January 23, 2020

Markets overview

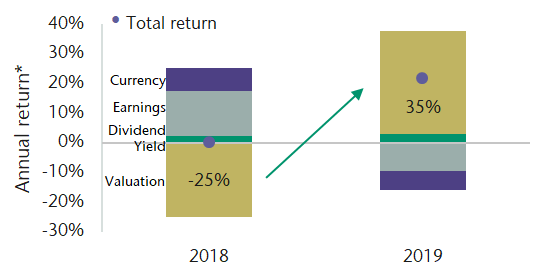

Equity market returns this quarter were strong, with the TSX and the MSCI World ex. Canada indices gaining 3.2% and 6.6% respectively in Canadian dollars. This brings 2019 returns for the TSX to 22.9% and the MSCI World ex Canada to 21.9%. The strong returns in 2019 are in contrast to negative returns experienced in 2018. The rally in equity markets this year was the result of central banks around the world easing monetary policy in response to deteriorating economic growth. More recently there have been signs of a potential recovery in global growth and improvement in political risks. The result has been increased valuations in the equity markets while earnings growth has been weak.

As we look forward we believe improved earnings growth is necessary for equity markets to move higher.

Bond markets gave back some returns this quarter as yields moved higher and prices declined. The FTSE Canada Universe Bond Index return was down -0.9% for the quarter but is up a notable 6.9% for the year. There has been a bottoming in bond yields, which reflects an improvement in the outlook for the global economy. The FTSE Canada Universe Bond Index yield is currently 2.3%. In the absence of deteriorating economic fundamentals and declining yields, long-term total return expectations for the index are around 2% going forward.

Equity markets reach new highs this quarter

Valuations had the largest effect on equity �market performance

Our thoughts

Our investment process indicates global economic growth is currently slowing but possibly bottoming. We feel it is too early to tell if recent stabilization in leading indicators of growth will lead to a sustained recovery. We see risks balanced and expect further market volatility as global central bank easing is mostly behind us and investors could be disappointed if stronger economic growth is not confirmed in 2020. In this environment our short-term tactical positioning maintains a neutral weight to equities vs. bonds.

Within equities, we maintain an overweight allocation to global stocks compared to Canadian. In a period of low economic growth we want to have more exposure to global equities, which have a better growth outlook.

Our equity teams are favouring resilient, stable businesses, with strong balance sheets and profit margins.

Within bonds, we have an underweight allocation to high yield and an overweight allocation to core bonds. This is prudent given that corporate debt levels continue to reach all-time highs and credit conditions can change quickly if the economic outlook deteriorates.

This quarter and year marks a strong period for deployment into our private market alternative portfolios, which include direct ownership in commercial real estate, infrastructure and private loans. Our teams continue to find opportunities to buy assets with attractive return characteristics which are differentiated from the public markets.

From the desk of Jeff Guise, Managing Director, Chief Investment Officer, CC&L Private Capital.