April 10, 2024

Markets Overview

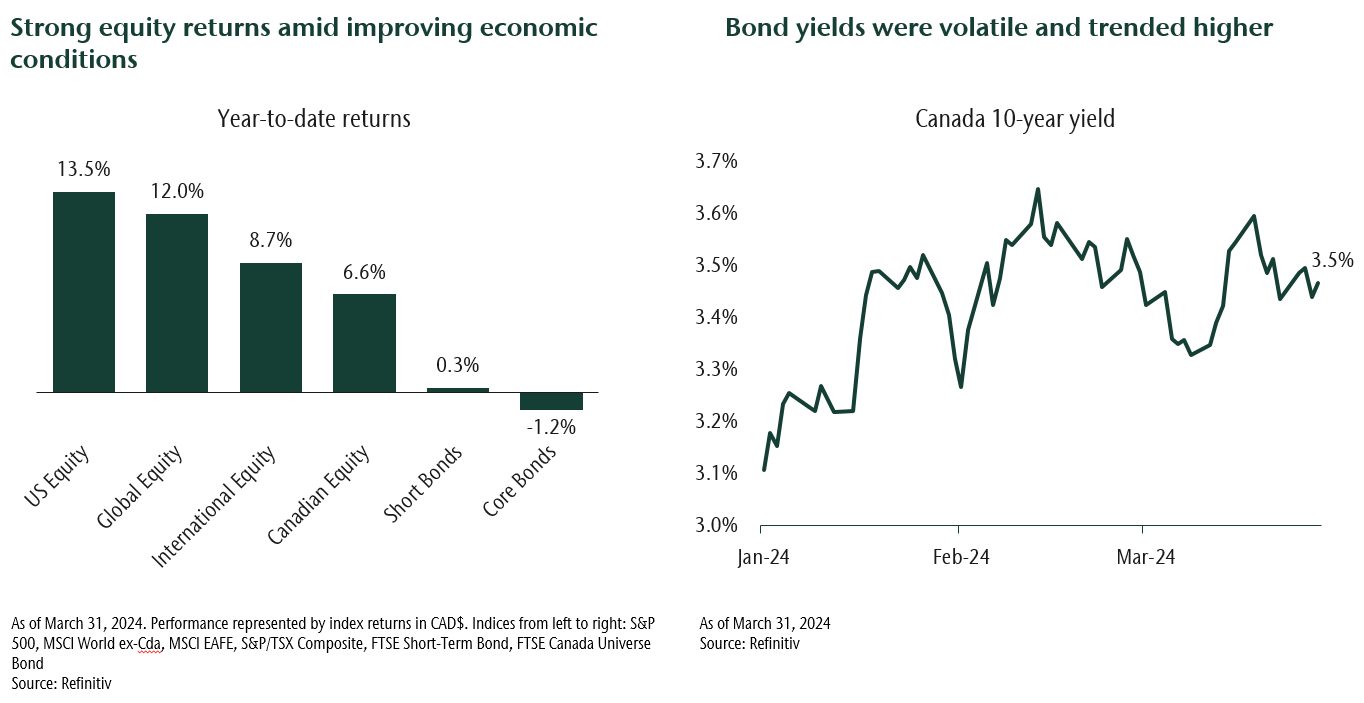

Equity markets started the year strong. Global stocks reached new highs and more stocks contributed to the market rally. Financials, energy and industrials all generated double-digit returns in the first quarter. This contrasts with last year where market returns were dominated by just seven large companies that enthralled investors.

Support for stocks has come as the market narrative shifted further away from the possibility of a recession towards a “soft landing”, in which economic growth slows but avoids contraction. Economic data this quarter has been in line with this view. The labour market has remained strong, which has supported consumption. Inflation has come down from high levels, albeit not in a straight line. And central banks have said they will cut rates later this year. On balance, this has been good for investor sentiment. Yet uncertainty remains. Given the resilience in growth it is not clear that inflation will continue to fall in the US and policymakers may wait longer to cut rates. We are also seeing increased divergences between the strong US vs Canada and Europe where growth is below trend.

Meanwhile, it has been a slower start for fixed income. Core bond returns were negative as bond yields moved higher. Volatility in yields were the result of markets assessing the amount of rate cuts that may come this year. At time of writing, the bond market is now expecting 0.75% in cuts in 2024, quite different than the 1.5% priced in at the start of the year. Short bonds and high yield generated better returns than core fixed income this quarter.

Portfolio Strategy

As the overall global economy has shown resilience, and financial conditions have improved, we have modestly increased portfolio exposure to more cyclical investments that can benefit if the economy remains supportive. From an asset allocation perspective, we are modestly overweight stocks vs. long-term targets. Within equities, we favour global stocks. Our global portfolio has benefited from being overweight many of the companies that have benefited from AI. While we continue to like these companies for their strong earnings growth potential, we are also well diversified across a broad set of investments that can benefit in different market environments. These include global small cap stocks and emerging markets where valuations are attractive and return prospects are strong on a longer-term basis.

In portfolios’ bond allocations we have been increasing exposure to corporate credit. This has occurred alongside significant work to enhance and broaden our investment platform within fixed income. Last year we enhanced our high yield bond offering to improve our ability to generate return and manage risk. We also introduced commercial mortgages as we saw both a current and long-term opportunity to increase portfolio yield while diversifying risk. This has been a source of solid returns in an environment where traditional fixed income has been volatile. This quarter we have added Emerging Market Credit to our platform. Here we can seek attractive yield premiums over traditional bonds. In fact, this area of the market has better company fundamentals than traditional high yield in North America* and we have structured the portfolio to eliminate direct currency risk that can come when investing outside of Canada.

These changes mark an evolution in how we manage portfolios as we seek not only to be invested in what has worked in the past but also allocate capital to the markets of tomorrow. We think this will improve portfolio returns and give us greater flexibility as we manage risks across markets.