August 25, 2019

The new kid on the alternative investment block is private loans, and it could lend a shine to your portfolio. Using it—and other alternative investments—may help offset lacklustre future fixed income returns.

A primer on private loans

Why haven’t I heard much about private loans? Until recently, Canadian investors have had limited opportunities to participate in this globally well-established asset class.

In the year to April 2019, investments in private loans totalled $19.4 billion, compared with $11.6 billion committed and invested in the same period last year and $14.4 billion year-to-date in 2017. In 2010, less than $10 billion was invested for the entire year versus nearly $52 billion in 2018 and a record of almost $70 billion in 20171.

Private loans are highly-tailored, secured loans made to corporate borrowers.

What else should I know? Private loans are highly-tailored, secured loans made to corporate borrowers (for CC&L Private Capital, it’s to mid-market Canadian companies) that typically have unique needs. For example, a company may require a larger loan than a traditional lender will offer, or may have complex requirements that banks or the corporate bond market cannot easily satisfy. Sometimes private loans are made in tandem with loans from traditional sources.

What are the pros? Private loans provide the lender with greater oversight of the borrower, thanks to the lender and borrower’s close working relationship over the lifetime of the loan. This is enforced with rigorous covenants and reporting requirements, meaning the lender will have early notice if the borrower runs into trouble and can take steps to mitigate potential losses. In exchange for highly-customized loans, private lenders can ask borrowers to pay a higher interest rate than they would for a loan from traditional sources. This offers the potential for enhanced returns on private loan investments compared to traditional bonds. Additionally, loans are secured so there’s greater protection of capital.

What are the cons? The trade-off is that private loans are a relatively illiquid investment with no secondary market like public bonds.

Private loans: a useful alternative to bonds

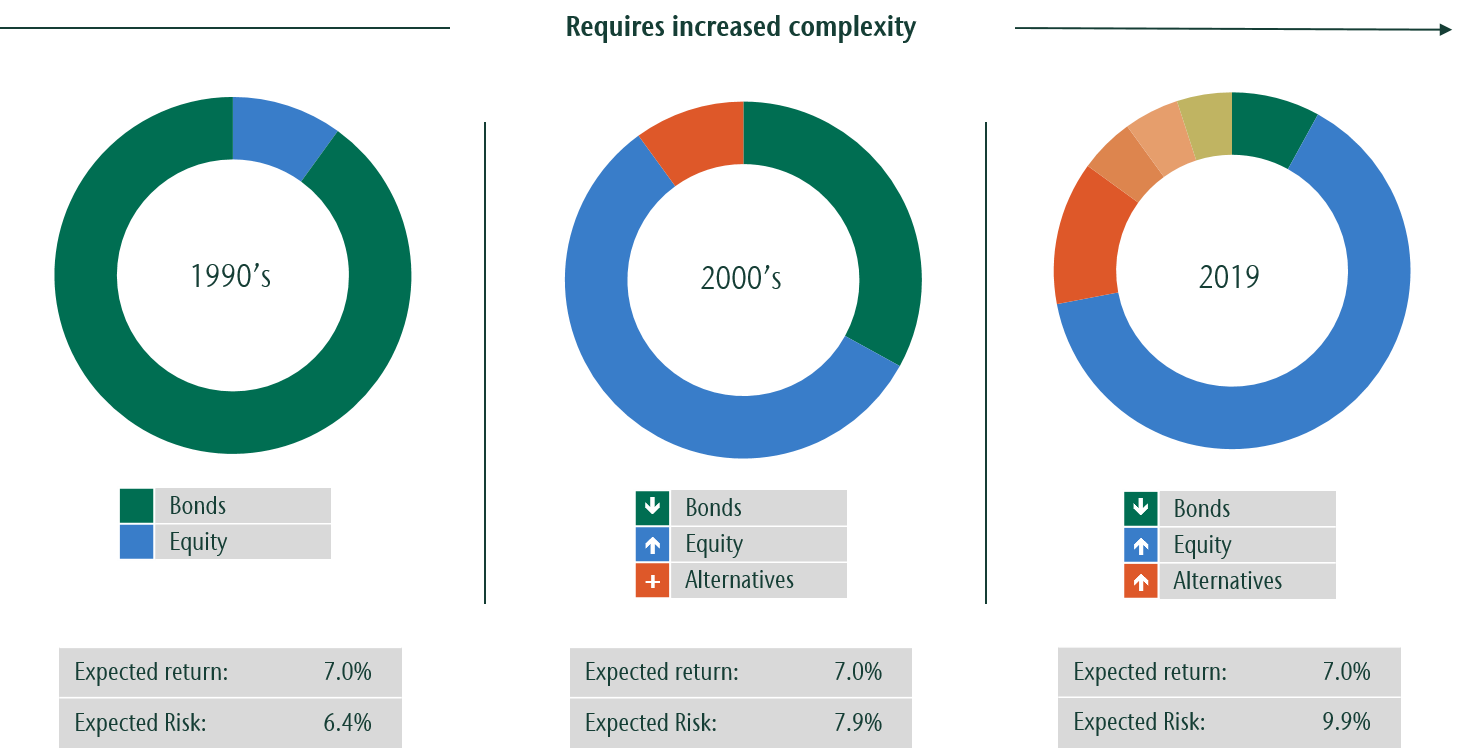

10-year expected bond returns have fallen from over 12% in 1980 to less than 3% today (based on the FTSE TMX Canada Universe Bond Yield index). This means investors have sound reasons to consider substituting some of their bond allocation with private loans, as well as including other alternative asset classes in their portfolios.

Take an investor looking for an expected 6% return. Back in 2005 they might achieve that by owning a simple equity and bond portfolio. But today, an investor with a medium level of risk tolerance looking for the same return may decide to increase their equity allocation, include commercial real estate and infrastructure investments, and substitute some of their bond allocation with private loans and other ‘alts.’ Together, the alternative assets can take on a capital protection role and are good income replacements—typical bond-like characteristics—and may also offer an element of inflation protection. Not only that, they help keep the investor’s portfolio aligned with their risk tolerance.

Expected return is based on estimates of the range of returns for the applicable capital markets over the next 10 years. Data does not represent past performance and is not a promise of actual or range of future results.

Results and allocations will vary for clients with different risk appetites. Investors in alternative asset classes should consider other risks, including illiquidity, effect of leverage, concentration and a fund managers’ ability to source

new opportunities. Source: Connor, Clark & Lunn Private Capital Ltd. 10-year capital markets assumptions.