July 21, 2020

Portfolio markets summary

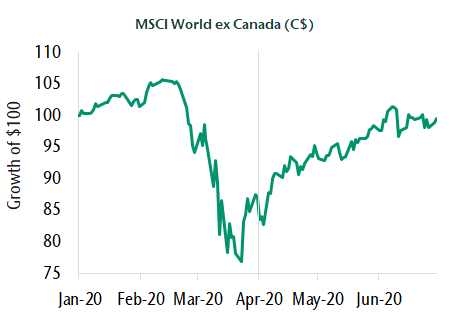

Equity markets have rebounded at one of the fastest paces seen in history after COVID-19 dealt a historic blow to the global economy. Despite a global recession and a surge in unemployment, this quarter the S&P/TSX Composite Index was up 17.0% and

the MSCI World ex Canada Index (C$) was up 14.4%, just 5.9% below its high in February. In particular the markets are sensitive to changes in the outlook for the health crisis, government policy and the longer-term impact on the economy. This quarter

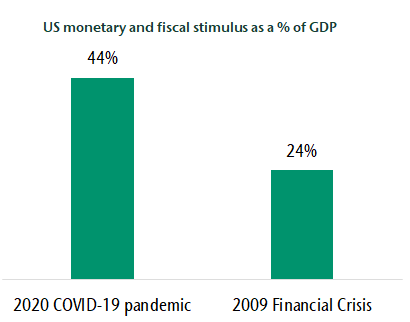

we saw new COVID-19 daily cases decline in many countries, a reopening of many parts of the global economy and government stimulus begin to work its way into the economy. The level of stimulus from policy makers has been unprecedented and has historically

stimulated economic growth and business earnings while serving to help support asset prices. While the path of the virus and the potential for more government shutdowns is unknown, the consensus is that the world will be in a better place a year from

now.

Bonds also benefited from an improved investment outlook. The FTSE Canada Universe Bond Index was up 5.9% this quarter. Most of the return came from corporate and provincial bonds which generated negative returns earlier in the year. This quarter

they benefited from yields retreating back to more normal levels and that resulted in price appreciation. The decline in yields was helped by the Bank of Canada buying these bonds and signaling a willingness to increase their purchases. Canada government

bond returns by comparison were lower as bond yields ended the quarter modestly below where they started.

Global equity market decline and recovery

Largest stimulus response in history

Portfolio strategy

Generally speaking, our portfolio positioning was defensive at the start of the quarter and we added cyclical investments as our outlook improved. In Canadian equities this means reducing underweights to the consumer discretionary sector and in global

equities reducing our bank underweight. Within bonds we have added to corporate and provincial credit through April and May. We expect these investments will do well during a continued recovery while still maintaining a focus on investing in quality

assets with strong balance sheets.

At the start of the quarter our asset allocation strategy was modestly underweight equities. As equity markets increased so did our allocation to stocks leaving us modestly overweight at quarter end. While our outlook for equities has improved we

are not seeing a strong signal from the economic data and therefore are maintaining a modest overweight to stocks. Within stocks we remain overweight global equities which have a larger opportunity set relative to Canada. In the bond allocation

we are underweight high yield bonds in favour of core bonds. This will continue to serve clients well in a period where volatility is likely to remain high.

From the desk of Jeff Guise, Managing Director, Chief Investment Officer, CC&L Private Capital.