January 10, 2024

Markets Overview

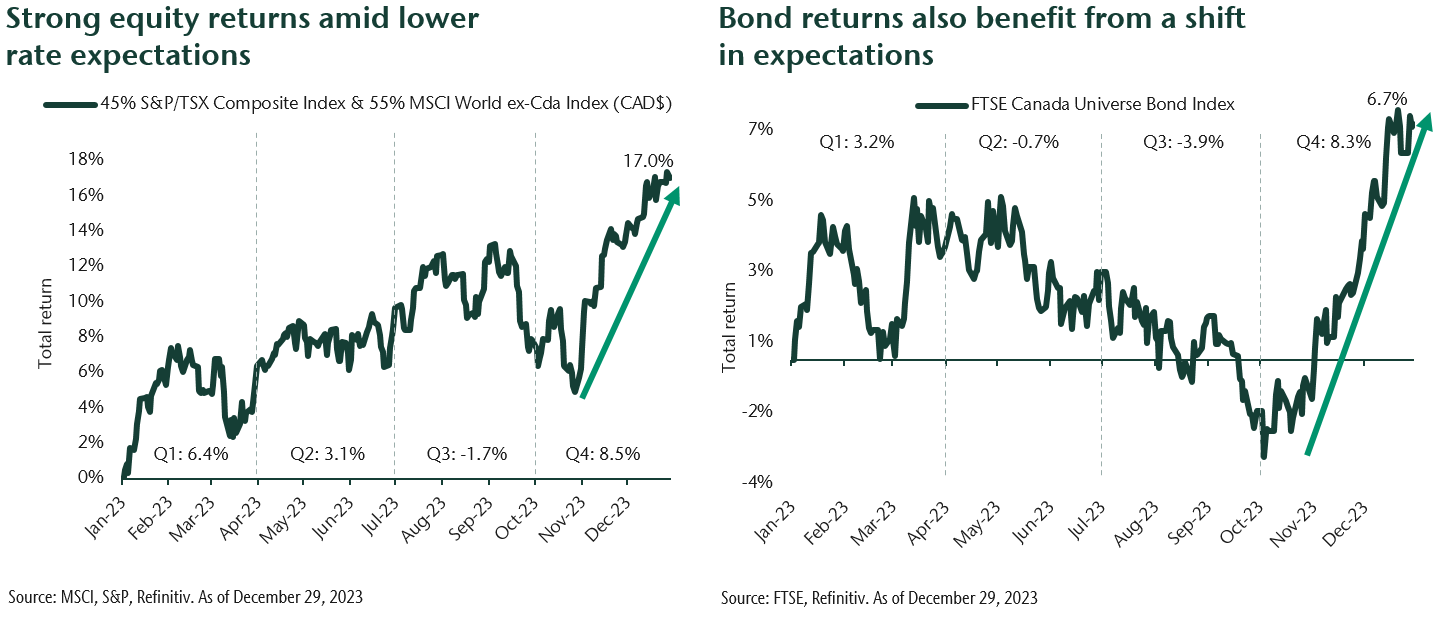

Markets finished the year very strong, bringing an end to a year which was anything but expected. At the start of the year most believed that high interest rates would stifle the global economy and result in a difficult year for stocks. Instead, stocks moved higher as the economy showed resilience while inflation was declining. There were several explanations for the economy surpassing expectations, but the two big reasons were a strong consumer and high levels of government spending. As risks of an impending recession declined and inflation fell, the global stock market trended higher. For most of the year the march higher was led by just a few stocks, dubbed the “Magnificent 7” which benefited from the advent of generative Artificial Intelligence (AI). Through the end of October, these stocks were responsible for the global market gains. Then markets became more confident that central banks will be able to lower rates in 2024 which sent the broader market higher.

The bond market saw significant moves in yields as they track sentiment for future levels of interest rates and economic growth. For most of the year bond yields moved higher as growth was resilient and the narrative from central bankers was for higher rates for longer. Yields then fell in dramatic fashion starting in October as it appeared that central banks will be able to cut rates more than expected in 2024. This all led to strong returns for the bond market in 2023, all of which came in the fourth quarter.

Portfolio Strategy

While the economy has been more resilient than we expected last year, we still believe it will slow in 2024 as pressure on the consumer rises and company profits are squeezed amongst weaker sales growth. It is possible the economy avoids a recession; however, we think the risks remain. Some of the areas of resilience such as the consumer are facing headwinds from dwindling savings levels and some signs of deterioration in the labour market, albeit from very strong levels. We are also seeing consumer credit quality weaken and more unpaid credit cards and auto loans. In Canada, consumers are being hit hard as mortgages renew at much higher rates, leaving less disposable income for spending. This is all leading to a material slowdown in economic growth.

What does this mean for portfolios? It may sound like déjà vu, but the investment landscape leads us to start another year with overall cautious positioning. At the same time we are optimistic in many areas. We are most cautious in clients' equity allocation. Strong equity returns in 2023 on the back of higher valuations lead us to feel the stock market is priced for perfection. We own larger multinational companies that we think are relatively insulated from a slowdown. Our portfolios have benefited from being overweight many of the companies that have benefited from AI. While we continue to like these companies, we are also cautious about extrapolating 2023 returns into the future. As such we have allocations to other areas of the market which have been beaten up. This includes global small caps as well as emerging markets where valuations are attractive and return prospects are strong on a longer-term basis.

In fixed income, we see the opportunity for good returns based on decent levels of yields and the potential that falling rates may boost returns further. The environment now looks better for investors who have cash on the sidelines to invest in quality intermediate term bonds.

Within the allocation to corporate bonds, our portfolios have made enhancements and we are adding new strategies to our investment platform which we think will improve portfolio return and our ability to manage risk. These include enhancements to our high yield strategy and adding mortgages to portfolios. Mortgages as well as private loans are benefiting from stepping into a void left by banks that are tightening their capital standards.

While some uncertainty cleared in 2023, others remain. Regardless of what is to come we will continue to steward client capital through shifting environments in 2024 and beyond.