May 30, 2022

Looking back on the last two years, the global economic recovery has been swift. The economy and markets have been supported by unprecedented low rates and government spending. Policymakers desired to ensure a swift recovery from the self-inflicted recession that occurred from the COVID lockdowns. Now the times have changed.

As we emerged from COVID, demand for goods surged, and meeting that demand has been difficult. This had led to the highest level of inflation in decades. The war in Ukraine further exacerbated inflation in food and gas prices. As expected, central banks have pivoted quickly to fight higher prices. Their primary tool is increasing interest rates several times in 2022. Ideally, the result of their actions will be lower inflation, and economic growth will slow but not to the point of recession. However, more often, rate hikes do lead to recession, and markets are now reflecting a higher likelihood of this occurring.

But what does this mean for an investment portfolio including stocks, bonds and alternative investments?

Uncertainty is higher now than earlier in the recovery, and investors are anxious about rate increases’ timing, magnitude and knock-on economic effects. This is normal at this stage in the cycle. Broadly speaking, we think investors should expect continued volatility. Portfolio managers are navigating this period by increasing investments that are less sensitive to interest rates moving higher while also focusing on quality assets that can protect if we experience a recession. Below we dig deeper into what this means for different asset classes.

Stocks, despite recent declines, can do well when rates are rising

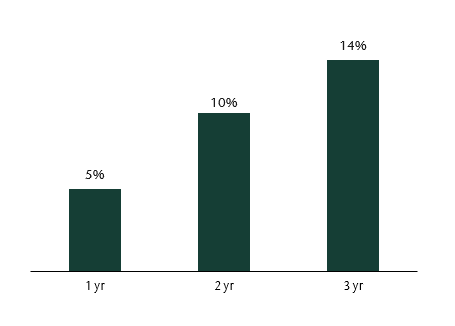

When central banks increase interest rates, they are doing so because the economy is doing well. When the economy is strong, stocks benefit from increased demand for their goods and services. On average, this outweighs the negative of higher costs from rising rates. That is for a while. The chart below illustrates the average annualized return one, two and three years after an initial central bank rate increase.

Average equity return after first Fed rate hike

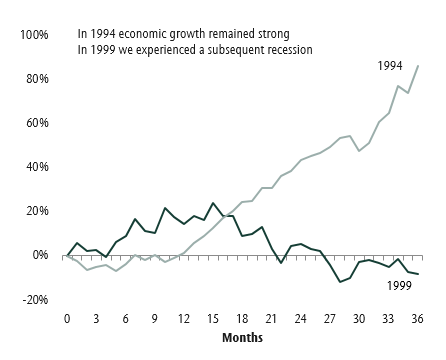

While averages can be helpful, they don’t tell the whole story. In the chart, we show the best and worst three year period following the start of rate increases. What is key here is that growth in the economy and earnings remain positive and don’t contract. In the 1999 cycle, rates increased, growth slowed, and we entered an economic recession that coincided with the tech bubble. At the other end of the spectrum, economic growth slowed but reaccelerated without contracting during the 1994 cycle. So the main message is that what happens to economic growth is of utmost importance.

Best & worst performance

after first rate hike

While stocks can generate decent returns in a rising rate environment, it’s important to take a dynamic approach to navigate this increased volatility. In our equity portfolios we have been actively:

- Increasing weight to sectors that can benefit from rising rates. An example is financials which see profits rise in this period.

- Reducing sectors that are highly sensitive to slower economic growth due to higher rates. An example is consumer discretionary and industrials.

- Maintaining a strategic weight to value equities. These more attractively priced stocks can do well relative to high-growth companies when rates rise.

- Increasing ‘quality’ in the portfolio, meaning companies with lower debt and differentiated products. The former results in lower interest costs, and the latter means they can pass on price increases to the consumer.

Fixed income is hit the hardest

Expectations of rising interest rates have clouded the outlook for bonds. The news is worst for traditional investment-grade core bond portfolios, which are most sensitive to these changes. As bond yields rise, prices decline, creating temporary periods of negative returns like we saw in 2021 and the start of 2022.

The outlook is better for short term and high yield bonds. These areas of the bond market are less sensitive to rising rates but for different reasons. The former, due to its shorter-term nature and for high yield bonds, they are more affected by economic growth and the business dynamics of underlying issuers. Currently, financial conditions remain attractive for most businesses, allowing high yield bonds to continue to do well despite higher rates. Combining short, core and high yield bonds is important to diversifying risk within fixed income markets. That said, returns are expected to be low.

Our clients have had a much lower weight to negatively affected core bonds because we have added short term and high yield bonds, and many of our clients have further reduced fixed income through alternatives that are sourced from bonds such as private loans and hedge strategies.

Alternatives, diversify risk and improve expected return

The alternative asset classes in a portfolio are attractive since they generate strong income relative to traditional equities and bonds. Higher income is a natural stabilizer to potential price declines when rates rise. These asset classes also tend to be the least sensitive to risks in the broader economy, including rising rates and inflation. Take, for instance, our infrastructure portfolio. Here we make investments in renewable energy (solar, wind and hydro assets) and traditional infrastructure (transportation and hospitals). The success of these investments is tied to each asset’s unique fundamentals and is less affected by the level of interest rates.

When allocating to alternative investments, the portfolio's sensitivity to rising rates declines. When we add these assets, we are reducing traditional asset classes in the portfolio, like core bonds that are most sensitive to rates.

So the answer is fewer bonds and more equities and alternatives?

While many investors have taken this approach, it is not necessarily the right answer for you.

Rising rates are not the only risks portfolios have to mitigate. Further, any changes to your portfolio should be done in the context of reviewing your unique financial situation and the impact a change will have on other risk factors, including your ability to meet your objectives. We spend a lot of time forming our expectations for asset class returns and risk, which is the basis for the planning work we do with clients. This enables clients to pre-experience changes to a portfolio under different market conditions and forms the basis of informed decisions.

In addition to our planning work with clients, we actively manage portfolios. In this environment, we have reduced portfolios’ sensitivity to rising rates in many ways. To name a few, we are overweight equities, reducing core bonds in favour of short and high yield and deployed capital to alternative investments. Yet we maintain a well-diversified approach. This remains the only free lunch in investing and is a critical factor in reducing risk and generating more consistent returns.