July 11, 2023

Markets Overview

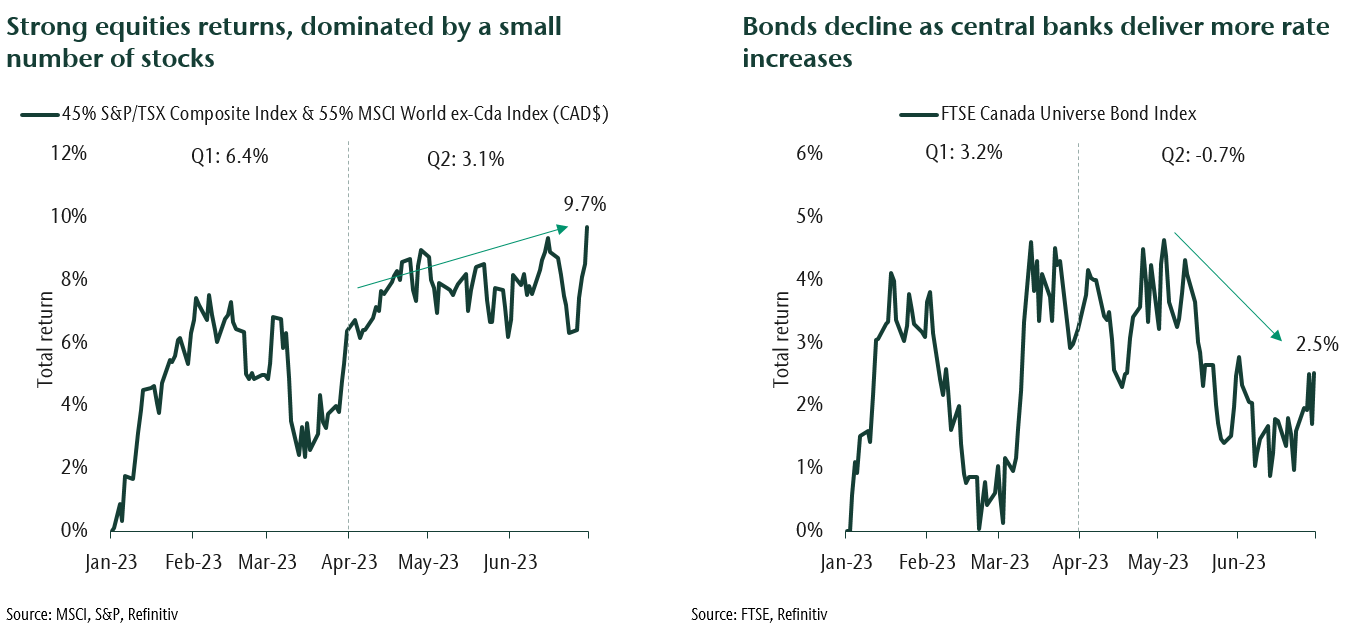

Stocks delivered very strong returns this quarter as the market looked beyond risks and focused on areas of strength in the economy. Specifically, layoffs have remained low, consumers have continued to spend and the economy grew faster than estimated. This suggests that a recession is further away than initially anticipated. At the same time, core inflation has declined significantly from the peak but remains higher than central banks want. This has led to more tightening in financial conditions to make sure the anchor on inflation holds. The debate in the market has been whether the decline in inflation back to 2% will come with or without pain for workers. The first is typical and the second is only possible if wages fall without a rise in unemployment. Markets are holding out hope for the second.

What isn’t apparent from looking at the broad market is that very few companies are generating the lion’s share of return. Most of the market rally this quarter can be summed up in two words: artificial intelligence (AI). The fury of investment in AI has propelled tech giants higher. And while we see promise in this technology, market leadership has been very narrow.

The bond market has been volatile as investors assess potential paths for interest rates and the economy. The main bond index in Canada declined modestly this quarter as the Bank of Canada unexpectedly increased rates in June. The Federal Reserve also raised rates and forecasted there may be two more increases this year.

Portfolio Strategy

The post-pandemic environment has created unique conditions in the economy. These include extra personal savings and a very tight labour market. Think very low unemployment, many jobs available and large increases in wages which has resulted in spending. This spending has contributed to both high inflation and a surprisingly durable economy. Yet we do believe central bank rate increases will work to rebalance the economy, reducing demand and inflation. It’s well known that policy acts with a lag. Today’s high level of interest rates will be working through the economy in the year to come. This lag, combined with raising already high rates, increases the risk of a recession. In this environment we have been defensively positioned as we see risks skewed to the downside in the second half of the year.

This quarter we have used strength in the equity market to tactically sell stocks and buy bonds. We maintain a modest underweight to equities in favour of bonds. Within bonds we have turned positive on core or longer-dated bonds vs the higher yields currently available in short term fixed income. Core bonds will benefit from the end of the rate hiking cycle and serve to protect portfolios if we experience equity volatility. Strategically, we have added commercial mortgages to fixed income portfolios. This is a very attractive time to be a lender. We can get yields of over 7.5% while investing in the lower risk, conventional loan market. We have focused our investments in the industrial and multifamily sectors which can do well despite economic uncertainty.

Our portfolio management teams’ primary focus remains on diversification to safeguard capital. Within equity allocations the emphasis is on quality companies with resilient earnings. Health care in the global portfolio has struck us as particularly attractive as the industry normalizes from labour shortages and procedure volumes reach pre-covid levels. This is also an area of the market that tends to have more durable earnings in the face of an economic slowdown. Within fixed income, we have been underweight corporate and provincial bonds in the core portfolio in favour of government bonds. This positioning will serve us well if we experience volatility in the second half of the year.