June 17, 2020

Establishing a long-term plan to meet your financial objectives is not a new concept. We talk about investment planning regularly with our clients. What does feel new is the amount of volatility investors have experienced in their portfolios lately. After

all, it has been 11 years since the equity market cycle began and then abruptly came to an end as COVID-19 rattled markets. Further, it had been 32 years since we have seen a comparable pace of decline in the value of equities. Portfolio volatility

of this magnitude is uncomfortable and it leaves many thinking that they have surely deviated from their long-term plan. For almost everyone, this is not the case.

Don’t jump ship - declines have been short lived

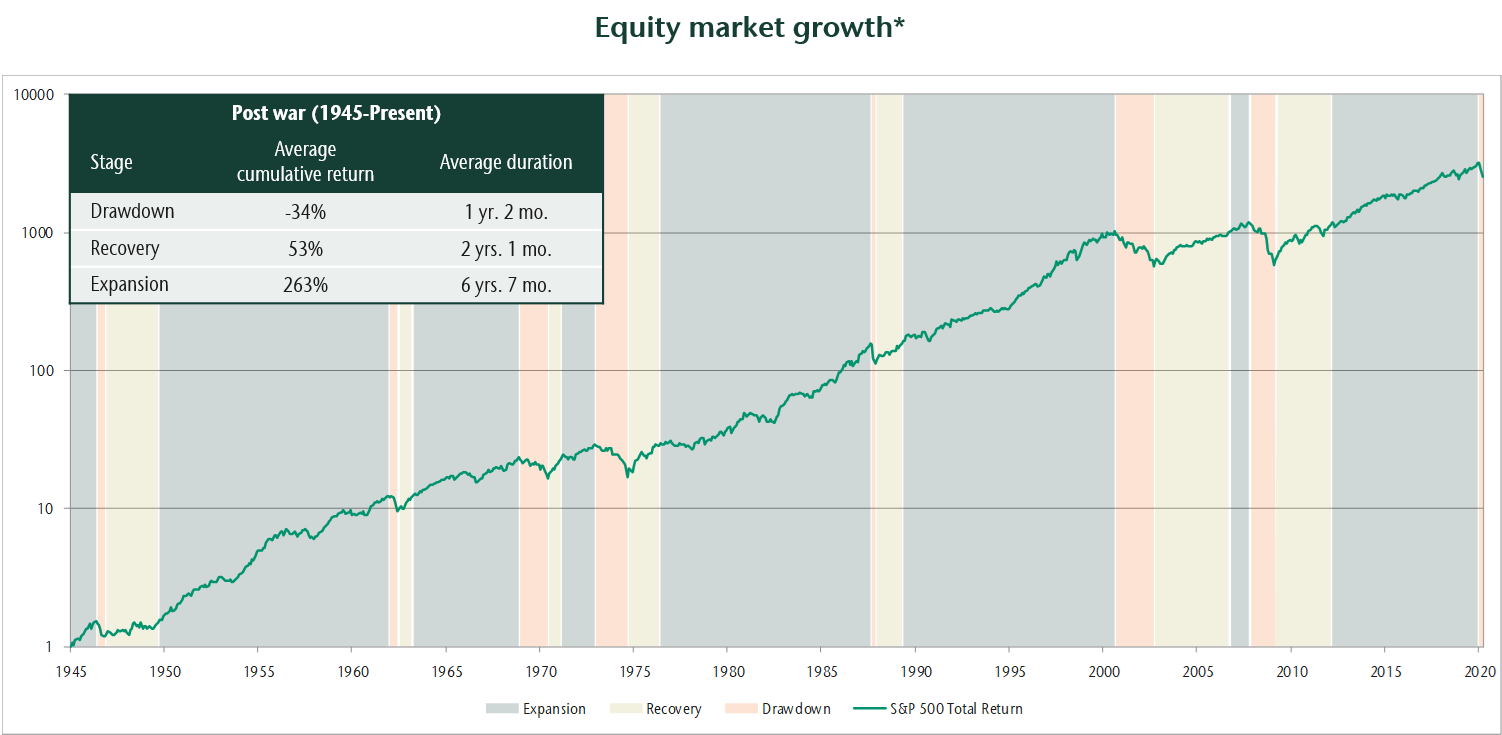

Equity markets are cyclical. Just like after winter comes spring, after an equity market decline comes a recovery and subsequent expansion. While seasons are predictable, the timing of market cycles is less so. Recognizing this, history can be a guide

to the duration and magnitude of different stages of the cycle. What is key to keeping your plan on track is that significant declines are temporary. The below chart shows the equity market cycles over the last 75 years which include seven market

cycles. When equity markets decline by more than 20% (defined as a bear market), the average decline has been 34%. These declines have occurred over a period of approximately one year on average. The subsequent recovery has then taken a little over

two years on average. The rest of the time markets are in expansion. Your ability to remain on track to meet your long-term objectives is based on your ability to withstand these temporary declines and participate in the future recovery. This is critical

but emotionally challenging.

History of market cycles

Volatility is your friend in a recovery

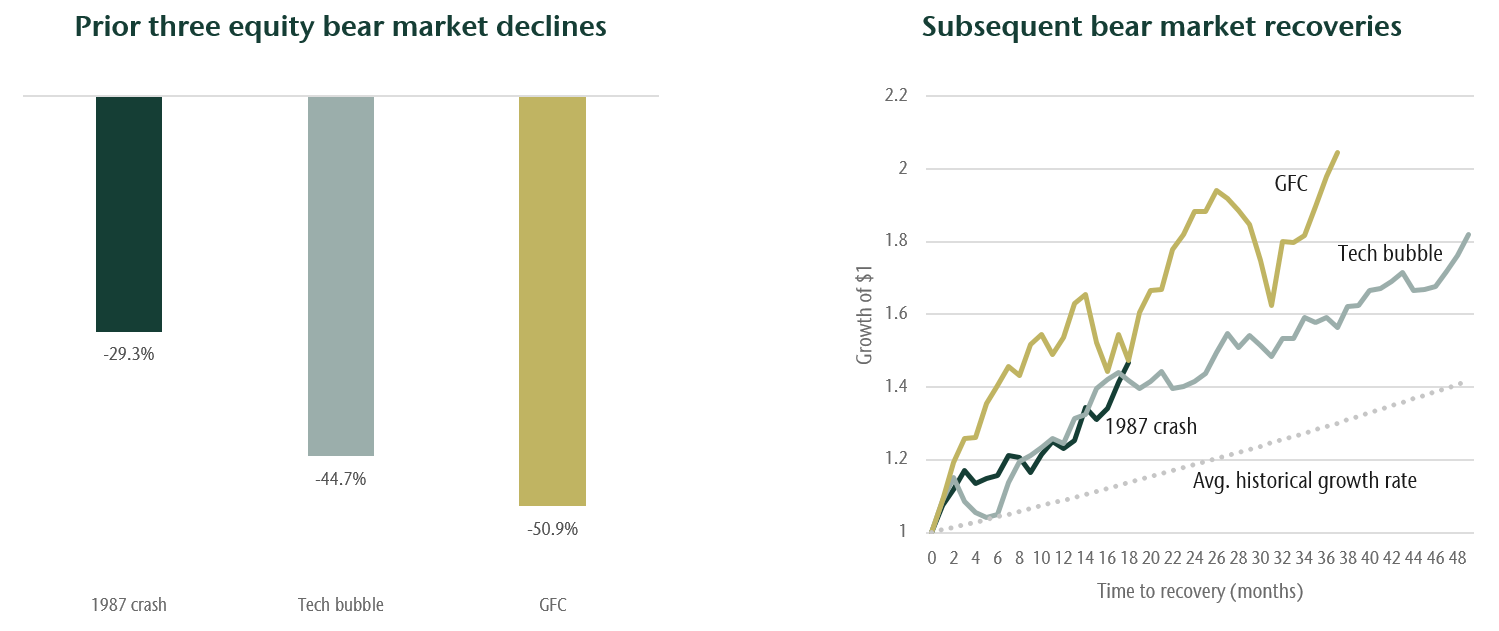

Equity volatility is the price investors pay for long-term returns. Volatility, a common measure of risk, is actually on your side during a recovery. Over the last 75 years, equity markets have increased at a rate of 9% per year. However, in any given

year the market return has deviated significantly from this rate, both higher and lower. In the second chart below we show the effects of volatility during a recovery from the last three bear markets. Each line ends when the market returned to its

prior high. The returns in the recovery are significantly higher than average, bringing portfolios to prior highs in just 18 months in the case of the 1987 crash but longer in the case of the global financial crisis (GFC) and tech bubble. Active managers

like us use these periods of volatility to your benefit by buying attractive companies at discounted prices and then benefiting from their recovery.

After severe declines, equity returns have been strong

The anatomy of the bear

When equity markets enter a bear market, there is a focus from investors on the unknown magnitude and duration of what’s troubling the market. As time goes on, natural stabilizing forces in the economy take effect and investor sentiment improves.

For investors with investment plans that consider volatility, these events can be discomforting but do not require a change in lifestyle. However, if you are particularly worried about your portfolio, modest changes to lifestyle will have a positive

effect. For example, if you are spending from your portfolio you can modestly reduce spending and if you are saving you can save a bit more. Both of these put more money to work during the recovery from the bear market.

Is it different this time?

This question comes up every time we experience a bear market. The legendary investor Sir John Templeton said, “The four most expensive words in the English language are ‘This time it’s different.” But surely he would have questioned

his statement this year as we deal with a global pandemic which resulted in a global economic shutdown for the first time in history. Yet, while the cause of the market decline has few historical comparisons it hasn’t been the first exogenous

shock. While there are many aspects of this shock that are new- the result has been the same. Those who remain patient have benefited from the potential beginning of the recovery. Years from now I expect investors will note that this period, like

others before it, was relatively short lived and the recovery got them back on track to meet their financial objectives.

This post is for information only and is not intended as investment advice. The views expressed are those of the author at

the time of publication and are subject to change at any time.