emerging Markets (EM) corporates default less than developed-market peers

Experienced team to uncover opportunities

Our Emerging Market Credit investment management team integrates specialized expertise, extensive market analysis, and insight to deliver dynamic Emerging Market Credit investment strategies. The team has over 50 years of collective experience gained

with some of the most prestigious and rigorous asset managers in the industry. After more than two decades of working together, they offer a unique skill set for emerging markets investing.

Understanding and mitigating risk

It's important to have a comprehensive understanding of this complex area. Our Emerging Market Credit investment management team invests the vast majority in US dollar-denominated Emerging Market Credit, which is governed under New York or UK law, as opposed to Emerging Markets debt issued domestically, governed under each issuer's domestic rules and regulations.

Further, our investment management team implements a robust risk-mitigation strategy as part of its investment process. This includes daily portfolio stress tests, stringent credit selection, a risk-reward analysis, and an exhaustive understanding

of the relevant credit and legal documentation—and its real-world implications. This helps increase the team's ability to secure investment returns, the bottom line for a fixed-income investor.

Diversification matters

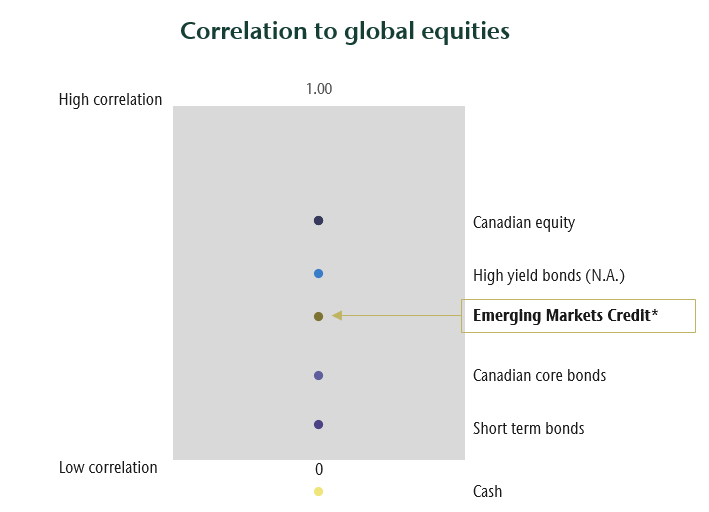

An allocation to Emerging Market Credit in clients' portfolios—replacing some of a portfolio's allocation to North American high-yield bonds—adds diversification since Emerging Market Credit has a lower correlation to global equities than US and Canadian high-yield credit.

Adding Emerging Markets credit can reduce North American high yield bonds, which have a higher correlation to equities

Emerging Market Credit, along with our other fixed-income asset classes including commercial mortgages, high-yield and core bonds, can be used to provide clients with a balanced portfolio of fixed-income, equity and alternative investments that may help them meet their long-term financial goals.

If you would like to learn more about our approach to Emerging Market Credit investing, please contact us.