March 11, 2024

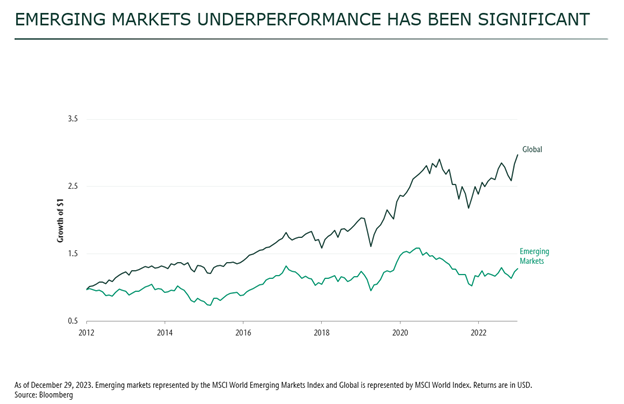

It’s not hard to see why investors are having difficulty being positive towards emerging market (EM) stocks. The MSCI Emerging Markets Index rose 7.3% in CAD terms in 2023. Not bad in absolute terms. However, it was significantly behind the developed

markets, the MSCI World Index which rallied 21.5%. The return last year finished over a decade of weak performance.

As relative returns have suffered, so too has investor sentiment towards EM. To be sure, concerns remain about EM. But we think some of the biggest concerns we hear are rooted in misconceptions and that the past decade may have set up promising conditions

for future returns.

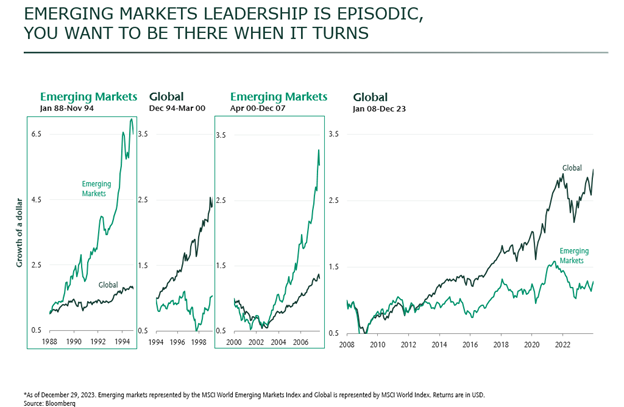

Misconception #1: Developed Market stocks always beat EM stocks

Some may be surprised to discover that EM stocks have outperformed developed markets (DM) since the inception of the EM index 36 years ago. The MSCI Emerging Market Index had an annualized return of 8.5% over this period, 1% higher than MSCI World at

7.5% (returns in CAD). Further, there have been many periods of very strong returns. In the below chart we show various periods of outperformance and underperformance. What is noteworthy is that when EM outperforms, it tends to do so in a big way.

In the late 80s to early 90s, growth of EM investments rose over 3.5x higher than DM. In the period 2000-2007 EM outperformed by over 2.5x.

Last year market performance obscured some encouraging trends. DM equities were dominated by the artificial intelligence (AI) revolution. Outside of the top 7 stocks in the MSCI World, the broader equity market didn’t perform nearly as well. At

the same time, EM stocks were hurt by sharp declines in China. However, when we exclude China, EM stocks returned 17.8% in CAD terms.

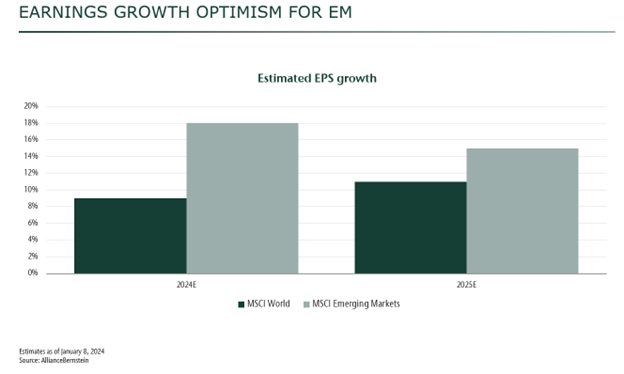

Misconception #2: Earnings growth is low in EM

EM earnings growth has been weak over the past decade. There have been a few reasons for this including a strong US dollar which eroded earnings and more geopolitical concerns which have been headwinds.

We believe the geopolitical environment will remain unpredictable but see several trends that may improve the environment for EM companies. These include:

- Innovation- much of the AI supply chain comes from companies in the EM.

- A possible peak in the strength of USD- we have been through a >10 year cycle of USD outperformance, the historical typical length of a cycle. Also, the US is expected to cut rates this year while many EM countries are not.

- Shifting global trade relationships- the reorganization of strategic supply chains could create new opportunities for EM nations outside of China.

- A more pro-growth stance in China- The government may begin to reprioritize the economy over some other goals related to security and social stability.

In fact, EM earnings growth is projected to be quite strong over the next two years, significantly outpacing DM. Eventually we expect the market will begin to recognize the improving growth in earnings.