August 30, 2023

The economy continues to surpass expectations despite central banks' efforts to slow inflation and economic activity. Consumers have remained resilient and have been supported by a tight labour market, wage growth, and built-up savings. Yet other indicators in the economy suggest more headwinds and choppy waters ahead.

The economy continues to surpass expectations despite central banks' efforts to slow inflation and economic activity. Consumers have remained resilient and have been supported by a tight labour market, wage growth, and built-up savings. Yet other indicators in the economy suggest more headwinds and choppy waters ahead.

When we look back historically, there have been two key conditions present ahead of recessions:

- An inflation problem that results in central banks increasing rates

- Banks tightening their requirements for making loans

This is where we find ourselves today, meaning it's harder for consumers and businesses to get money and much more expensive.

Good news – slowing inflation

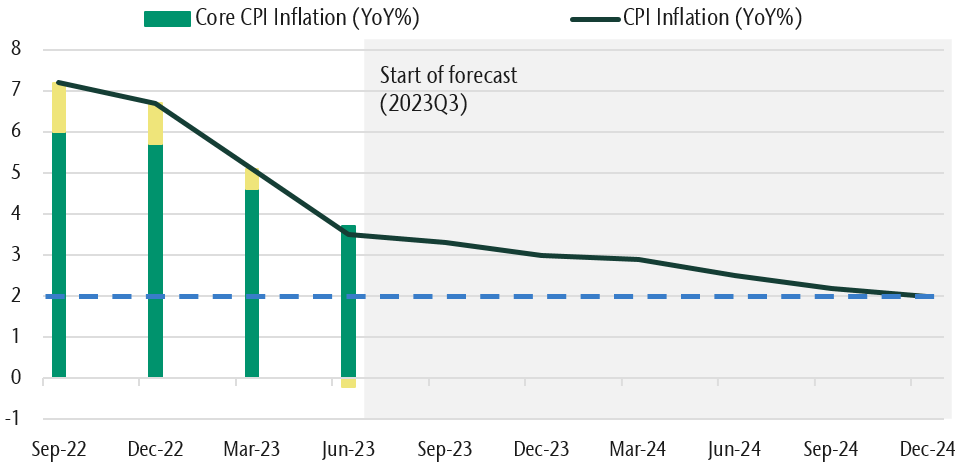

The inflation problem is starting to abate from its high in June 2022. Current forecasts suggest Canadian inflation reverting to the Bank of Canada's 2% target in the first half of 2025. The decline from very high levels indicates that central bank rate increases are working, and the bank may be able to pause rate hikes. This has helped to lead financial markets higher this year. However, in July, Canadian inflation ticked up slightly to 3.5%, indicating that above-target inflation may be more persistent than anticipated.

Inflation is expected to slow, reaching 2% end of next year

The not-so-good news – business sentiment signals a recession

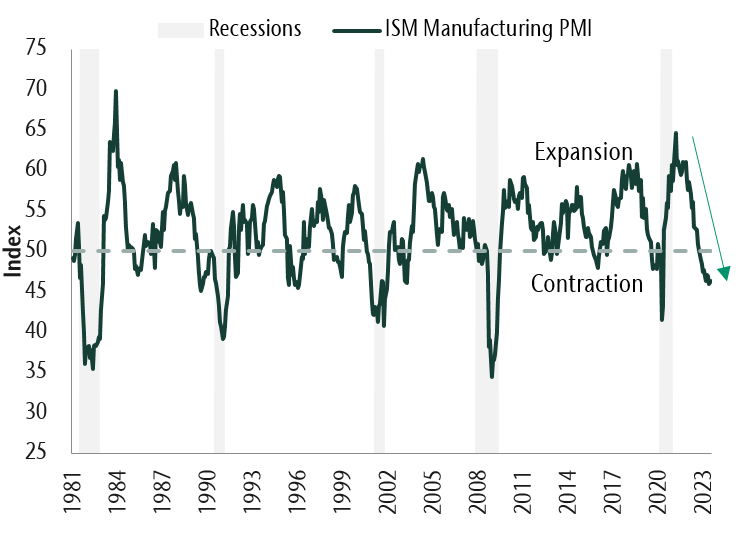

Depending on where you look, you can get a different picture of the global economy. One of the more reliable indicators of how businesses view the economic environment is the ISM Manufacturing PMI, a monthly survey of purchasing managers at manufacturing firms that indicates economic activity. Global Manufacturing PMI has been contracting and is approaching recessionary levels.

Business sentiment pointing to a significant slowdown

Banks also broadly see a deteriorating environment, with tighter financial conditions and weaker loan demand from businesses and consumers. This is likely to stall risk-taking and economic activity.

The biggest concern – rapid rate hikes take time to affect the economy

This time last year, the Bank of Canada's main interest rate was 2.5%, half of where it stands today. It's well known that rate changes take time to fully affect the economy and higher debt costs impact firms' profits. Corporate earnings have been resilient, but they are slowing--and as higher interest rates take a larger bite, history shows layoffs occur. We are starting to see cracks in the labour market. Canada's unemployment rate increased in July, and large retail and tech companies have announced layoffs.

Consumer strength may fade

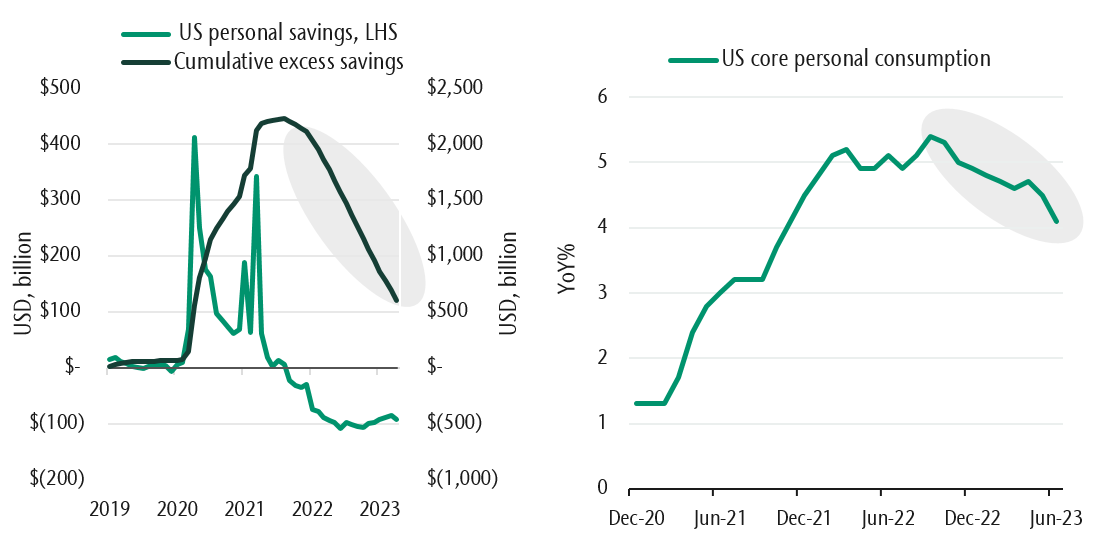

Higher unemployment and dwindling excess savings may lead to a slowdown in consumer spending, the economy's primary driver. The US Federal Reserve estimates that US consumers' excess savings will likely be depleted during the third quarter of 2023. While we don't expect consumption to collapse, we expect it to slow and reduce economic growth and inflation. While not certain, our base case is for a mild recession.

Personal consumption is declining as excess savings are exhausted

What are equity markets pricing in today?

Markets expect central banks in Canada and the US to pause rate hikes for 2023 and begin cutting next year, assuming inflation continues to fall towards 2%. Investors also estimate that the subsequent Economic slowdown won't become a recession or result

in a significant increase in unemployment.

Our view of the path forward

While central banks have managed to lower inflation without hurting employment rates, it may be overly optimistic to expect a pain-free return to the 2% inflation target. Historically, reining in inflation has led to job layoffs and recessions. If we dip into a recession in the current cycle, we expect it to be mild. Our positioning of client portfolios remains defensive, and we are continuing to search for attractive investment opportunities that already reflect a pessimistic outlook. As we move through this transitionary economic period from high inflation, we expect to see a more balanced relationship between prices and growth, and are closely monitoring the economy and market indicators.