October 10, 2023

Markets Overview

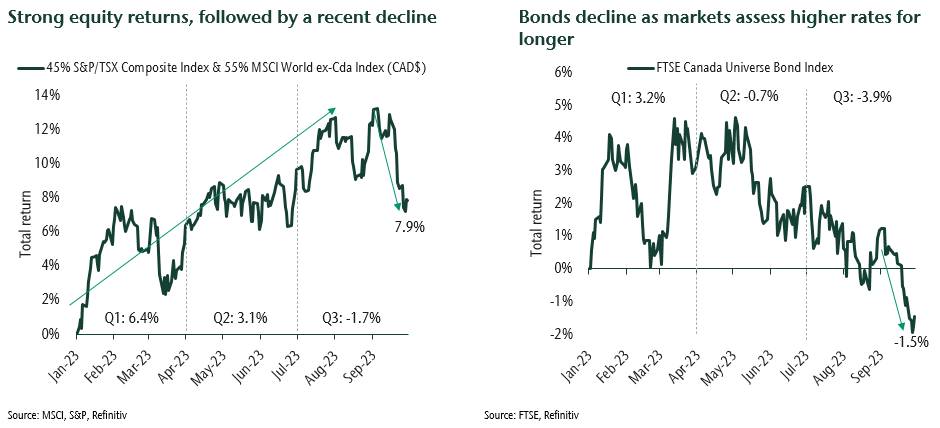

After a very strong start to the year, global stocks fell in August and September. The recent weakness reflects the uncertain outlook. On one hand, the economy has been very resilient and central bank rate increases are likely close to being over. On the other hand, policymakers are signalling that they will leave interest rates higher for longer to make continued progress toward lower inflation and slow the economy. This year, the slowing effects of higher rates have been partially offset by strong corporate and household finances. In addition, high levels of government spending have also helped keep the economy on a sure footing.

This has been good news. Yet looking forward, we think the road ahead for stocks will be bumpier. Our analysis suggests that most of households’ excess savings have been spent and we see signs that the strength in labour markets is slowing. We think this trend will continue, and when combined with a restrictive level of rates, it will inevitably lead to a slowdown in consumer spending, economic growth and eventually company earnings. These conditions tend to coincide with a period of higher market volatility before we inevitably see growth bottoming and an improvement in the prospects for market return. Uncertainty today leads to market opportunities for our active investment approach.

In the bond market, performance for investment grade fixed income turned negative for the year in the third quarter. Higher interest rates combined with a shifting outlook that rates may remain higher took a toll. In the near term, there remains downward pressure on fixed income performance. However, higher levels of income from this area of the portfolio provide an offset to this headwind.

Portfolio Strategy

Until recently, equity markets have been optimistic about a scenario in which inflation comes down and economic growth remains positive. While this remains possible, we feel it’s more likely that growth will slow to recessionary levels. When we look at leading indicators for the economy, they suggest that if we get a recession, it will be mild. While the outlook isn’t dire, risks in the market are tilted to the downside. Therefore, we have defensively positioned portfolios to protect capital in the event of a temporary pullback in markets. At the same time, we are diversified across themes that can do well despite the economic uncertainty. These include positions that benefit from the evolution of generative artificial intelligence and companies that benefit from accelerated investment spending from both business and government.

This year, we have been working to evolve our investment offerings and client portfolios. Our recent focus has been on enhancing portfolio yield within fixed income. We believe that the return environment for traditional fixed income has shifted. While income levels are higher, we can’t expect the strong boost of capital appreciation we have had for many years. We have begun to modestly reduce traditional fixed income and introduced commercial mortgages with very attractive yields, even on lower-risk conventional loans. We are also expanding our team's tools to deliver performance and manage risk within high yield bonds. And there is more to come next year when we continue to expand the universe of investments we can bring to bear on our clients' behalf. While the portfolio evolves, the goal remains consistent: delivering strong investment outcomes for diverse client objectives while managing risks.