March 22, 2023

Last year was difficult for investors, and times remain uncertain. Inflation, wars, central bank policy and now regional bank solvency are just some of the clouds on the horizon. And yet investment markets are efficient and there are multitudes of portfolio

managers all looking for opportunities to beat the market. How, then, do you stay ahead of the pack and continue to add value in portfolios? In the CC&L Private Capital asset allocation team and our investment management teams, we are constantly

asking ourselves this question. In this article, we highlight four areas of the market we find attractive today.

Emerging opportunity in emerging markets

The strategic case for emerging markets is that they offer much higher growth, driven by their important role in the production and distribution of goods globally. Today, supply chains have largely mended from COVID disruptions and China has reopened

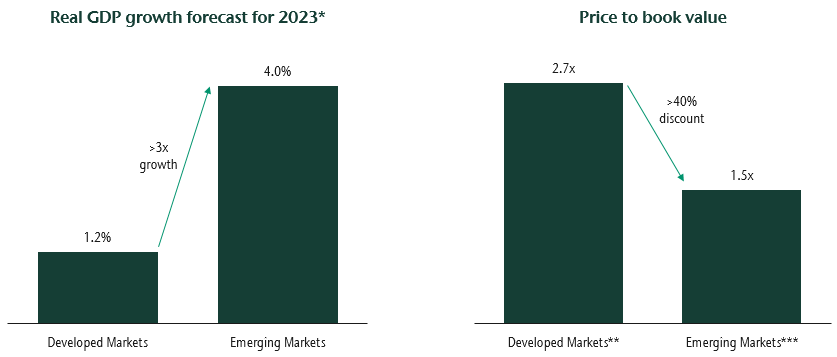

its economy. This means an increase in China’s demand for goods and also its ability to export globally. And that leads to a situation where economic growth in emerging markets is expected to remain positive while we anticipate developed world

growth to be anemic and possibly turn negative this year. Further, emerging markets prices remain at a solid discount to the developed world.

Emerging markets: Better growth at reasonable price

A new 'frontier'

Frontier markets are a close cousin of emerging markets but are largely overlooked by global investors. These markets are made up of some of the fastest-growing countries in the world and are not yet considered emerging markets.

While emerging markets are heavily tied to global supply chains, growth in frontier markets is linked to very large populations that are experiencing high levels of income growth. As income rises, large segments of the population move out of poverty

and begin increasing their spending significantly on goods and services that weren’t affordable before. Our investment team selectively finds companies that can benefit from this growth in consumption as well as benefit from themes of these

growing populations such as urbanization and improvements in technology. The earnings growth potential of our portfolio of frontier companies is significant and expected to be over 15% this year, while developed market earnings growth is likely to

be declining from current levels. Of course, there are risks to investing in frontier markets, including that many countries lack a truly democratic process. However, this area of the market offers some of the best long-term return potential, and

their returns tend to be different from developed markets.

What about income?

Until last year, the biggest investment challenge investors faced was dismal yields from bonds. We saw that change in a hurry in 2022 as central banks increased rates to combat high inflation. The result was temporary pain for

existing bondholders but also long-term gain in the form of higher levels of future income. Some areas of the fixed-income markets benefited more than others. Particularly investments that had floating payments like private loans and commercial mortgages.

Yields today on these strategies are over 10% and 8%, respectively. This is a very strong level of income, and these loans are backed by assets. Further, our active management approach tends to reduce the instances of loan losses relative to comparable

public markets.

The balancing act

As an investment manager, we are continuously balancing the current risks on the horizon vs the long-term opportunity that these risks inevitably present. Caution is the order of the day in portfolios, yet we also have a keen eye to the future and have

started selectively increasing portfolio allocations to some of the areas mentioned above. While we think these are some of the most compelling investment opportunities today, as wealth advisors, we assist our clients in developing their long-term

strategy. In conjunction with our clients’ input, we create long-term portfolios that address whatever surprises the world throws our way.