April 11, 2023

Markets Overview

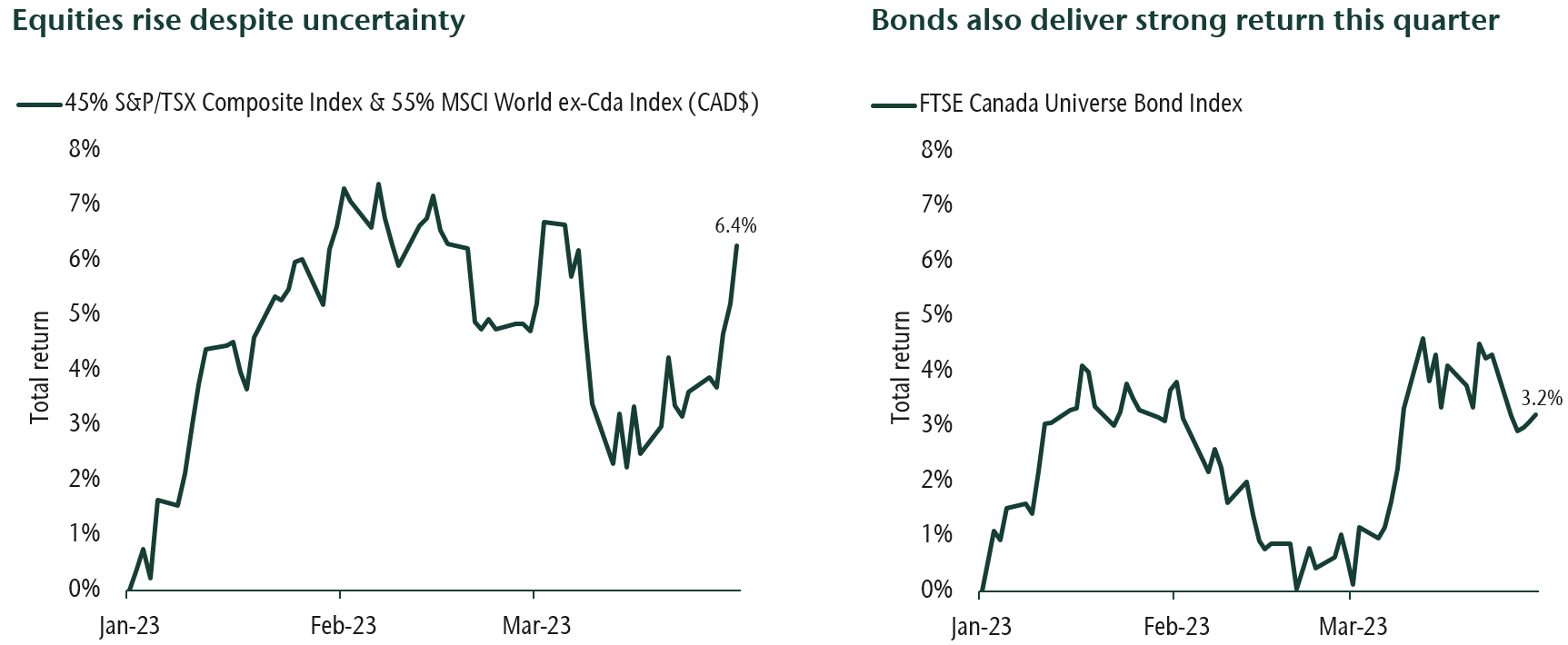

Both equity and bond returns were strong this quarter after a difficult 2022. Market performance however did not move in a straight line. The volatility was initially the result of inflation remaining high, a red-hot job market and the possibility of

even higher rates. Then in March, two US regional banks entered receivership and one in Europe needed to be rescued by a competitor. These events resulted in further market unease with both stocks and bonds moving sharply up and down. Markets quickly

interpreted these events as increasing the odds of a recession and the possibility of rate cuts, opposed to increases, by the Federal Reserve. Further, in reaction to the bank failures, governments acted quickly to stem the potential for contagion

to other banks. As a result equity markets moved higher.

Market performance trends this year have notably diverged from last year. In 2022, value stocks, the energy sector and short bonds significantly outperformed. This year has been distinctly different. Now growth stocks have significantly outperformed,

energy was the worst performing sector and core bonds outpaced short bonds by a wide margin. This shift has been the result of central banks nearing the end of rate increases and a change in focus from inflation to deteriorating economic growth.

Portfolio Strategy

We came into this year expecting that central banks’ rate hikes would successfully slow the global economy. However, economic data was stronger than expected in January and stocks rallied on optimism that a recession might be avoided. Despite better-than-expected data, our tactical allocation indicators were flagging weakening growth. And if growth slows while inflation remains high, company earnings will be revised lower. Given our outlook, we used this period of market strength to reduce equities in client portfolios.

Towards the end of the quarter, we made another tactical asset mix shift to increase core bonds within fixed income. Given the deeply inverted yield curve and economic environment we have laid out, we believe central banks will shift their focus to stimulating growth later in the year. In this environment core bonds should outperform short bonds and high yield.

Our balanced portfolios are conservatively positioned and diversified against various risks. The primary focus remains on diversification to safeguard capital. Within equity allocations the emphasis is on quality companies with resilient earnings. Quality refers to the strength in balance sheets, companies’ competitive advantage and the ability to generate relatively consistent earnings. Within fixed income, we have been underweight corporate and provincial bonds in the core portfolio in favour of government bonds.

While caution is the order of the day, our asset mix and investment management teams are always balancing the current risks on the horizon vs long-term opportunities that these risks inevitably present. As we look across the investment landscape, emerging markets, frontier markets, private loans and mortgages offer some of the most attractive long-term performance opportunities today. Most recently, we added to emerging markets and are in the process of increasing mortgages within fixed income. Despite the ups and downs of markets, we have confidence in how we are positioned at this time.