October 31, 2025

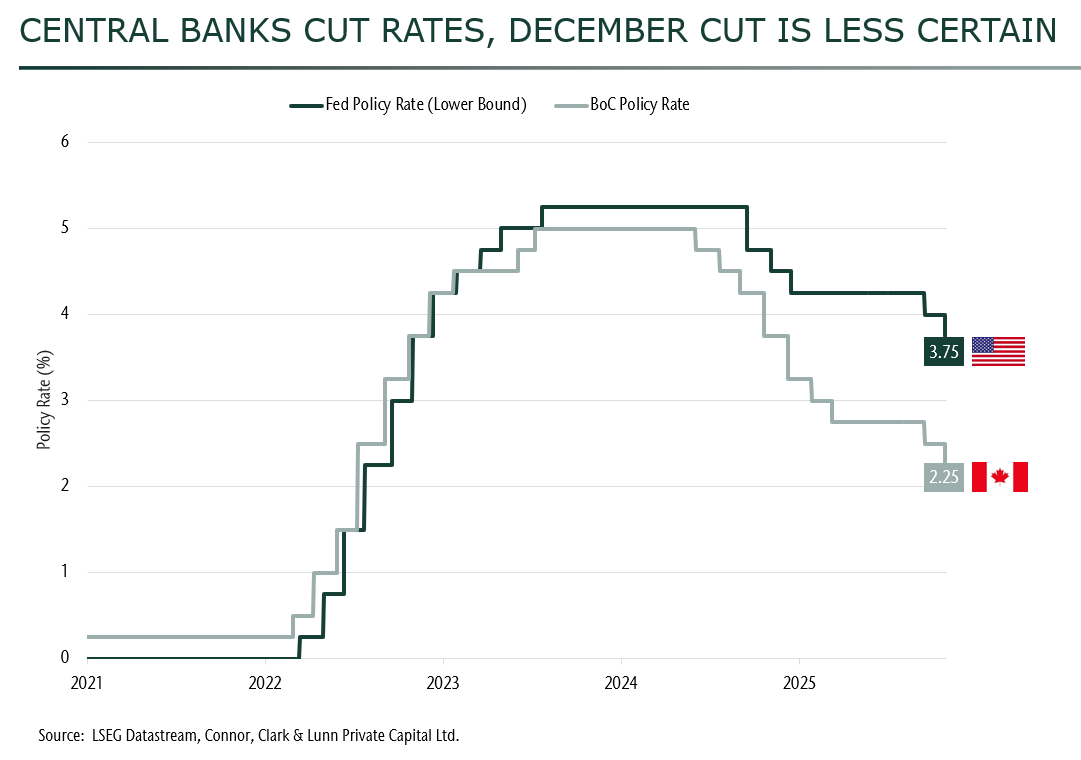

This week the United States (US) Federal Reserve (Fed) and the Bank of Canada (BoC) cut rates by 0.25%. While this was widely expected, bond and stock markets initially moved lower. The volatility came from the forward guidance provided by the central

banks. In the US, Chair Powell said that a December rate cut was “not a forgone conclusion”; and in Canada, it was suggested that interest rates are now “at about the right level”. Following these comments, the market lowered

expectations of another rate cut this year. This, in turn, initially sent bonds lower, with bond yields posting their largest move in four months.

In the medium term, the backdrop for equities remains strong. However, with less clarity from the Fed on its path forward, the potential for market volatility has increased. Prior to this week, the prevailing market narrative held that the Fed would cut

into what has been a non-recessionary environment. With more uncertainty about a December rate cut and the future path for interest rates, we could see some areas of the market—which have done very well over the past several months—start

to fall off.

Notably larger AI spending

We are currently in the middle of earnings season, and we heard from several of the largest technology companies this week, including Alphabet, Meta and Microsoft. Earnings and profitability remain strong; however, these companies are ramping up spending on data center construction and infrastructure to support Artificial Intelligence (AI) services. The heavy spending has raised questions as to whether a bubble is forming, with investors growing concerned about the potential return on investment.

Forward guidance

We continue to believe that the Fed will not be able to cut rates as aggressively as markets have been anticipating, given the potential for inflation to move higher and economic growth to remain resilient. While the labour market is weakening, it remains balanced. Fewer cuts could put pressure on bond returns and higher-valuation companies—particularly in speculative areas of the market that have outperformed over the past several months.

While we still believe that AI is in its early innings, market concentration is elevated. Consequently, we have modestly reduced our overweight in NVIDIA, which has performed extraordinarily well and became the first company in the world to surpass a $5 trillion market cap this week.