August 27, 2019

You've saved and invested for your dream retirement, and without jeopardizing that goal you'd like to help your children with a deposit for their first home, or put some money to use for philanthropic purposes, or otherwise spend a portion of your savings before retirement. Understanding how much you can spend now and still afford to fund your golden years can be difficult—but knowing what we call your core and excess capital can help you

What is core and excess capital?

Core capital is the wealth an investor needs to retain to support his or her retirement.

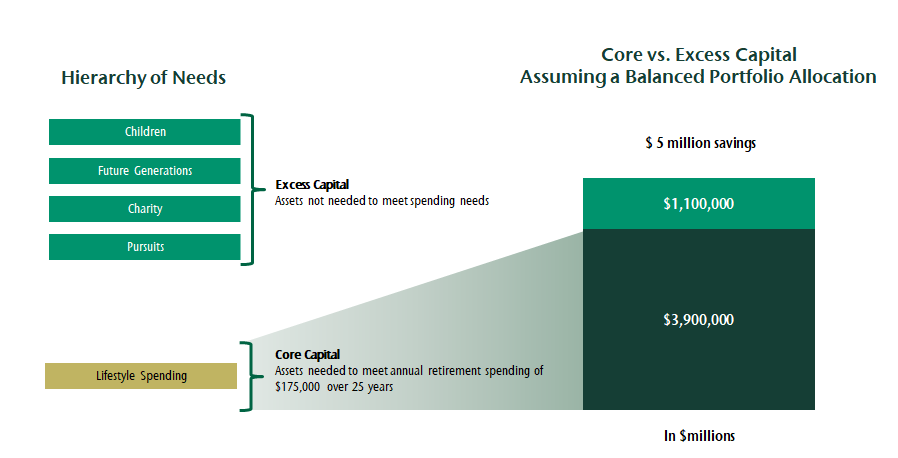

In a nutshell, core capital is the wealth an investor needs to retain to support his or her retirement, while excess capital is the amount that can be spent today without affecting those plans.

For example, imagine an Ontario couple, both aged 65 and taking full CCP and OAS benefits. With $5 million saved up and invested, they plan to spend $175,000 each year of their retirement (linked to inflation and after tax). Knowing this, along with the composition and tax treatment of their investment portfolio1, it's possible to work out how much money the couple is likely to need today in order to meet their retirement-spending aspirations. Happily for our imaginary pair, after crunching the numbers it's around $3.9 million, less than their $5 million invested wealth. The $3.9 million is their core capital, and the remaining $1.1 million is their excess capital, namely what they can afford to spend today and still support their retirement as intended.

Confidence to determine strategy

Core and excess capital values are based on calculations and forecasts of future investment performance that can never be 100% certain. However, at CC&L Private Capital, we believe we can estimate clients' core and excess capital with a high level of confidence, such that the core capital amount will be able to sustain clients' planned spending even if financial markets perform poorly. We simulate 1,000 potential investment return scenarios, looking for a core capital amount that provides adequate resources in at least 900 of them. This is called the 90th percentile (90%) level of confidence and many of our clients feel this is an appropriately conservative approach. Of course, if you want more certainty we can plan for that, but it will require a higher level of core capital.

Knowing your core and excess capital can also help in determining the right investment strategy for you.

Knowing your core and excess capital can also help in determining the right investment strategy for you. Take an investor, saving for retirement, who has a portfolio that reflects their moderate risk appetite. Finding out that they

have excess capital above and beyond what they need to fund their retirement may result in a reevaluation of their investment allocations. Their core capital, the amount needed for their

retirement, could remain invested in line with their moderate-risk preference, while they could decide to treat their excess capital differently, depending on their

circumstances. In short, understanding your excess and core capital may help you to make better-informed investment decisions.