January 10, 2023

Markets overview

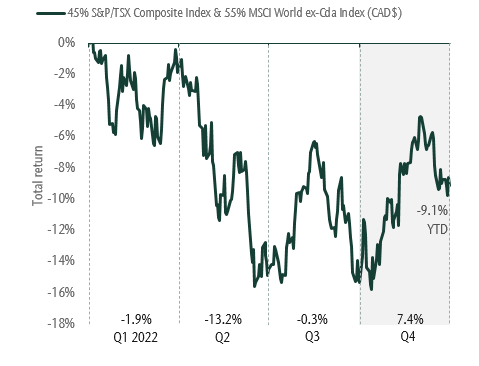

Persistent inflation was a hallmark of 2022. At the start of the year, we noted that market returns would be choppy as central banks shifted policy to fight inflation. What surprised most investors was the pace at which rates would rise to combat stubbornly high inflation. This environment was very challenging for markets and left few places to hide. This year, defensive stocks outperformed more cyclical and big tech names. The market rallied a number of times, as inflation showed signs of peaking and now declining. Despite slowing inflation, central banks reasserted their commitment to leave rates higher. This has increased the likelihood of a recession and further equity declines.

Equities reflect changes in inflation and rate outlook

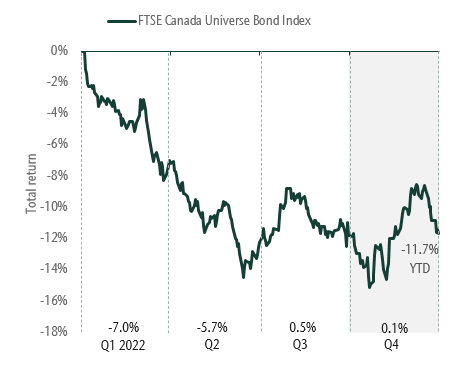

Bond declines were significant this year as they are sensitive to rising interest rates. 2022 was one of only a few years in history where equity and bond returns were both negative. In the fourth quarter, bond returns were flat as market concerns moved from rate increases to slowing economic growth.

Bonds flat after a terrible start to the year

Portfolio Strategy

The tensions of 2022 will not fade quickly but we do see a shift in the market’s focus to company earnings. We think earnings estimates are too high and will be revised lower. This means continued volatility and equity declines before beginning a sustainable recovery later in 2023. Signposts for the recovery will be economic growth reaching a bottom and rates moving lower. We think central banks will be unlikely to reduce rates until they are convinced that inflation has meaningfully declined and the labour market has cooled.

This means caution is the order of the day. Our balanced portfolios are conservatively positioned and diversify exposures to various economic risks. Diversification remains the key to both protecting capital while maintaining some strategies that will benefit from the eventual recovery. Within equity allocations the focus is on quality companies with resilient earnings. In select cases we are buying companies that are oversold and offer very strong return potential over the medium term. We will look to increase this opportunistic positioning when we see signs of economic improvements. Within fixed income, we have been underweight corporate and provincial bonds in the core portfolio.

Our tactical allocation process has closely monitored tightening financial conditions and slowing growth. As we saw the outlook deteriorate, we became more defensively positioned, selecting periods of short-term stock market rebounds to reduce equity. Within bonds we have a meaningful allocation to short-term bonds which have outperformed as rates were rising. However, we have begun reducing short bonds as yields may be close to their peak levels.

Strategically, we have been recommending an allocation to alternatives for many years. These asset class strategies can enhance portfolio performance while reducing economic risk, depending on how they are incorporated in a portfolio. This year was a prime example as these strategies performed well through a challenging period for public markets, protecting client capital and delivering strong income.

While it may seem like little consolation, the silver lining of a down year is the potential for higher future returns when the recovery ensues. Further, our portfolio management and tactical allocation teams are constantly on the lookout for the best risk-adjusted returns. We look for opportunities to take advantage of mispricing whenever short-term events cause the markets to disconnect from fundamentals. While risks are high, we are confident that our tools and teams can navigate near-term challenges and that client portfolios are strategically positioned for long-term success.