September 18, 2025

.jpg?sfvrsn=2e433359_3)

While many people are very generous with “cheque book philanthropy”—donating at community events, attending a gala, or participating in a ride, race or run—very few families think strategically about charitable giving. Even ultra-high-net-worth

families with a history of giving don’t typically approach philanthropy from a long-term perspective.

Most donors opt to give cash directly rather than use a Donor-Advised Fund (DAF), or a private foundation, simply because these options are not top-of-mind. While few financial advisors, accountants and consultants are knowledgeable in this area, CC&L

Private Capital’s background in foundation management enables our experts in charitable giving to have meaningful and impactful conversations with clients on this subject.

“It’s important to build on the good work a client is already doing when developing a philanthropic plan,” says Robert McLean, Wealth Advisor, Advising Representative. Robert is an expert in building strategic philanthropic plans, and a Master Financial Advisor–Philanthropy (MFA-P™), a designation earned through the

Canadian Association of Gift Planners (CAGP). “We consider what causes the client is already supporting, as well as their motivations and goals. Once we understand their history of giving and their passions—whether environmental, social

or health related—we target how to make the most meaningful impact.”

Windfall events—like the sale of an asset or a business, and large tax assessments as with a trust rollover—are opportune occasions to think tactically about philanthropy.”

DAFs vs private foundations

There are three options open to philanthropists: ad hoc giving, a private foundation, and a DAF. Ad hoc giving is the hardest to manage strategically. A private foundation is the most flexible, but also the most onerous to set up and manage, given strict

rules and regulations. For most philanthropists, a DAF offers a comfortable middle ground between the two.

DAFs are relatively simple to establish and manage. A DAF can be funded from as little as $25,000. For this reason, it is more attainable and manageable than many high-net-worth families think. However, there are a number of restrictions. For instance,

you are only able to donate to Canadian-registered charities, making a DAF more of a flow through vehicle that enables other charities to act.

Private foundations offer greater flexibility than DAFs. You can support a wider range of organizations, giving you the ability to have a more targeted and direct impact in your area of choice, and you can support “qualified donees” and potentially

even charities in other countries. However, the bureaucratic hurdle in creating and running a private foundation is onerous, and the higher the complexity, the higher the cost. Canadian Revenue Agency (CRA) approval and annual tax filings are necessary.

As a distinct legal entity, a board is required to establish governance and policies, and to oversee the foundation and its activities.

Both DAFs and private foundations have positive and negative traits and associated costs. There are many DAF providers to choose from, each with a different value proposition. Some are quite flexible, others extremely rigid. An experienced charitable

expert can help you navigate the decision-making process and ascertain which option is best suited to you.

Modelling impact over time

“After determining a willingness to give, the next stage in the process typically involves a financial assessment to ascertain how much the client can comfortably give, and how best to structure their funds to achieve their charitable aspirations,”

explains Robert.

CC&L Private Capital utilizes powerful proprietary financial modelling tools which provide a range of potential scenarios for your charitable giving. By taking your details—such as asset type and value, income and tax bracket, projected giving,

and timeframes—and combining this information with investment return data, we build a model that reflects more than just numbers: it offers a lens through which to view what your philanthropic impact could be over time.

Consider a hypothetical family with $10 million. We can model out how much they will likely need to support their lifestyle through retirement, leaving them with millions in “aspirational capital”. These funds could be used to enhance their

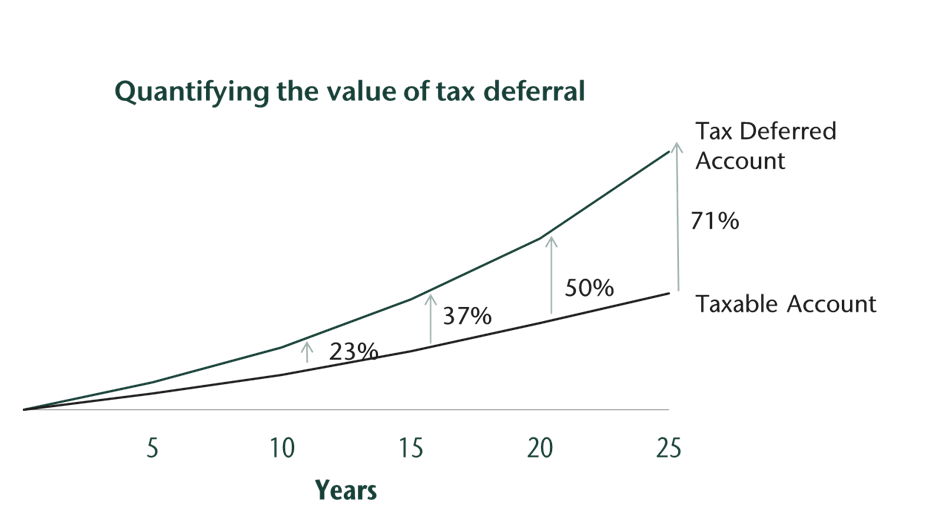

lifestyle, to support children and other family members, or it could be gifted to charity—the concept of the ‘charitable child’ in financial planning. Families who have assets earmarked for charity can benefit significantly if they

plan ahead and invest in a tax deferred account as opposed to leaving their money invested in a taxable account, subject to tax drag. This can have a far-reaching positive impact, as seen in the graph below.

“Talking to families about leaving a legacy, and how a foundation could exist for decades to come through several generations, is a great conversation to have,” says Robert.

A win, win, win, win

While enhancing the positive impact you can make, utilizing a DAF or a private foundation can also help you to meet your cashflow needs. The CRA offers some of the best tax treatment in the world for charitable giving. Such vehicles offer significant

tax credits enabling families to continue to steward their funds instead of having the government decide how to allocate the proceeds of their labour.

Strategic philanthropic planning can benefit anyone. From those families for whom philanthropy is important, and who want to increase their impact; to those families who have not yet considered it, and who could benefit from the tax tools which strategic

philanthropy makes available.

“Everyone wins,” explains Robert, “The giver, from a tax perspective; the family, from meaningful conversations with its members about how to allocate the annual donations; the charity, from the donation; and society at large, as the

positive impact of funds and the charity’s work uplifts the community. It's one of the few scenarios in wealth management where it's a win, win, win, win. It’s my hope that more and more people incorporate philanthropic planning into their

wealth management strategy.”

Conclusion

As one of Canada’s largest independent and privately held investment managers, CC&L Private Capital is uniquely equipped to steward clients’ philanthropic assets and guide them in leaving a legacy. To learn more, fill in the contact form

on this page and our wealth advisors will help you to discover your philanthropic potential.