August 20, 2019

A clear view

Since the end of the financial crisis, investors have experienced strong returns–but most indications suggest the road ahead may be paved with more modest returns. For this reason it's important for us to work together with our clients to understand

how future returns may affect their ability to meet their long-term financial objectives.

When we update our forecasts we look forward to how capital markets may perform over the next 10 years, 20 years and beyond.

An important part of this process is our annual update of long-term capital market forecasts, which serve as the basis for constructing clients' portfolios. When we update our forecasts we look forward to how capital markets may perform over the next

10 years, 20 years and beyond. We examine each asset class that comprises our diversified portfolios, and in addition to forecasting returns we also consider volatility and the degree to which the markets move relative to each other (known as correlation).

By using these forecasts to form our long-term views, we are able to guide our clients' expectations in matters such as when they might afford to retire, how much they could expect to spend in retirement, or how much and how often they can donate to causes

that are important to them–in short, helping them 'pre-experience' their future wealth under different scenarios. As a result, clients can be confident knowing that decisions they make are made in conjunction with a rigorous analysis for assessing

outcomes in a wide range of market conditions.

Changing conditions

We believe the utility of our forecasts is especially important given that current economic and market conditions are very different than they have been historically. Today bond yields are near all-time lows, valuations of most assets are above average,

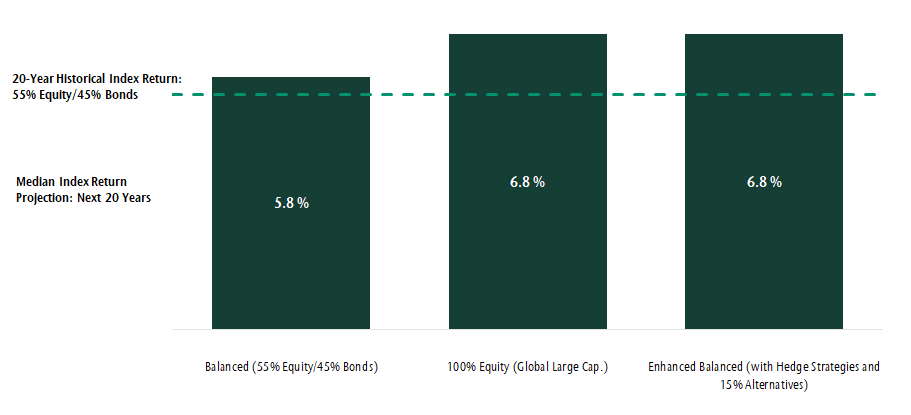

and global economic growth is expected to be lower than what we have experienced in the past. We forecast that a balanced portfolio comprising 55% equity and 45% bonds has an expected return of 5.8% over the next 20 years— near the 5.4% annualized

return delivered over the prior 20 years(see chart 1 below).

Chart 1: Historical and forecast annualized returns

Mapping the road to success

Given lower return expectations, we talk with our clients about how best to respond. Typically, there are three options for clients. First, they may simply accept lower returns and choose to maintain their balanced portfolios' current asset mix—and

the associated level of volatility. For some, this option is acceptable given the lower returns going forward have been offset by the higher-than-expected returns we have experienced in the past. However, the potential downside for many is not generating

sufficient wealth to meet long-term objectives and possibly having to reduce spending or increase savings to compensate.

Option number two is increasing the portfolio's allocation to equities, which we expect will increase returns. This would be suitable only for clients that are willing to accept larger fluctuations in their portfolio value over time as equity markets

inevitably experience significant but temporary declines. Our forecasts suggest that a portfolio comprising solely equities is 3.5 times more likely than a balanced portfolio to fall in value by 20% over the next 20 years (as illustrated in chart

2 below). This is a level of volatility that makes most clients uncomfortable.

Chart 2: Probability of a 20% peak to trough decline*

If equity and fixed income assets were the only choices in constructing a portfolio, then this is where investors may encounter a roadblock. Happily, there is a third option that can enhance returns: further diversifying a balanced portfolio by incorporating

alternative asset classes such as commercial real estate, infrastructure and private loans. For example, an "Enhanced Balanced " portfolio (also shown in chart 1 and 2 above), which includes hedge strategies and a 15% allocation to alternatives, is

forecast to meet the historical return target. This asset mix reduces the portfolio's sensitivity to economic cycles and interest rates, but with the trade-off of alternative assets' limited liquidity, use of leverage and typically higher concentration

risk.

Together on the road trip

The investment planning work we undertake with clients combines their unique objectives, financial situations and our views of current and future market and economic environments. While we expect the future to be more challenging than the past, investors

don't have to accept higher volatility to meet their objectives. We help clients by sharing our calculated and thoughtful approach, and by doing so we believe it improves the likelihood of meeting their desired investment outcomes.